E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Texas Energy Jobs Rising, Along with Permian DUCs, Haynesville NatGas Rigs

Oil and natural gas employment in the Lone Star State grew by roughly 4,300 jobs in June to 223,300, the seventh consecutive monthly increase, as activity was driven by statewide drilling gains, the Federal Reserve Bank of Dallas said.

According to Eleventh District statistics, support activities added 4,400 jobs, while payrolls in oil and gas extraction fell by 200 jobs.

In the No. 1 oil prospect in the country, the Permian Basin, production rose 3% in July from June, or 68,100 b/d, to 2.47 million b/d. Eagle Ford Shale output was up 3.1%, or 41,400 b/d, to 1.35 million b/d.

Expanding oil takeaway from the Permian, including by BridgeTex Pipeline Co. LLC, has enhanced capacity, said researchers.

“Recent expansion in the capacity of the BridgeTex Pipeline, from 300,000 b/d to 400,000 in second quarter 2017, will likely help support growth in the Permian,” economists said. Meanwhile, Eagle Ford production “has been on an upward trend since it bottomed out in November 2016,” researchers noted.

At the end of July, operating rigs In the Permian numbered 379. In the Eagle Ford, 76 were working.

Meanwhile, drilled but uncompleted (DUC) wells in the Permian increased in July to 2,330 from 2,195 in June, “as the number of wells drilled at 485 exceeded that of wells completed at 350,” said researchers.

Permian DUCs have been at an all-time high in the region, according to U.S. Energy Information Administration data that goes back to December 2013, but the number of monthly completions also is increasing.

The DUC-to-completion ratio, which is the total number of DUCs divided by the number of wells completed in a specific month, was 6.7 in July and matched the 2017 average, said researchers.

“The ratio signifies the number of months it would take for the inventory to be depleted, assuming no new wells are drilled.”

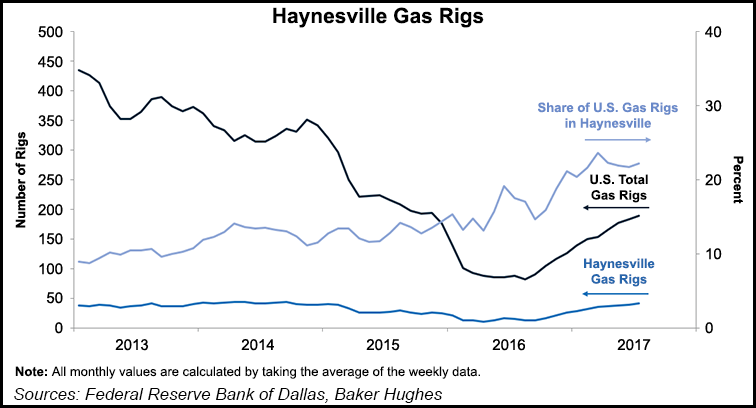

The natural gas-directed rig count in the Haynesville Shale also is blooming, data show. The Haynesville, which extends from parts of East Texas into northern Louisiana, saw the rig count gain two to 42 in July from June. The overall U.S. gas rig count rose in the same period by five to 189.

“Since May 2016, Haynesville’s share of U.S. gas-directed rigs has been trending upward, rising from 16% to 22%,” researchers said. “Better economics in specific ”sweet spots’ in the region and its geographic proximity to current and future liquefied natural gas export terminals and to the Henry Hub distribution hub have likely contributed to the rise.

“Henry Hub gas generally trades at a premium compared with gas from locations in the Marcellus and Utica basins in Pennsylvania and Ohio, allowing producers to get a higher price.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |