Markets | E&P | Mexico | NGI All News Access

U.S. LNG Export Trade Jumps 1,000% in 1Q, While Canadian NatGas Imports Increase 9%

Natural gas sales heated up across North America in the first three months of the year, raising volumes and prices of flows between Canada, the United States and Mexico, according to the U.S. Department of Energy (DOE).

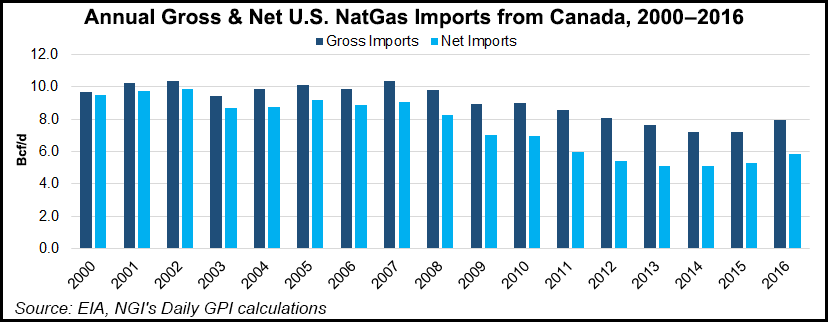

Canadian exports to the United States, still the continental gas trade’s biggest item, rose by 9% in 1Q2017 to 824.9 Bcf from year-ago volumes of 756.4 Bcf, the DOE’s regulation and international engagement division said.

While the United States still is a net gas importer from Canada, exports to Eastern Canada have steadily increased since the completion of the Vector Pipeline in 2000. Exports of U.S. gas across the border from Michigan to the Dawn Hub in Ontario make up the largest share of pipeline exports to Canada, according to an analysis of Energy Information Administration data. The government agency’s new August Short-Term Energy Outlook reiterated that the United States should become a net gas exporter in 2018.

The average price fetched by southbound Canadian gas at the U.S. border rose by 43% in 1Q2017 to $2.88/MMBtu from 1Q2016’s $2.01/MMBtu.

U.S. gas exporters likewise reaped gains. Pipeline deliveries of U.S. gas into Canada grew by 34% to 286.2 Bcf from 213.2 Bcf a year earlier. The border price for northbound U.S. gas rose by 45.4% to $3.30/MMBtu from $2.27/MMBtu.

U.S. liquefied natural gas (LNG) exports, launched in mid-2016 and accelerating, stood out as the continental industry’s growth star.

The volume of U.S. LNG overseas shipments shot up by 1,000% year/year in 1Q2017 to 146.7 Bcf from 13.3 Bcf. The average LNG export price rose by 48% to $5.47/MMBtu from $3.71/MMBtu.

Counting a 22% gain in gas pipeline deliveries to Mexico — 365.6 Bcf from 299.5 Bcf in 1Q2016 — total U.S. international sales grew by 52%.

U.S. exports of all types of gas rose to 798.7 Bcf in the opening three months of this year from 526.2 Bcf in the year-ago period. The performance included a 48% gain in prices received for Mexican deliveries to $3.28/MMBtu from $2.21/MMBtu.

The strong showing in the early months of this year has poised the U.S. industry to overtake its Canadian counterpart’s long-standing stature as the world’s second-biggest gas exporter after Russia, according to the DOE scorecard.

In 1Q2017, the Canadian lead over the United States in export volumes shrank from 1Q2016 by 90% to 26 Bcf from 260.8 Bcf. Total net U.S. imports, counting LNG tanker deliveries from overseas, were only 52.7 Bcf.

Industry analysts credit the 1Q2017 rising gas trade volumes and prices to a strong heating season, the new LNG outlet for surpluses, and use of gas-fired power stations to replace coal and back up renewable windmill and solar electricity sources.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |