Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Pennsylvania NatGas Production Posts Modest Increase in Second Quarter

Pennsylvania’s natural gas drillers continue turning to quick, cheap production to increase volumes, with drilled but uncompleted (DUC) wells accounting for nearly all growth through the first eight months of the year, according to the state’s Independent Fiscal Office (IFO).

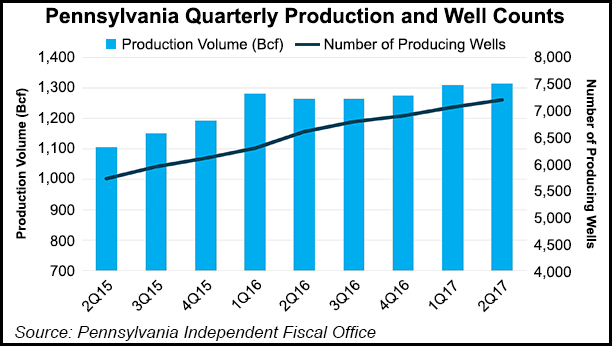

Year/year natural gas production increased again in 2Q2017 by 3.8% to 1.316 Tcf. Through the first eight months of the year, the IFO said natural gas production was 2.627 Tcf, or 3% higher than it was during the same time in 2016.

Nearly all the production gains came from wells spud in 2015 and 2016, the IFO said. Year-to-date, DUCs are up to 762 from 623 during the same time last year.

While the growth was not as robust as it has been in the past, natural gas production in 2Q2017 reached its highest point in the last two years. Producing wells increased to 7,853 in the second quarter, compared to 7,302 in the year-ago period. Second quarter production was also up from the 1.306 Tcf reported in 1Q2017.

Shale producers relied heavily on a deep backlog of DUCs, focused on more economical dry gas and brought more deep, dry Utica Shale wells online in 2016, when year/year production increased 11% to 5.1 Tcf. Production is expected to increase again this year as a bevy of infrastructure projects planned through 2020 are expected to start coming online.

Even still, the IFO noted that among the country’s top-ten natural gas producing states, Ohio and West Virginia posted the highest gains through the first five months of 2017. Ohio reported 651.7 Bcf and West Virginia reported 619.8 Bcf, where production was up by about 10% in each state compared to the same time last year. Nearby Pennsylvania posted a modest increase of 2% during the same time, which prompted the industry to warn state officials of implementing more restrictive policies.

“While our industry has cautious optimism about what will be a long and difficult recovery, the immensely challenging market conditions along with intense competition among energy producing states can’t be lost on anyone,” said Marcellus Shale Coalition President David Spigelmyer. “Pennsylvania’s permitting logjam has already impacted local jobs and pushed investment elsewhere. This data reflects that fact, with West Virginia and Ohio realizing much larger production rate increases.”

Pennsylvania has long been the Appalachian Basin’s leading producer and it remains the second largest natural gas producer in the country behind Texas. But the industry continues to caution against imposing a severance tax on shale gas production, which is again being considered by the legislature, levying higher permitting fees and tightening regulations.

Susquehanna, Washington, Bradford and Greene counties were again the state’s top-four producing counties. They comprised two-thirds of statewide production during the second quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |