E&P | NGI All News Access | NGI The Weekly Gas Market Report

Shell Adopts ‘Lower-Forever Mindset’ on Crude Oil Prices

Royal Dutch Shell plc delivered a solid quarterly performance, returning the upstream to profitability from a year ago, but the oil major has adopted a “lower-forever mindset” regarding oil prices, as peak demand should hit within a decade, CEO Ben van Beurden said Thursday.

The Shell chief, during a second quarter conference call, laid out what fossil fuel boosters might call a pessimistic vision of the future, despite the quarterly earnings triumph.

Crude oil prices may never return to triple-digit prices, and management is preparing to operate under that scenario, van Beurden said.

“We have to have projects that are resilient in a world where oil has peaked,” he said. “When it will happen we don’t know, but that it will happen we are certain.”

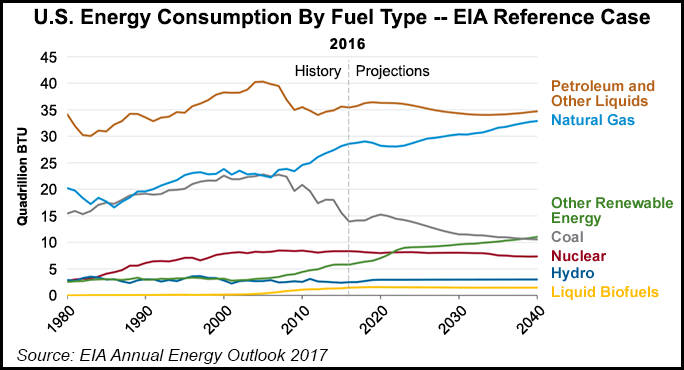

Experts differ on the timing of peak oil demand. The International Energy Agency, the global energy watchdog, is forecasting the peak to be around 2040.

“We are getting fit for the $40s,” van Beurden said, referring to a world in which oil prices remain below $50/bbl.

While a dismal view for fossil fuel enthusiasts, the executive team doesn’t see the need for oil disappearing.

“It doesn’t mean it’s game over straight away,” the CEO said. “There will be a continued need for investment in oil projects.”

Shell’s two big North American liquefied natural gas (LNG) projects remain solid investments, but they aren’t ready for primetime yet, van Beurden said.

LNG Canada, a joint project with Asian partners, has permits in hand for siting on the west coast in British Columbia. It recently requested permission to extend its export license. Lake Charles LNG, to be sited along Louisiana’s coast, was shelved last year to await better market conditions.

Shell is continues to wring costs from LNG Canada before making a final investment decision. “We are clearly not at a point that this was considered to be competitive enough when the industry started to change on us,” van Beurden said. Two things, he said, need to happen before the project moves forward.

“First of all, do we think we have a project with a breakeven price that is very resilient? This needs to be a project that can of course survive also under downcycles. It has many sorts of fundamental advantages in terms of its feed gas position that is somewhat more stranded than anywhere else in North America and proximity to premium markets etc., but the key thing of course is, do we have the confidence that the capital will come out, where we think we can get it too, having sort of witnessed cost escalation cycles in Canada. That, of course, is big our mind.”

Shell also wants to ensure the breakeven price is credible and competitive.

“The second point that we need to get to is timing,” the CEO said. “How does it fit into the sequence? These things are related. If you have the best possible project in the cost of supply curve for new projects, you are little bit less obsessed with the timing, because you will be able to get it into the market.”

Shell could take a large part of the LNG supply into its portfolio. However, “we need to get the timing roughly right. We think we can. If we look at an investment decision in the next 18 months or so, this is going to be a project that could start producing…right at the moment when the…short-term market is getting very tight again. So our projects will be able to find a home in the lead up to it.”

The same is true for Lake Charles. A “bit of restructuring” for the project still is required, “but we need to get it to a point that is really competitive, really resilient…

“Can we do two projects at the same time? Yes, we can. We have room for that. But can we absorb both projects at the same time in the market? We have to think a little bit harder for that, definitely not exactly at the same time.”

Shell already had shifted its focus to producing more natural gas than oil. However, over the next year, expect to see more capital diverted to renewables, including into electric vehicles.

The announcement comes as the UK on Wednesday followed France’s decision to halt the sale of internal combustion vehicles by 2040. Ending the use of traditional vehicles is “absolutely necessary,” said the Shell chief. The company is taking into account a “very aggressive scenario” in which oil use is peaking.

Shell plans to spend $1 billion a year on its New Energies division, which was set up in 2016 to develop hydrogen fuel cells and biofuels. Other Big Oil companies also have alternative energy divisions working on renewables.

As an aside, van Beurden said this week that he plans to switch from a diesel car to a plug-in Mercedes-Benz S500e in September. CFO Jessica Uhl already drives a BMW i3 electric car.

“The whole move to electrify the economy, electrify mobility in places like northwest Europe, in the U.S., even in China, is a good thing,” van Beurden said Tuesday in an interview on Bloomberg TV. “We need to be at a much higher degree of electric vehicle penetration — or hydrogen vehicles or gas vehicles — if we want to stay within the 2 degrees Celsius outcome.”

Van Beurden said during the conference call Thursday the advancement into low-carbon fuels would be “deliberately capped at a moderate pace.” Shell is sure to “make mistakes, but I don’t want them to be big mistakes.”

In any case, “the external price environment and energy sector developments mean we will remain very disciplined, with an absolute focus on the four levers within our control, namely capital efficiency, costs, new project delivery and divestments,” he said.

Shell more than tripled profits year/year and beat consensus forecasts. Net profit jumped nearly 32% year/year to $1.55 billion (19 cents/share) from $1.18 billion (15 cents). Revenue increased 23% to $72.1 billion, aided in part by asset sales. On a current cost-of-supplies basis, which strips out changes to the value of oil and gas inventories, profits more than tripled to $3.6 billion, versus $1 billion in 2Q2016.

Shell reiterated its plans to spend around $25 billion this year for capital projects, which is at the lower end of the long-term range.

The same is true for Lake Charles. A “bit of restructuring” for the project still is required, “but we need to get it to a point that is really competitive, really resilient…

“Can we do two projects at the same time? Yes, we can. We have room for that. But can we absorb both projects at the same time in the market? We have to think a little bit harder for that, definitely not exactly at the same time.”

Shell already had shifted its focus to producing more natural gas than oil. However, over the next year, expect to see more capital diverted to renewables, including into electric vehicles.

The announcement comes as the UK on Wednesday followed France’s decision to halt the sale of internal combustion vehicles by 2040. Ending the use of traditional vehicles is “absolutely necessary,” said the Shell chief. The company is taking into account a “very aggressive scenario” in which oil use is peaking.

Shell plans to spend $1 billion a year on its New Energies division, which was set up in 2016 to develop hydrogen fuel cells and biofuels. Other Big Oil companies also have alternative energy divisions working on renewables.

As an aside, van Beurden said this week that he plans to switch from a diesel car to a plug-in Mercedes-Benz S500e in September. CFO Jessica Uhl already drives a BMW i3 electric car.

“The whole move to electrify the economy, electrify mobility in places like northwest Europe, in the U.S., even in China, is a good thing,” van Beurden said Tuesday in an interview on Bloomberg TV. “We need to be at a much higher degree of electric vehicle penetration — or hydrogen vehicles or gas vehicles — if we want to stay within the 2 degrees Celsius outcome.”

Van Beurden said during the conference call Thursday the advancement into low-carbon fuels would be “deliberately capped at a moderate pace.” Shell is sure to “make mistakes, but I don’t want them to be big mistakes.”

In any case, “the external price environment and energy sector developments mean we will remain very disciplined, with an absolute focus on the four levers within our control, namely capital efficiency, costs, new project delivery and divestments,” he said.

Shell more than tripled profits year/year and beat consensus forecasts. Net profit jumped nearly 32% year/year to $1.55 billion (19 cents/share) from $1.18 billion (15 cents). Revenue increased 23% to $72.1 billion, aided in part by asset sales. On a current cost-of-supplies basis, which strips out changes to the value of oil and gas inventories, profits more than tripled to $3.6 billion, versus $1 billion in 2Q2016.

Shell reiterated its plans to spend around $25 billion this year for capital projects, which is at the lower end of the long-term range.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |