E&P | Eagle Ford Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Global Oil, NatGas Dealmaking Still Hot, Led by Permian, Canada Oilsands

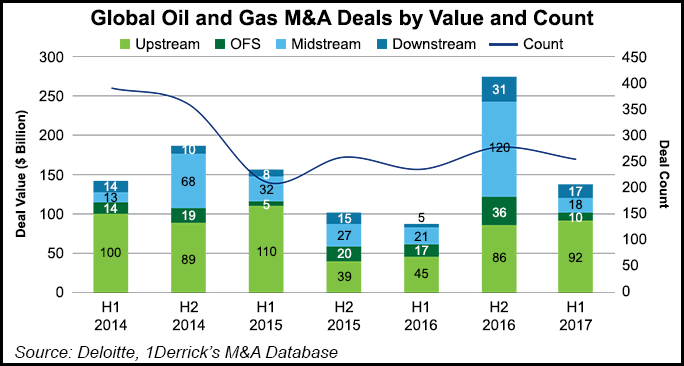

Fueled by unconventional asset sales in North America, global oil and gas companies continued their enthusiastic dealmaking through the first six months of this year, with transaction values rising almost 57% from a year ago, according to a Deloitte analysis.

Deal values increased to $137 billion in the first half of 2017 (1H2017) from $87 billion in the first six months of 2016. About 72% of total upstream deals were asset-based transactions, which provide immediate cash flow.

The first six months of this year coincided “with a period in which oil prices seemed to be settling at a higher level than the previous two years,” Deloitte researchers said. There is “some confidence” that the industry’s market recovery has begun, even though oil prices began to retreat in early June.

“The price improvement for most of the first half of 2017 translated into higher cash flows in the industry, particularly for upstream companies, some of which could be deployed either into increased drilling and completion activity or transactions,” according to Deloitte.

The M&A activity in the report is based on data from 1Derrick’s M&A Database as of July 10, representing acquisitions, mergers and swaps with deal values of more than $10 billion, including transactions with no reserves and/or production disclosures. Deloitte’s analysis excluded deals with no announced values and transactions with affiliated companies.

The Permian Basin, where most of the oil and gas activity is centered today, had the most asset sales in 1H2017, followed by the Marcellus Shale and the Eagle Ford Shale. Parsley Energy Inc. struck the biggest deal in the Permian during 1H2017, a $2.8 billion transaction to buy up acreage from from Double Eagle Energy Permian LLC.

Within the United States, private equity investors also primarily were trained on the Permian, with a total of 59 M&A-backed deals.

Nearly 92% of the asset-based transactions in 1H2017 were focused on unconventional assets, while the retreat from Canada’s oilsands continued, accounting for 26% of the $92 billion in overall upstream merger and acquisition (M&A) activity.

MA& upstream deals in 1H2017 were one of the top three periods in the past five years. The United States attracted the largest upstream deal value at around $42 billion, followed by Canada.

In the oilfield services sector, the deal count was up 55% year/year, while total deal value fell to about $10 billion, lower than previous periods when large corporate-scale transactions were announced.

In addition, there was “moderate” midstream M&A activity during 1H2017 but it was down sequentially and year/year, according to Deloitte. The midstream sector posted 26 deals with a combined value of around $18 billion, a decline of 85% from 2H2016 and 17% decline from 1H2016.

A significant trend during 1H2017 was that asset-based deals “aimed to refocus and reinforce portfolio positions” to prosper in the expected market recovery, said researchers. The trend was “particularly prevalent in North America, with the Permian Basin standing out by attracting deals totaling around $20 billion.

“The Permian has experienced a shift of focus from securing entry positions to focusing on add-ons that enhance development opportunities. Private equity funding has played a role here, backing both upstream and midstream deals.”

The realignment of holdings in Canada oilsands also was a trend, as international players exited and Canadian-based operators built their portfolios.

In addition, transactions in 1H2017 appeared aimed at securing improved access to downstream refined products markets for national oil companies “at a time when crude oil production cut agreements temporarily limit crude oil trade for some countries,” researchers said.

“Looking to the second half of 2017 and into 2018, much will depend on the extent to which the industry retains an outlook of confidence in firmer oil prices, keeps costs under control, and seeks continuing opportunity for resource development and profitable market access,” said researchers.

“The fundamentals appear somewhat stronger than one year ago, but risk and uncertainty may dampen a further upturn in M&A transactions if oil market stabilization and recovery look like they are taking longer than previously anticipated.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |