Utica Shale | E&P | NGI All News Access

Eclipse Agrees to $325M Utica JV for Financial Flexibility

Ohio pure-play Eclipse Resources Corp. is entering a $325 million Utica Shale drilling joint venture (JV) with an affiliate of GSO Capital Partners that management said may provide more financial flexibility as commodity prices fluctuate.

The JV with Sequel Energy Group LLC is still being finalized, but Eclipse expects to make it official by the end of September. “As we see a significant amount of commodity volatility looking into 2018, the terms of this drilling joint venture will allow us to maintain, or even accelerate our current drilling pace, while scaling our company level capital expenditures based on the economic environment,” said CEO Benjamin Hulburt.

Sequel would provide up to $325 million to fund its share of two drilling programs comprised of 34 gross Utica wells. Some wells are currently in progress, while others would be spud through the end of 2018, Eclipse said. GSO is the credit division of the private equity firm Blackstone Group LP.

An option for a third program of similar size would increase committed funding from Sequel. Eclipse would also have the ability to choose its working interest for each program within an agreed upon range. The company may adjust its pre-carry working interest in the first program up until 4Q2017 for 30-50%, and its pre-carry working interest in the second program to 30-70%.

“We believe this structure allows us to maintain an efficient two-rig operating program while providing flexibility to manage capital spending to a level that is appropriate depending on the strength of forward commodity curves,” Hulburt said.

The company also issued its second quarter results, noting that its borrowing base has been increased to $225 million from $175 million.

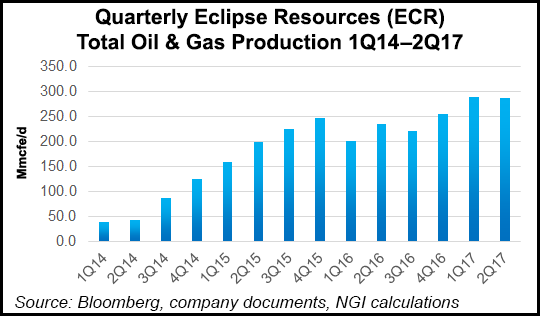

Eclipse produced 287.8 MMcfe/d during the quarter, down sequentially from 290 MMcfe/d but above guidance of 265-275 MMcfe/d. In 2Q2016, Eclipse produced 212.1 MMcfe/d in the year-ago quarter.

The company is also at work completing its latest super lateral wells, the Great Scott 3H and the Outlaw C11H in the Utica, with laterals longer than 19,000 feet. The wells are 70% complete and should come online by the end of the year, Hulburt said.

Average realized prices, including hedges, increased to $2.84/Mcfe in the second quarter from $2.42/Mcfe in the year-ago period.

Net income in 2Q2017 was of $11.5 million (4 cents/share), compared with a net loss of $73.2 million (minus 33 cents) in the year-ago quarter. Revenue increased year/year to $86.2 million from $47.1 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |