E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

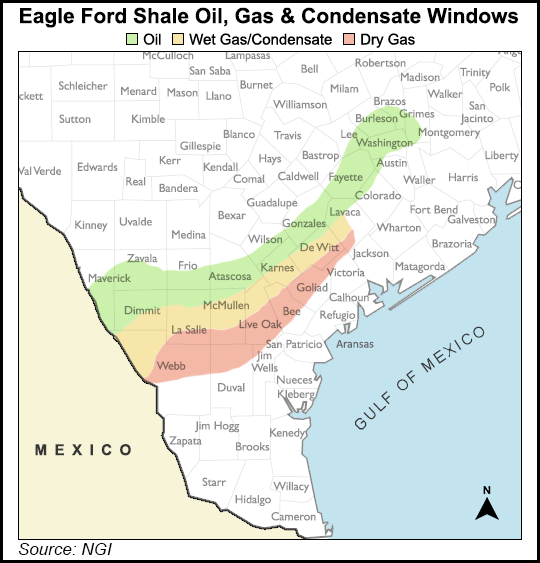

Eagle Ford’s Dry Natural Gas Focus of New PE-Backed Sierra Resources Affiliate

Post Oak Energy Capital LP is opening up its pocketbook once again, agreeing to commit $100 million to Sierra EF LP, which is zeroing in on the Eagle Ford Shale’s dry natural gas window in South Texas.

The Houston-based Sierra Resources LLC subsidiary already has financial commitments from affiliates of GSO Capital Partners LP and the Sierra management team, the private equity (PE) firm said. Privately held Sierra Resources, founded in 1996, has extensive experience operating in many onshore basins, but most recently it has worked on acquiring and developing unconventional assets in South Texas. It also works in the Utica Shale.

“We value this relationship with Post Oak,” said President John Eads. “Their approach to investing is consistent with GSO’s and our vision, and we are pleased to be working with them on this new venture as we further capitalize on our investments in the Eagle Ford.”

Sierra EF’s executive team includes CFO John C. Eads and COO John T. Campbell. Executive Vice President (EVP) Robert S. Fabris handles land and business development, while EVP John H. Kelly is in charge of engineering.

“Having known the team at Sierra for decades, Post Oak is excited to partner with management and GSO to target the dry gas window of the Eagle Ford Shale,” said Post Oak Managing Director Frost Cochran. “Management has an impressive track record of investing in and operating across a number of basins across the country, and is well positioned for success in the highly economic Eagle Ford Shale play.”

Houston-based Post Oak, whose PE commitments primarily are in the upstream sector, has a roster of exploration and production investments in the U.S. onshore that include Double Eagle Energy Permian LLC, Moriah Henry Partners LLC, Nadel and Gussman NV LLC, Rimrock Resource Partners LLC and Saxet II Minerals LLC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |