Markets | NGI All News Access | NGI The Weekly Gas Market Report

Industry Continuing To Assess Harvey’s Impact; Bidweek Prices Modestly Lower

Hurricane Harvey’s demand-killing impact on the natural gas market has been apparent since the Category 4 storm made landfall across the Texas coast late Friday, but things could turn decidedly more bullish — albeit temporarily — in the days to come as demand begins to creep higher while production remains offline, some analysts say.

Total gas production is down about 2.4 Bcf/d since last week: about 1.3 Bcf/d from offshore areas plus roughly 1.1 Bcf/d from onshore, according to data and analytics company Genscape Inc. The bulk of the production declines are concentrated in the Eagle Ford of South Texas, but extend into the Gulf of Mexico (GOM) and onshore Louisiana. Texas volumes are down about 0.98 Bcf/d from last week, with about 0.73 Bcf/d of the declines occurring in South Texas, Genscape said.

“Louisiana gas production is so far stable at 5.7 Bcf/d, but we are keeping a close eye on developments there as the National Weather Service’s predicted storm track has most of the state getting hit starting early Wednesday morning,” Genscape said.

Indeed, in its 4 p.m. CDT update, the National Hurricane Center (NHC) said the center of the storm was about 75 miles south-southeast of Cameron, LA, moving north-northeast near 5 mph and expected to remain on this track into Wednesday.

“On the forecast track, the center of Harvey is expected to be just offshore of the middle and upper coasts of Texas through Tuesday night, then move inland over the northwestern Gulf Coast early Wednesday,” the NHC said.

Harvey is expected to produce additional rainfall accumulations of 6-12 inches through Friday over parts of the upper Texas coast into southwestern Louisiana, the NHC said.

Genscape estimated that demand in the U.S. Energy Information Administration South Central region is down about 0.7 Bcf/d from the storm, largely concentrated in South Texas spanning the Houston/Beaumont/Corpus Christi areas. East Texas weather-correlated demand has averaged 2.5 Bcf/d over the past week, but has fallen roughly 0.5 Bcf/d to 1.93 Bcf/d this weekend. Louisiana demand averaged 3.5 Bcf/d prior to the storm, then shed 0.3 Bcf/d during the weekend.

The Louisville, KY-based company said its estimates of offline production and demand are likely to the low side as estimating actual Texas production and demand on a timely basis is extraordinarily difficult given that its pipeline sample covers roughly 30% of actual production and the preponderance of volumes that move on non-transparent intrastate systems. On the demand side, there are other demand factors that need to be considered, such as closed schools and businesses, evacuated homes or other.

Genscape’s power desk has noted there are roughly 253,000 customers without power within the Texas footprint served by ERCOT, the Electric Reliability Council of Texas. Genscape monitors indicated that generation at two power plants along the coast amounting to 1.5 GWs has seemingly come offline due to the storm. In Louisiana, the U.S. Department of Energy is estimating about 2,500 customers were without power Tuesday. Genscape’s ERCOT desk has noted wind generation in South Texas is strong, but it should weaken as the storm moves offshore.

Genscape’s oil group estimated about 110 platforms and rigs have been evacuated, leaving roughly 300,000 b/d of GOM oil production shut-in. All waterborne receipts and deliveries had been halted to Houston-area ports since last Friday (Aug. 25). Genscape noted public reports of about 3.267 million b/d of refinery capacity are either offline or at reduced levels across 11 refineries. The three Corpus-area refineries are shut, as are two north of Galveston. Deer Park area refineries were operating at reduced rates, while refineries within Galveston and Port Arthur appear to be operating normally. Pipeline flows into the area have also been reduced.

Meanwhile, exports to Mexico plummeted to a three-month low at just under 3.4 Bcf/d on Saturday (Aug. 26), a 937 MMcf/d reduction from pre-storm levels. Tuesday’s volumes were “showing some recovery to just over 3.95 Bcf/d, led by gains on our proprietary monitored flows of the NET Mexico pipeline,” Genscape said.

All of the declines are from South Texas, triggering power price spikes in northeastern and central Mexico. Since Permian/West Texas production is less impacted, and because several downstream pipelines in Mexico that would accept West Texas gas are still not yet in service, Waha, Arizona, and Southern California exports to north-central and northwestern Mexico are relatively unaffected.

While liquefied natural gas (LNG) cargoes have been halted, pipe deliveries to Sabine’s export facility continued unabated but they may reach limits of storage, Genscape said. Pipeline deliveries to Sabine are actually higher, having averaged 2.19 Bcf/d since last Friday versus 1.84 Bcf/d in the 14 days prior, it said. Since the weather-related disruptions to LNG operations are focused on ship loadings, those pipe volumes are moving into storage. Genscape estimated there is about 12 Bcf currently in storage.

“At those levels of storage and pipe flows, we expect liquefaction can continue for approximately three more days if no cargoes leave. If storage fills up, and ship loadings are still delayed, liquefaction operations may need to shut-in. There is also shut-in risk in order to ensure worker and facility safety,” Genscape said.

So far, Harvey has had a bearish influence on prices, as has become the norm with Gulf Coast-region storms over the past decade. In recent years, Gulf storms have had a larger impact on demand than supply. At the same time U.S. production gradually migrated to liquids-rich, higher-return onshore plays, demand along the Gulf Coast has grown, making storms more about demand-destruction.

In 2005, hurricanes Katrina/Rita temporarily shut-in 8 Bcf/d of supply and permanently destroyed 1.7 Bcf/d. Hurricanes Gustav/Ike in 2008 temporarily shut-in more than 7 Bcf/d of supply and around 1 Bcf/d was permanently destroyed.*

With offshore production having fallen from over 10 Bcf/d prior to Katrina to around 3 Bcf/d today, the market has correctly come to view hurricanes as bearish “demand killers.” Last week was a good example as the September contract settled unchanged week-over-week at $2.89 despite surprise development of a major hurricane in the producing area of the GOM.

“That said, Harvey could be different and may flip to a bullish event. Demand can typically recover more quickly than production. On the demand-side, businesses and industrial sinks are already re-opening as evacuation orders are lifted,” Genscape said.

For example, all six major oil refineries in the Corpus Christi area shut down, but one is already back online and the remainder appear likely to come back soon as they were mostly out of harm’s way. Power burns should also rise with restoration of service and temperatures climbing back to seasonal norms with the storm’s departure.

However, production could remain offline for a much longer period. Like a heavy blizzard in the Rockies, the record amounts of rainfall hitting Texas may inhibit a quick production recovery by rendering some production sites inaccessible for a prolonged period of time.

Bespoke Weather Service’s Jacob Meisel, chief weather analyst, said it’s difficult to summarize Harvey’s impact as directly bearish or directly bullish.

“While there will be some heavy rain across Louisiana…through Wednesday that should lead to some sporadic flooding, it will be nothing like what we have seen already across Houston,” Meisel said.

Additional demand destruction can be expected as the storm moves over land and keeps killing cooling loads as well. And, Meisel agreed that low storage capacity at Sabine Pass could halt liquefaction processing if ships can’t leave, which would provide additional bearish headwinds to the natural gas markets.

“Something we see a bit more supportive is the fact that demand-side disruptions tend to be shorter duration than supply-side. Some shut-ins across the Eagle Ford and offshore may take a bit longer to get back online, while most demand disruptions appear shorter term,” Meisel said.

Still, no major long-term supply disruptions appear likely, and the disruptions the market does see are rather minimal, so if anything, the market could see just a bit of cash volatility over the next couple of days, Meisel said.

BTU Analytics CEO Andrew Bradford agreed that any disruptions seen thus far are quite minimal, while some of the power outage lost demand “will be gone for days, weeks or even months.”

BTU’s biggest concern, as previously mentioned, was flooding at Enterprise Products Partners LP’s Mont Belvieu facility, which has partially occurred. That may cause short-term production back up into the Midcontinent and Rockies should these facilities be down for many days or even a week.

Enterprise said Monday it sustained no major damage and expects to be back online quickly after storm and flooding clears, and power is back to stable levels.

“So all in all, once gas processing plants and Mont Belvieu are back online, production can return pretty quickly while demand recovery will lag for longer,” Bradford said.

Looking ahead, Genscape’s meteorology group noted that exceptional rainfall continues to hammer Houston, but gradual clearing should begin Tuesday night. “While the system shifts ever-so-slightly eastward, it’s relatively stable nature will continue producing record-breaking rainfall and exceptional flooding along the coast,” Genscape said.

NatGasWeather said the impacts on production could continue longer than the markets might have been expecting, as it has been difficult to gauge impacts on natural gas production, and it could be another few days before all impacts are accounted for. This uncertainty could have aided Monday’s market move higher, it said, as the Nymex September futures contract closed 3.3 cents higher on the day at $2.925.

“We do see support remaining in the $2.88-$2.92 level today and would be surprised to see that be cleanly broken ahead of expiry, especially as cash prices have been rather firm. Resistance still sits overhead from $2.97-$3 and could be tested if cash prices come out a bit stronger, but we may wait for the October contact to test such levels again as it is trading at around a 4-cent premium currently,” Bespoke said Tuesday morning.

Early bidweek indications show some modest declines occurring in regional prices, according to NGI’s Bidweek Alert, but the declines could be indicative of overall market weakness rather than Harvey-related pressure. Already, weather forecasts are pointing to cooler weather in the medium term, with cooling degree days diminishing by the day and no signs of significant heating just yet.

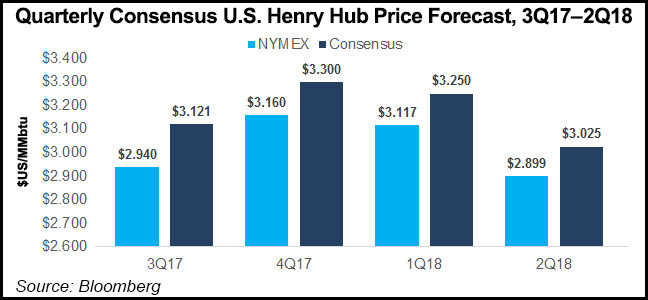

At the Henry Hub, prices for the first three days of bidweek ranged in the mid- to upper $2.90s, averaging around $2.96, down just a penny from the August bidweek average, according to NGI’s Bidweek Alert. The Nymex September futures contract expired Tuesday at $2.961, 3.6 cents higher on the day. October was up 2.2 cents to $2.983.

Elsewhere in the Harvey-affected South Texas region, prices posted similar small declines. At NGPL South Texas, September bidweek prices were averaging around $2.88, down 2 cents month over month.

The South Texas Regional Average ranged from $2.80 to $2.89, averaging 3 cents lower at $2.84.

Download NGI’s Bidweek Alert xls, with the latest First of Month pricing, updated each bidweek day.

*Correction– In the original article it states thatin 2005, hurricanes Katrina/Rita temporarily shut-in 8 Bcf/dof demand andpermanently destroyed 1.7 Bcf/d of demand. HurricanesGustav/Ike in 2008temporarily shut-in more than 7 Bcf/d of demand and around 1Bcf/d waspermanently destroyed. This statement was based on a reportfrom Genscape Inc.which has indicated the report contained a typo and that itwas actually supply(not demand) that was shut-in and permanently destroyed duringall of thosestorms.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |