E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

GOM Shut-Ins, Evacuations Underway as Harvey Heads to Texas

ExxonMobil Corp., Royal Dutch Shell plc and Anadarko Petroleum Corp. had curbed natural gas and oil production at facilities in the Gulf of Mexico (GOM) as Hurricane Harvey was intensifying Thursday, bearing down on the Texas coast.

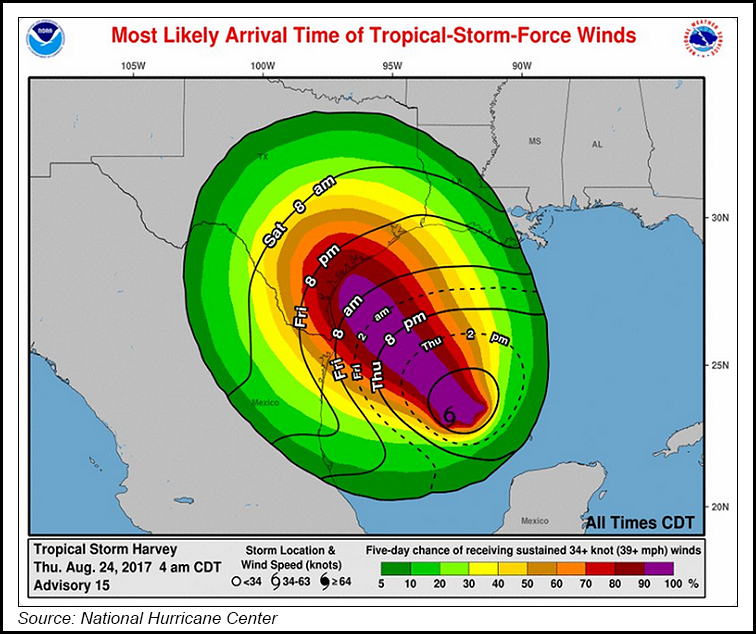

Harvey’s winds were near 85 mph late Thursday afternoon, according to the National Hurricane Center (NHC). Some forecasters were predicting winds could reach 115 mph or higher before Harvey makes landfall, which would put it near Category 3 status. Landfall was predicted sometime late Friday along the middle Texas coast.

In its 4 p.m. CDT update on Thursday, the NHC said Harvey was about 305 miles southeast of Corpus Christi, moving toward the north-northwest near 10 mph. “A turn toward the northwest” was expected Thursday evening, with Harvey’s forward speed forecast to slow down during the next couple of days.

“On the forecast track, Harvey will approach the middle Texas coast on Friday and make landfall Friday night or early Saturday, and then stall near the middle Texas coast through the weekend,” NHC forecasters said.

“Harvey is then likely to stall near or just inland of the middle Texas coast through the weekend.”

A hurricane warning was in place for Port Mansfield to Sargent, TX, with a hurricane watch in effect for south of Port Mansfield to the mouth of the Rio Grande. A tropical storm warning was in effect for north of Sargent to High Island, near Galveston, and from south of Port Mansfield to the mouth of the Rio Grande.

Natural gas analytics firm Genscape Inc. on Thursday morning was already observing production impacts in the GOM.

“Spring Rock daily pipe production data shows GOM production has averaged 2.83 Bcf/d over the past two weeks. As of timely cycle today’s gas day (Aug. 24), nominations were showing production drops at several locations, putting GOM production at roughly 2.4 Bcf/d,” Genscape analysts said.

According to Genscape, that includes the Discovery system, where total production is down 272 MMcf/d; Transco where receipts at the Perdido M1761 MP 7863 meter were down 156 MMcf/d; Tetco, which showed a 43 MMcf/d day/day drop at the Chevron Corp.’s Venice, LA processing plant; and Destin, which showed a 29 MMcf/d day/day drop at the MC254 Delta House gathering meter.

Workers were evacuated from one rig and 39 production platforms in the GOM, and a total of 167,231 b/d of oil was shut in, the Bureau of Safety and Environmental Enforcement (BSEE) said Thursday afternoon. The shut-in oil was equivalent to 9.56% of GOM production, BSEE said. In addition, 472 MMcf/d (14.66%) of natural gas was shut in. No rigs had been moved off location out of the storm’s path, BSEE said.

Tennessee Gas Pipeline Co. LLC (TGP) declared a force majeure at its Station 1 near Agua Dulce, TX, for Friday. TGP said it was monitoring Harvey’s potential impact on its South Texas pipelines.

“Due to ongoing scheduled maintenance in South Texas, current operating conditions and the projected path of the storm, evacuations at Station 1 and Station 9 in South Texas are scheduled to occur,” TGP said in a notice to customers. “The stations will be shut down and secured pending the storm’s effects. Additionally, there is a potential for commercial electrical outages that could affect other stations in the area.”

TGP said the force majeure event could curtail up to 238,000 Dth flowing through Station 1 and up to 250,000 Dth flowing through Station 9 Friday.

PointLogic Energy said in a Thursday morning report to clients that “the potential flooding could cause a large disruption in refining and could force down natural gas production. The storm could also disrupt liquefied natural gas (LNG) exports from the Sabine Pass facility.

“…When Tropical Storm Cindy hit the nearby area in June, Gulf of Mexico and Texas combined gas production dropped by over 600 MMcf in a single day. Current Houston Ship Channel gas prices are just below $3.00/MMBtu and if there is a significant production disruption in the area, those prices could edge higher. The saving grace to a potential large scale production drop is that power demand is expected to be down by nearly 4 Bcf on [Thursday] Aug. 24 and continue to drop through the weekend as the storm, the weekend effect and cooler temperatures in the middle of the country lessen the power load for air conditioning during the duration of the storm.”

BTU Analytics’ Andrew Bradford echoed those sentiments, saying while he was not so concerned with losing production at the wellhead in Texas and Louisiana, he had concerns about gas processing plants getting flooded and therefore impacting production.

For a storm surge expected along the coast, gas processing plants and oil refineries could take a big hit, as 55% of gas processing capacity and 45% of the nation’s oil refining capacity is along the Gulf Coast, mostly in Texas.

“The other concern is what if Mont Belvieu shuts down due to flooding, Bradford said. “This happened during Hurricane Ike. This would impact production all way back into the Rockies and Midcontinent.”

Indeed, Southern Union Gas Services, the company’s gathering and processing business, was forced to shut in its processing plants and attendant production for approximately a week after Ike hit.

Harvey would be the first hurricane to make landfall in the Lone Star state since Hurricane Ike struck southeast Texas in 2008. Ike slammed into Galveston as a Category Two hurricane with winds that destroyed nearly a dozen offshore production platforms and caused the largest blackout in Texas history, affecting as many as five million people from Texas into Louisiana.

As RBN Energy’s Rick Smead, managing director of advisory services, points out, Ike occurred during the first year that shale gas surged into the market from onshore, essentially replacing all offshore production. If Harvey plays out much like Ike did in 2008, then the market impact could be relatively muted as the drop in production would be effectively cancelled out by the drop in demand, as other analysts have noted.

“But the logic only works if there are a lot of power outages,” Smead said. “Houston being pretty much taken out was what helped in Ike. With flooding but not too much wind, it’s much harder to say. It’s possible a lot of coastal processing gets drowned, but gas-fired generation keeps rolling along if transmission still works.”

Of course, the path of the storm, both ahead of landfall and after, continues to be closely watched in the market. Smead said while most paths indicate mostly flooding from Houston northward, if the storm does the “button hook” and comes back east and north — or goes back offshore, re-strengthens and comes ashore a second time — then Harvey could be a lot more like Ike.

What happens after initial landfall is what causes additional concerns for facilities like Cheniere’s Sabine Pass LNG facility. “Sabine is way out of the path initially, but could certainly be affected with this twitchy storm,” Smead said.

He said it also could turn as Hurricane Rita did in 2005.

“Also, like Rita, if the storm did turn and go onshore so that Sabine was in the dirty path, there’s a horrible silting problem in the Sabine River. I’ve been told that it took six months to dredge it in 2005, and that Lake Charles was dredging the Calcasieu River with their tanker hulls,” Smead said.

Market reaction to the storm appeared to be muted on Thursday as prices had swung in a less than 7-cent range less than an hour before the close.

“The natural gas market seems right to shake off the storm so far as any demand-side impacts are likely as severe as the supply-side impacts. However, we are watching closely that potential for the storm to trend back to the east after stalling over coastal Texas, as if there were re-intensification and/or a second landfall over Louisiana that could complicate things further,” said Bespoke Weather Services’ Jacob Meisel, chief weather analyst.

The best case scenario for the region would be that trend to the south and west with the track, as that would allow the storm to move more over land and weaken further, with rain not sitting over the same area for numerous days, Meisel said.

The worst case scenario would be for the storm to stall right along the Texas coast, inundating it with heavy rain and dangerous winds, but then begin sliding to the east gradually, maybe moving back over the Gulf briefly where it would re-strengthen a bit before a second landfall over western Louisiana, he said.

Such a path would impact more natural gas wells, both onshore and offshore, and hit the same areas with numerous days of very heavy rains, impacting natural gas supply, but also severely limiting cooling/power demand across the region with widespread outages.

“The storm stalling near the Texas coast does look more likely than the better-case scenario, but it is unclear if the storm moves back out over the open Gulf for any period of time, or just sits on land and gradually weakens,” Meisel said.

ExxonMobil is in the process of reducing production from the Hoover facility offshore. It also was working on transportation for staged evacuation of personnel from offshore facilities expected to be in the path of the storm.

Shell was evacuating all personnel from the Perdido platform as a precaution. The Perdido development is able to produce annual peak production of more than 200 MMcf/d of natural gas and 100,000 b/d of oil. The first producing platform in the promising Lower Tertiary Trend, the development is in a frontier area in the deepest waters of the GOM and is furthest from shore.

Anadarko also has shut in some GOM production and was evacuating workers.

“We continue to closely monitor the weather conditions in the Gulf of Mexico, and given the potential path of Harvey, we have safely removed all personnel and temporarily shut in production at our operated Boomvang, Gunnison, Lucius and Nansen facilities,” an Anadarko spokesperson said. “These facilities will remain shut in until the weather has cleared and it is safe to return our people to these offshore locations. We will continue to track Harvey and are prepared to remove additional personnel and shut in other operated facilities in the Gulf if necessary.”

The GOM has been reduced in importance as U.S. onshore production has surged, but it still is home to around 17% of the nation’s crude oil output and 5% of dry gas production, according to the Energy Information Administration.

East Daley Capital’s Ryan Smith, director of research, said since Harvey’s path is focused on the Texas offshore, there isn’t as much oil and gas production to curtail compared to a Louisiana storm path. The aggregated production from the Shell, Anadarko and ExxonMobil facilities is 475 MMcf/d of gas and 130,000 b/d of oil production, although curtailing production at these facilities will impact throughput for several midstream providers, including Williams Partners LP, Genesis Energy and DCP Midstream, he said.

“We don’t expect the storm to cause any permanent damage to these facilities, but we will keep an eye on the recovery during the next week or so,” Smith said.

On a side note, Smith said that since Shell and Anadarko are operating drilling rigs near these facilities, the storm could delay drilling activities at Shell’s Whale exploration project and Anadarko’s Phobos appraisal.

Between 10-15 inches of rain are expected from the central Texas coast to southwestern Louisiana, with some areas receiving up to 20 inches of rain, according to the NHC.

“Heavy rainfall is likely to spread across portions of eastern Texas, Louisiana, and the lower Mississippi Valley from Friday through early next week and could cause life-threatening flooding,” the NHC said.

Texas Gov. Greg Abbott has declared a state of disaster for 30 counties ahead of the storm.

In Corpus Christi, where refining and petrochemical expansions are underway, city officials warned residents to expect a storm surge of four to six feet. It had begun distributing sandbags to residents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |