Markets | E&P | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

North America’s NatGas Markets Working, with ‘Paradigm Shift’ Underway, Says BP Exec

The North American natural gas market is more globally interconnected than ever before, as exports steam along both overseas and to Mexico, a top BP plc executive said Wednesday.

BP Energy Co.’s Dawn Constantin, senior vice president of marketing and regulatory affairs, was keynote speaker in San Antonio on the final day of the inaugural U.S.-Mexico Natural Gas Forum, presented by LDC Gas Forums.

The unearthing of the vast unconventional gas reserves across the U.S. onshore has created a “deep, fungible market in North America,” in turn creating a “paradigm shift,” that has sent a signal that “this market is more interconnected than ever before,” she told the audience.

And it’s interconnected globally not only among gas markets but among oil and natural gas liquids (NGL) commodities, Constantin said.

“There’s plenty of supply; that’s a common theme,” she said, as well as billions of dollars being invested to move gas, via liquefied natural gas (LNG) exports and otherwise to where they are needed most.

Evolving Continental Relationships

“The pricing relationships that we know of, that we care about with Henry Hub, with basis relationships across Canada, the U.S. and Mexico…all that is going to continue to evolve, which means that managing the business, managing the risks, becomes very, very critical when thinking about changes in the future.”

BP has been North America’s largest gas trader for years, according to NGI’s quarterly survey of Top North American Gas Marketers. During 1Q2017, BP traded 22.53 Bcf/d, more than double the No. 2 marketer in the quarter, Shell Energy North America.

Constantin’s Houston-based marketing team is responsible for planning and executing programs that position BP as a counterparty, while also promoting customer relationships. Her regulatory affairs team advises on evolving policy developments that impact the marketing and trading businesses in Canada, the United States and Mexico.

As traders attempt to predict gas prices, Constantin warned that they shouldn’t try to do it in a bubble.

“If someone puts a Henry Hub forecast in front of you and they haven’t considered the oil equation, the NGL equation or the LNG equation, then it’s not credible,” she said. “Oil prices matter because they influence where producers drill.”

Whether it’s a “$50/bbl world, a $75/bbl world or a $100/bbl world, that influences where we drill in North America. That matters, because when you drill for oil, you get natural gas.”

The other thing that matters is liquids prices for the same reason as oil, she said. If propane, butane and ethane prices are strong, there’s an incentive to drill for rich gas, and in some areas, a lot of dry gas comes with those liquids.

Those liquids prices transfer globally, as manufacturers can use naphtha or NGLs in the manufacturing process, and if North America is able to export more liquefied petroleum gases (LPG), that matters.

“Oil prices influence naphtha prices,” Constantin said. “$100 oil means really expensive naphtha,” which is an an opportunity for North America to export more LPG to displace naphtha in crackers.

“When it’s a $100/bbl world, the opportunity to displace naphtha to markets around the world is quite big.” Gas traders may not think NGL prices are paramount to their business, but they are, she said.

For example, if oil/liquids prices are trading at $50/bbl, there’s not as much opportunity for North American supply, and that means it needs to find another home.

“All things considered, it could be bearish for prices because it’s all connected…gas, oil, LNG.” There still are long-term contracts around the world linked to oil prices, but gas balances in North America influence whether LNG is exported or whether a lot of supply has to find a home on the continent.

Gas Trading: It’s Complicated

The unconventional gas revolution has made global trading “more complicated than ever before,” Constantin said. “Shale has moved North American gas supply curve decisively to the right.”

Achieving a balance also more difficult than ever before because the massive gas supply now is being met by ever-more efficient producers.

For example, in the last five years or so, U.S. producers have sharply increased the resource potential at much lower prices. A $3.50/Mcf gas price five years ago could recover 870 Tcf. Better technology and improved efficiencies have changed the equation.

“We now can recover over 1,400 Tcf at the same price,” Constantin said. “We might see the rig counts go up and down…but believe me, the rocks are there and we have the logistics to get [it] out of ground.”

U.S. drilling activity also is “shifting in key plays,” which is an important driver for gas supply, she explained. Associated gas from the “four big oil plays,” the Eagle Ford and Bakken shales, the Niobrara formation and the big daddy Permian Basin has brought on an estimated 20 Bcf/d.

“That’s a big deal in a 75 Bcf/d market,” Constantin said of today’s average U.S. gas supply. And in turn, that means higher or lower oil prices “are really important.”

In the Eagle Ford and Permian alone, there’s an estimated 12-13 Bcf/d — all within the state of Texas.

“That matters,” she said, “because when you talk about demand, where demand growth is coming,” the state will be a key supplier for Mexico and LNG exports overseas.

Meanwhile, the dry gas play that upended the overall market, the Marcellus/Utica shales, is not oil-driven. Gas production is on cruise control in Appalachia, with little holding it back except infrastructure and price signals.

BP, which publishes an annual global energy outlook, expects North American gas demand to continue growing to 2030. “North America is a big demand sink for natural gas, and it’s growing,” for the industrial and power demand sectors and for overseas exports.

Mexico will be a big target for the future, Constantin said.

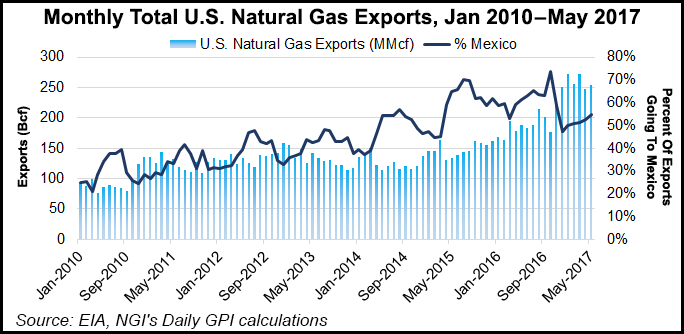

A recent forecast by the U.S. Energy Information Administration foresees the United States becoming a net gas exporter in 2018, a shift already underway this year as gas exports exceeded imports in three of the first five months of 2017.

“That’s significant,” Constantin said.

In Mexico, with a plethora of pipeline infrastructure underway and more expected, the country could grow from a 4 Bcf/d export market for U.S. gas to 9 Bcf/d, she said.

Mexico gas output also has been on a steady decline, while demand is rising. “That’s real demand…” If Mexico were to move to 9 Bcf/d of capacity within a few years in a 75 Bcf/d U.S. market, “that’s material.”

She reminded the audience that “commodity markets work and price sends a signal. We’ve got lots of supply…In the end, pricing relationships that we know are going to continue to evolve…both domestically and internationally.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |