Markets | NGI All News Access | NGI Data

NatGas Futures Squeak Lower Following On-Target Storage Figures

September futures moved little following a report by the Energy Information Administration (EIA) showing a natural gas storage injection that was on track with what traders were expecting.

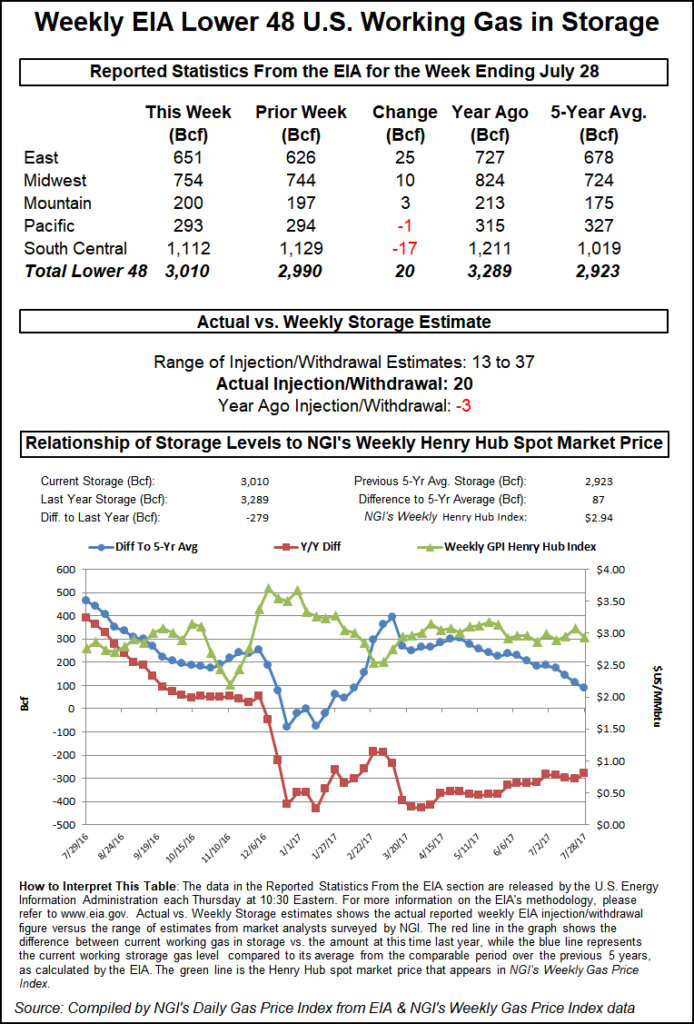

The EIA reported a build of 20 Bcf, only 1 Bcf less than consensus estimates. When the number was released, September futures dropped to $2.814 but were unable to break through the day’s high of $2.846 or low of $2.800. By 10:45 a.m., however, September had slipped to $2.802, down nine-tenths from Wednesday’s settlement.

Prior to the report traders were looking for a build on either side of the actual figures. Last year 3 Bcf was withdrawn and the five-year average stands at 44 Bcf. JP Morgan calculated an 18 Bcf injection and Stephen Smith Energy estimated a 23 Bcf build. A Reuters survey of 24 traders and analysts showed an average 21 Bcf with a range of +13 Bcf to +23 Bcf.

“The market response to the figure was uneventful to say the least,” said a New York floor trader. “We are looking at a range of $2.75 to $3.00.”

In spite of the weak market response, analysts saw the report as supportive. “The build for last week was in line with consensus expectations, slightly more than the 17-Bcf build in the prior week, and well below the 44-Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “So the report was bullish on a seasonally adjusted basis, as expected.”

The Denver-based analytical team at Wells Fargo saw the report as neutral, with the market still undersupplied by 2 Bcf/d.

“The reported figure was 27 Bcf above last year’s reported figure and 21 Bcf below the five-year average of 41 Bcf. The surplus versus the five-year average has fallen by 210 Bcf over the past 13 weeks (16.2 Bcf per week on average), reflecting at least 2 Bcf/d of undersupply in the natural gas market.

“However, based on current cool weather forecasts, which should drive relatively weak power burn levels, our model projects an 85 Bcf cumulative storage build over the next two weeks. This would still be below the five-year average of 107 Bcf and would reduce the storage surplus to just 75 Bcf by the second week of August,” Wells Fargo said.

Inventories now stand at 3,010 Bcf and are 279 Bcf less than last year and 87 Bcf greater than the five-year average. In the East Region 25 Bcf was injected, and the Midwest Region saw inventories rise by 10 Bcf. Stocks in the Mountain Region were greater by 3 Bcf and the Pacific Region was down 1 Bcf. The South Central Region fell 17 Bcf.

Salt storage fell 12 Bcf to 306 and non-salt storage decreased 6 Bcf to 806 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |