Markets | NGI All News Access | NGI Data

Physical NatGas Slumps, But Futures Ease Only a Penny

Physical natural gas Wednesday fell hard and fell often in trading for Thursday deliveries. Only a few market points made it to positive territory, and the greatest setbacks were seen in the Northeast as temperatures were forecast to trend lower into the weekend.

The NGI National Spot Gas Average fell 8 cents to $2.71.

Futures prices didn’t even have the luxury of a double-digit move as traders noted a lack of volatility. At the close September had eased 1.1 cents to $2.928 and October was down by eight-tenths to $2.960. October crude oil rose 58 cents to $48.41/bbl.

Temperatures were forecast to moderate across key market areas. Wunderground.com predicted Boston’s high of 80 degrees would slide to 79 Thursday before tumbling to 73 on Friday, 6 degrees below normal. New York City’s 80 high Wednesday was also expected to drop to 70 Thursday and fall to 77 Friday, 5 degrees less than its seasonal norm. Chicago’s 77 max on Wednesday was seen falling to 72 Thursday and rebounding to 74 Friday, 7 degrees below normal.

Gas at the Algonquin Citygate shed 41 cents to $2.26 and deliveries to Tetco M-3 dropped 6 cents to $1.81. Packages on Dominion South were quoted 7 cents lower at $1.74 and gas bound for New York City on Transco Zone 6 rose 6 cents to $2.53.

Deliveries to the Chicago Citygate fetched $2.84, down 10 cents and gas at the Henry Hub changed hands 9 cents less at $2.92. Gas on El Paso Permian fell 8 cents to $2.66 and gas on Northern Natural Demarcation came in at $2.77, down 11 cents.

Kern River was quoted at $2.68, down a nickel and Kern Delivery shed 4 cents to $2.89. Gas at Malin fell 6 cents to $2.75 and gas priced at the SoCal Citygate gave up 4 cents to $3.20.

The rise in prices at Transco Zone 6 New York and Transco Zone 6 non New York North — a gain in a sea of red ink — caught the attention of traders. According to Stefan Baden, analyst with EnergyGPS, the anomaly could have been caused by the fact that power markets close ahead of physical natural gas markets, and in this case a buyer on the New York ISO grid could have jumped the gun and sought to secure supply before the power market closed.

The National Weather Service in southeast Massachusetts reported Wednesday “a cold front crosses most of the region this morning bringing beautiful weather today an end to the oppressive humidity, except for the cape and islands where low clouds and muggy conditions will persist into this afternoon. Otherwise, high pressure brings dry weather with very comfortable humidity levels Thursday through early next week.”

Traders see the market mired in not only a narrow trading range but also low volatility.

“If you take a look over the last two weeks you are trapped in that range,” said Elaine Levin, president of Powerhouse LLC, a Washington DC trading and risk management firm.

“I said to a client unless it falls below the lower end at $2.75, I’m just sitting here spinning my wheels. We have a hurricane in the Gulf, look how the mighty have fallen. The joke now is that it doesn’t matter unless it hits Pittsburgh.

“I was talking to some of our marketer clients whose business is derived from end-users that are looking to lock in price. They either have fear or greed, and right now it is complacency,” she said.

Although forecasts warmed ever so slightly, the bottom line is that cooling requirements are still below average. WSI Corp. in its morning report to clients said, “The six to 10 day period forecast is now warmer or not quite as cool as the previous forecast over the central U.S.” Continental United States population-weighted cooling degree days “are up 1.1 to 40.3, which are 3.3 below average. Forecast confidence is only average at best today. Medium range models are in modest agreement and have shown some general consistency with the overall pattern.”

WSI cautioned that “there is localized/regional uncertainty because of the long range track/influence of Harvey. Uncertainty with Harvey offers risks in either direction. Faster progression offers some warmer potential across the Rockies and central U.S.”

The National Hurricane Center is tracking Tropical Depression Harvey in the western Gulf of Mexico. Landfall is forecast later this week along the Texas Gulf Coast, with possible severe weather impacting the entire Texas Coast and areas inland. Should Harvey reach Hurricane status it would be the first hurricane to strike Texas since 2008. This week it forced workers to be evacuated from Gulf of Mexico platforms, sent cotton rallying and has airlines preparing for flight disruptions.

The storm could disrupt field operations as it comes ashore. The Texas Division of Emergency Management has warned the system “is likely to slow down once it reaches the coast, increasing the threat of a prolonged period of heavy rainfall and flooding across portions of Texas and Louisiana into early next week.

“Harvey could also produce storm surge and tropical storm or hurricane force winds along portions of the Texas coast later this week,” the Texas agency said. Also, tropical storm or hurricane watches could be required before Thursday morning for portions of the coast of northeastern Mexico, Texas and southwestern Louisiana.

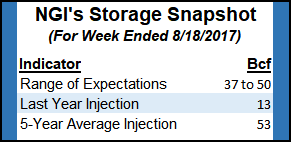

Also vying for traders attention will be the weekly Energy Information Administration storage figures. Last year 13 Bcf were injected and the five-year pace stands at 53 Bcf. A Bloomberg survey showed a median 47 Bcf with a range of plus 37 Bcf to plus 50 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |