NatGas Cash, Futures Having Hard Time With Uninspired Weather; August Sheds 2 Cents

Next-day natural gas drifted lower in concert with a weak screen in Wednesday’s trading, as modest gains in California were unable to offset much deeper losses in New England and Appalachia. Most points were down by a couple of pennies or more, and the NGI National Spot Gas Average skidded 4 cents to $2.64.

Futures worked lower ahead of Thursday’s August contract expiration. At the close August had retreated 2.0 cents to $2.924, and September had fallen 1.7 cents to $2.914. September crude oil made it three in a row and rose 86 cents to $48.75/bbl.

One only had to look at next-day temperature forecasts for major metropolitan areas to decipher the cash market’s move lower. AccuWeather.com forecast New York City’s high of 77 Wednesday would rise to 82 Thursday and ease to 80 on Friday, 4 degrees below normal. Washington DC’s 84 Wednesday max was seen making it to 88 Thursday before sliding back to 85 Friday, 3 degrees less than its seasonal norm. Chicago’s 86 peak Wednesday was expected to fall to 80 Thursday and 79 Friday, 5 degrees below normal.

Gas at the Algonquin Citygate shed 6 cents to $2.04 and deliveries to Transco Zone 6 in New York plunged 34 cents to $1.74. Gas on Tetco M-3 Delivery lost 14 cents to $1.69, and gas on Dominion South shed 13 cents to $1.64.

Deliveries to Iroquois bucked the trend as Iroquois reported at-capacity nominations for Thursday at its interconnect with Algonquin Gas Transmission.

Iroquois Zone 2 rose 16 cents to $2.56 and deliveries to Iroquois Waddington added 8 cents to $2.60.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

August natural gas opened a penny lower Wednesday morning at $2.93 as traders dealt with weather forecasts showing a higher degree of variability than normal. Overnight oil markets were mixed.

Overnight weather models turned cooler, but forecasters admitted to a lack of confidence in the forecast. “[Wednesday’s] 11-15 day period forecast is several degrees cooler in the East when compared to yesterday’s forecast,” said WSI Corp. in its morning report to clients. Their calculations show continental United States population-weighted cooling degree days down 3.9 to 58.2 for the period.

WSI confessed confidence in the forecast is considered well below average standards due to abnormally high uncertainty in the models. There are both warmer and colder risks to the forecast across the Plains and East (north focused), they said. There is support for either a colder than average, or warmer than average pattern. “We are at a limit of predictability,” WSI said.

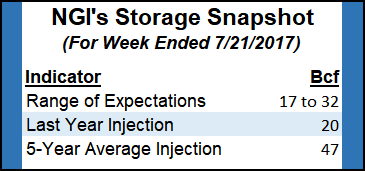

Traders are beginning to turn their attention to Thursday’s Energy Information Administration (EIA) storage report, and the trend of a decreasing year-on-five year storage surplus remains intact. Tim Evans of Citi Futures Perspective estimates a build of 30 Bcf, well below the five-year pace of 47 Bcf but greater than last year’s 19 Bcf.

He says that this is “confirming that the market is becoming tighter on a seasonally adjusted basis, even as the storage trends higher. This is a supportive fundamental trend that normally translates into rising prices over the intermediate term.”

As supportive as this may be it has only been enough “to produce sideways, choppy price action, but we continue to see potential for a test of failed technical support at $3.25 or the $3.50 area probed in mid-May.”

Energy CEOs taking a somewhat broader view are optimistic on the oil and gas industry in the United States. The “activity outlook in North America for the second half of the year remains robust,” but management also is encouraged by “more positive signs in the international markets with increases in activity and new project plans starting to emerge in several geomarkets,” said Schlumberger CEO Paal Kibsgaard Friday.

“We continue to be optimistic about the future of Schlumberger, as we maintain an attentive watch and flexible approach to the shape and pace of the emerging oil market recovery.”

Traders will have their hands full with the expiring August contract and the release of the EIA storage data. Last year 20 Bcf were injected, and the five-year average stands at 47 Bcf. ION Energy in Houston calculates a 21 Bcf addition, and Raymond James is looking for a 322 Bcf build. A Reuters poll of 24 industry cognoscenti revealed an average 24 Bcf with a range of +17 Bcf to +32 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |