E&P | NGI All News Access | NGI The Weekly Gas Market Report

Lower Tertiary Draws Most Prospectors in GOM-Wide Lease Sale

In the first lease sale covering the entire Gulf of Mexico (GOM) since 1983, the Lower Tertiary Trend, an intriguing deepwater play that has yielded big-time discoveries, captured most of the attention.

The Department of Interior’s Bureau of Ocean Energy Management (BOEM) said Lease Sale 249 garnered $121.14 million in high bids for 90 tracts covering more than 508,000 acres of the Western, Central and Eastern Planning Areas. Almost 76 million acres total had been on offer.

Twenty-seven exploration and production companies, led by Big Oil and large independents, submitted a total of 99 bids worth more than $137 million.

“It’s a continued show of the strength of deepwater,” said BOEM’s Mike Celata, who directs the GOM region. He discussed the results in a conference call and said of the 90 blocks receiving bids, 76 (84%) were in deepwater. “It’s a continued investment in the Gulf looking at the Lower Tertiary and Miocene trends.”

Most of the enthusiasm for leases was trained in Alaminos Canyon (AC), East Breaks, Garden Banks, Keathley Canyon (KC) and Mississippi Canyon (MC).

“I characterize this as a very successful sale,” said Interior’s Katharine MacGregor, assistant secretary for Lands and Minerals Management. “We made $121 million, and last August for Lease Sale 248, we made $18 million…There is something to be said about having a Gulf-wide sale that offers more acreage for competitive leasing.” Last year’s Lease Sale 248 only offered blocks in the Western Planning Area of the GOM.

In the latest auction, Total E&P USA Inc. offered six high bids worth nearly $16.8 million, but it also claimed the sale’s highest offer of $12.1 million for Garden Banks Block 1003. The block is in water depths of nearly a mile, at 5,249 feet (1,600 meters).

Total E&P is working with Cobalt International Energy Inc. in Garden Banks area to develop the North Platte discovery. The North Platte No. 4 sidetrack 2 well earlier this year hit about 400 feet of Lower Wilcox oil pay. A subsequent bypass adjacent to the sidetrack led to the recovery of about 200 feet of Lower Wilcox conventional core.

Meanwhile, Shell Offshore Inc. submitted the most high bids at 19, worth a total of $25.1 million. Shell’s highest offer of $4.5 million is for the Lower Tertiary’s KC Block 214.

Chevron U.S.A. Inc., which submitted 15 high bids for nearly $28 million total, offered as its highest bid almost $5.7 million to capture AC Block 814, also in the Lower Tertiary. Chevron was an early mover in the Lower Tertiary, where it continue to rack up discoveries, including its promising Guadalupe development.

Meanwhile, ExxonMobil Corp. made seven high bids in the lease sale worth a total of close to $20.4 million, with a $10.8 million offer for MC Block 779. Anadarko US Offshore LLC, which works with ExxonMobilon some deepwater tracts, had 10 high bids totaling $10.6 million, with a high bid of $3.8 million for MC Block 40.

Other high bidders in the latest offshore sale included Statoil Gulf of Mexico LLC, with four high offers totaling nearly $5 million. LLOG Bluewater Holdings LLC submitted six high bids worth more than $2.6 million, while Apache Deepwater LLC offered one high bid for $1.17 million.

BP Exploration & Production Inc. issued three high bids worth a total of almost $1.7 million, and LLOG Exploration Offshore LLC had three high bids totaling $1.6 million.

Ridgewood Energy Corp. had five high bids totaling $1.4 million. Ecopetrol America Inc. submitted four high bids that were worth $460,000, and Houston Energy LP had seven high bids totaling nearly $445,000.

The lease sale, livestreamed from New Orleans, was the first under the Outer Continental Shelf (OCS) Oil and Gas Leasing Program for 2017-2022. The sale offered parcels offshore Texas, Louisiana, Mississippi, Alabama, and Florida.

However, while Wednesday’s sale was deemed a success, it garnered less than half of the OCS sale in March, which also offered far fewer packages. Lease Sale 247 only offered blocks in the Central GOM, but it attracted 28 producers and 189 bids on 163 blocks. High bids for that sale totaled nearly $275 million.

“Coming right on the heels of a Central Gulf sale, there’s a lot to be said for companies accumulating capital to bid again on area-wide leasing,” MacGregor said. “It proves opening more acreage gives folks a lot more options when it comes to investing in offshore leases.”

National Ocean Industries Association President Randall Luthi on Wednesday was circumspect on the low number of bids.

“While the results of today’s Gulf of Mexico oil and gas lease sale reflect market realities, they also demonstrate the offshore oil and gas industry’s commitment to the U.S. Gulf of Mexico, even with extended low commodity prices and lingering regulatory dysfunction.”

Wood Mackenzie analyst William Turner noted that lease activity was down “by roughly half from Central Lease Sale 247, with operators submitting a total bid value of $137 million for 90 blocks, a decrease of 57% and 45% respectively. The decrease in activity comes after the first increase in five years seen during the last sale in March.”

However, the GOM deepwater still is proving its mettle, Turner said.

“Deepwater (400-plus meters depth) blocks won the day…with 76 blocks receiving 98% of high bid value at $118 million,” Turner said. “The deepwater industry is emphasizing short-cycle, low-risk prospects above high-impact, wildcat drilling. Today we saw operators continue to focus on areas near existing infrastructure with a majority of bids close to existing hubs or appraised developments.”

The bids near pre-final investment decision discoveries “were a vote of confidence in higher-risk, standalone developments with potential for higher rewards,” Turner said.

BOEM included fiscal terms in the latest sale that take into account “market conditions and ensure taxpayers receive a fair return for use of the OCS.” Terms include a 12.5% royalty rate for leases in water less than 200 meters deep, and a royalty rate of 18.75% for all other leases issued. The 12.5% rate is lower than the proposed 18.75% royalty rate for shallow water leases that BOEM had published in the proposed notice of sale.

“Through regulatory streamlining, expanded offshore and onshore opportunities and great cooperation with our stakeholders, we expect to encourage competition while continuing to receive a fair and equitable return on oil and gas resources,” said MacGregor.

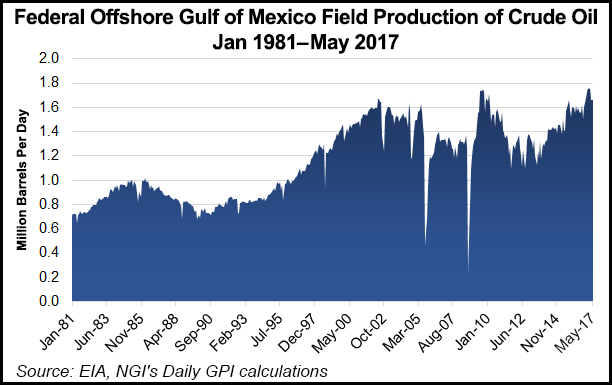

The estimated amount of resources projected to be developed as a result of the region-wide lease sale is 0.55-4.42 Tcf of natural gas and 0.21-1.12 billion bbl of oil. Most of the activity, up to 83% of future production, is expected to occur in the GOM’s Central Planning Area.

The bids are to be evaluated over the next three months, with awards posted on BOEM’s website as they are completed.

Nine additional region-wide lease sales are to combine all three planning areas in the GOM. In late June, the Trump administration launched a comment period for the OCS program covering 2019-2024. The current program is to continue to be executed until the revised national program is completed.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |