Infrastructure | E&P | NGI All News Access

U.S. Adds One Rig In NatGas Patch, but Oil Drilling Declines

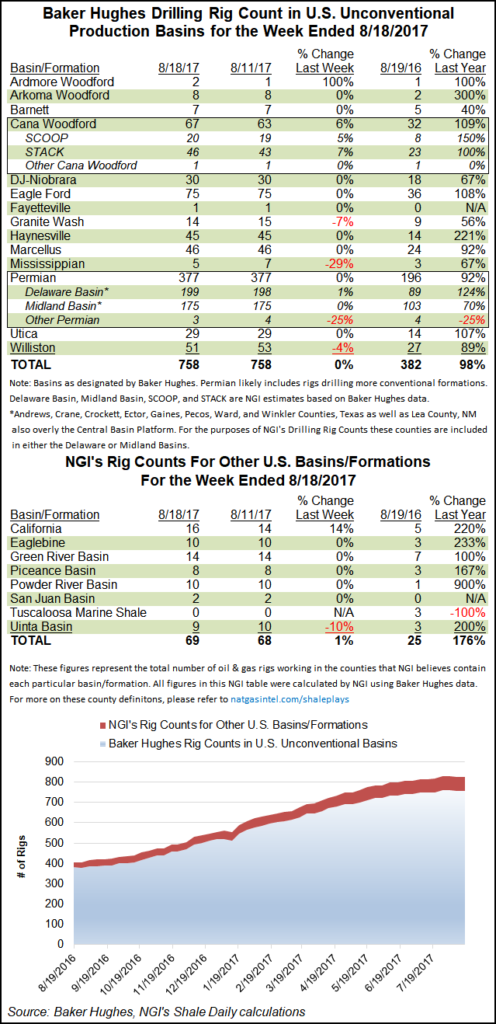

The U.S. rig count fell by three for the week ended Aug. 18 as five oil-directed rigs left the patch, according to data released Friday by Baker Hughes Inc. (BHI).

The United States added one natural gas-directed rig and one “miscellaneous” rig to end the week at 946 rigs, down from 949 a week ago and 491 in the year-ago period. Five directional rigs were added in the United States, while two horizontal and six vertical rigs packed up.

Canada saw six rigs dropped for the week, all oil-directed, finishing at 121 rigs versus 65 running a year ago.

The total North American rig count fell by nine week/week to 1,160, compared with 612 rigs in the year-ago period.

There were no big movers among the states for the week. Interestingly, California added two rigs to finish at 16, up 11 year/year. Alaska, Louisiana, Oklahoma and Utah each dropped one rig, while New Mexico saw one rig return during the week, according to BHI.

North Dakota’s Bakken Shale appears to account for two of the dropped oil-directed rigs. The Williston Basin fell to 51 rigs from 53 running a week ago. Still, the play’s rig count is nearly double its year-ago tally of 27. North Dakota officials said recently the Bakken infrastructure buildout is catching up to production, with 78% of the oil output for June transported via pipeline, while crude-by-rail volumes declined to 7%.

There was some shuffling this week in the Midcontinent as the SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) each added rigs, the BHI data shows.

The Cana Woodford added four rigs to end at 67 from 32 a year ago, while the Ardmore Woodford added one rig to double its year-ago tally. The Granite Wash saw one rig leave during the week, ending at 14; the Mississippian Lime gave up two rigs to finish at five.

Elsewhere, the Permian Basin, as well as the Eagle Ford, Marcellus, Utica and Haynesville shales, among others, all carried over the same number of rigs from the week before.

The oil drilling declines in this week’s report may be early signs of retrenchment following a sustained dive in crude oil futures that began in late spring. Raymond James & Associates analyst J. Marshall Adkins and his team said recently that a decline of around 100 rigs through the second half of 2017 “appears inevitable” as a response to oil prices that went from highs in mid-$50/bbl in the spring to cratering in the low-$40/bbl over the summer.

While the firm is forecasting the U.S. rig count to rise to 1,100 next year in response to $65/bbl oil, a short-term decline is likely based on a typical 15-20 week lag time when exploration and production (E&P) activity responds to changes in oil prices.

After months of oil prices in the mid-$40s, it is “abundantly clear that E&P spending is rapidly outpacing cash flows. In fact, our U.S. E&P cash flow analysis suggests that at current oil prices, the U.S. E&P industry is on pace for one of the highest outspend years in the past two decades in percentage terms,” Adkins wrote. “U.S. E&Ps simply can’t keep outspending at the pace they have done so far this year. Either oil prices move sharply higher or drilling activity slows. We think both will occur in the next few months.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |