E&P | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton E&P Customers ‘Tapping’ Brakes Across North America, Cutting Proppant Sand Use

North America’s rig count growth has begun to plateau, as producers slow activity “all over the place in North America,” a sign that they are learning from their high-spending days of the past, Halliburton Co. Chairman Dave Lesar said Monday.

During a conference call to discuss second quarter performance, Lesar said exploration and production (E&P) companies “are making rational decisions in the best interests of their shareholders.

“This tapping of the brakes is happening all over the place in North America. I can tell you the market will respond. It will rebalance, and these companies will stay alive, survive and thrive. Because that is what they do.”

There are signs of concern besides a plateauing rig count for the No. 1 pressure pumping company in North America.

While it’s too early to interpret the impact of stagnant oil and natural gas prices on E&P plans for 2018, CEO Jeff Miller said for the first time in years, Halliburton during the second quarter experienced a decline in average sand pumped per well.

“While this is only one data point, it’s something we will be watching,” Miller said. “We believe current sand price levels have encouraged operators to optimize their completion design using more science as opposed to simply maximizing sand in a trade for increased production.”

The Houston operator’s North American revenue increased 24% year/year (y/y), outpacing the average sequential U.S. land rig count growth of 21%. North America margins jumped by double digits, while international operations “continue to be challenged,” Lesar said.

The conference call marked Lesar’s last as chairman, as he is taking over as executive chairman for the next 18 months, while Miller takes control. As has been his bent, Lesar waxed optimistically about the state of the energy industry, and in particular, the bread-and-butter North American business.

“I think it’s important to look at the North America unconventional ecosystem to understand our customers’ behavior and why their ability to so quickly increase production has expanded rapidly. Currently, there’s a strongly held view by energy investors that the U.S. independent operators behave as a group. That view is wrong.

“When thousands of companies make discrete decisions about the same market each day, they do have a tendency to swing the activity and production pendulum too far one way or the other. That is not group think. It’s the impact of individuals trying to do the right thing for their investors.”

E&Ps Are ”Classic American Entrepreneurs’

Halliburton’s U.S. customer base isn’t a cartel like the Organization of the Petroleum Exporting Countries (OPEC) but rather individual businesses large and small, he said.

“When you look at them separately, you see thousands of entrepreneurial, smart and motivated risk-takers,” Lesar said.

“They readily adapt to the quality of their reservoirs, have almost unlimited access to capital, aggressively apply new technology and quickly morph their business models and structures to meet changing market conditions, and, yes, sometimes even take advantage of U.S. restructuring laws. They are your classic American entrepreneurs, and their success should be recognized.”

A success like the one witnessed by E&Ps in the U.S. onshore “would be greatly celebrated as another industry disrupter” were it in the Silicon Valley, Lesar said. “The unconventional disruption is not widely celebrated beyond the energy space, but it should be.”

U.S. unconventional resource development “has been as disruptive to the global energy markets as Amazon has been to big box retailing or Uber to the taxi business. It unleashed a wave of cheap, reliable energy that has disrupted global geopolitical and energy dynamics, made the U.S. more energy independent, caused OPEC to react and changed the fundamental economics of offshore production…Unconventionals is what I would call a disruptor, so let’s celebrate that.”

North America “is clearly serving as the world’s swing producer, which means this is where the game will be played and Halliburton is the distinct leader in this market,” Miller said during the call. Some experts were skeptical when Halliburton accelerated its onshore equipment reactivation early this year.

However, based on second quarter performance, “this decision was not only right but dead on target,” he said.

Pressure Pumping Equipment Sold Out

Case in point: Halliburton’s pressure pumping equipment is sold out for the third quarter.

The fracture sand “war room” and logistics infrastructure allowed the company to manage completions intensity with customer demand, giving the company an edge in passing through supply cost increases.

“Today we believe that current customer demand has outpaced the supply of completions equipment, and this should create a runway for a strong utilization through the second half of the year,” Miller said.

“As some of you have heard me say before, customer urgency is the foundation for the path to normalized margins. Today our customers remain urgent and therefore, we believe our path to normalized margins is achievable. We get there through a combination of increasing leading pricing, improved legacy pricing, better utilization and continued cost control…

“As we gauge the utilization of our equipment on a 24/7 basis, we see a significant opportunity to improve and drive the downtime out of our calendar. In this environment, it’s imperative to be aligned with the most efficient customers where we can create value for them while delivering the best returns for Halliburton. Filling our calendar with a hyper-efficient customers is an important part of what allows us to achieve our margin goal.”

Halliburton’s income from continuing operations totaled $28 million (3 cents/share) in the second quarter, versus year-ago losses of $3.2 billion (minus $3.73). Revenue totaled $4.96 billion, versus $3.84 billion in 2Q2016; it was 16% higher sequentially.

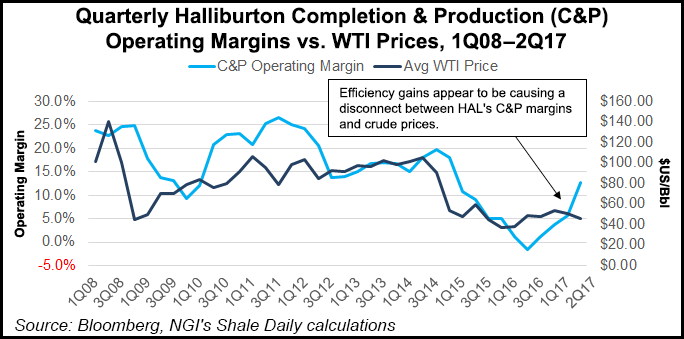

North America revenue increased y/y by 24% in 2Q2017, outperforming the average sequential U.S. land-rig-count growth of 21%. The completion and production division revenue increased 20%, while operating margins improved by 700 basis points to 13%, driven by the strength of production enhancement, cementing and completion tools product service lines.

This month, Halliburton acquired two businesses to expand its artificial lift and wireline portfolios. Summit ESP provides electric submersible pumps and related technology. Ingrain Inc. is a specialist in analyzing complex rock types using digital scanning.

Halliburton also highlighted some of its technology successes, including the AccessFrac Service, which was used by a Permian Basin operator to develop a multi-well Spraberry pad offsetting existing production. After one year of production, the wells that applied AccessFrac averaged a 33% increase in cumulative boe production when compared to previous pad development efforts, and it reduced negative impacts on the offset wells, the company said.

Halliburton also is working with Accenture to help transform how operators may achieve a lower cost per boe by digitalizing business activities between the field, front office and back office.

In addition, Halliburton and GroundMetrics have teamed up to deliver full field reservoir characterization and monitoring services. The collaboration combines GroundMetrics’ capabilities in electromagnetic and resistivity sensing where the capabilities and expertise of both companies would enable the generation of 3-D saturation models to help reduce subsurface uncertainties and assist operators in making better production-related decisions.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |