Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Schlumberger’s North American Land Activity Accelerates, Sending Revenue Sharply Higher

A surge in hydraulic fracturing capacity between April and June sent Schlumberger Ltd.’s North American revenues up 18%, with U.S. land revenue jumping 42% from the first quarter, a rate that was nearly double the increase in the onshore rig count.

Led by the continuing rebound in North America’s onshore, the No. 1 oilfield services operator sharply reversed year-ago losses, with quarterly revenue rising 8% sequentially and pretax income up 25%, resulting in earnings per share growth of 40%, CEO Paal Kibsgaard said Friday.

Even factoring in the “significant costs associated with reactivating equipment, all of our U.S. land product lines were profitable in the second quarter, driven by higher pricing, market share gains, improved operational efficiency, timely resource additions and proactive supply chain management,” he said.

North American revenue was 18% higher from the first three months of this year, with the “fast-track deployment of idle capacity as unconventional land activity accelerated during the quarter,” said the CEO.

The “activity outlook in North America for the second half of the year remains robust,” but management also is encouraged by “more positive signs in the international markets with increases in activity and new project plans starting to emerge in several geomarkets.”

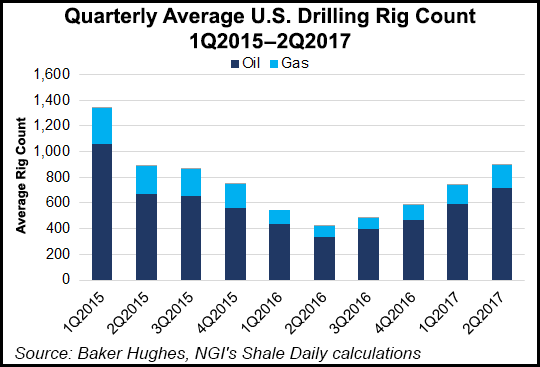

U.S. land revenue experienced 42% sequential growth during 2Q2017, “a rate almost double that of the 23% growth in the U.S. land rig count, driven primarily by hydraulic fracturing revenue that grew 68% as completion activity intensified and pricing continued to improve.”

U.S. land directional drilling revenue also was higher, as well design and longer laterals requiring rotary steerable systems and drillbit technologies continued to drive well productivity. Higher product sales in Cameron Valves & Measurement, as well as increased activity for Cameron Surface Systems, contributed to the strong financial performance.

However, U.S. land revenue growth partially was offset by the usual seasonal spring break-up in Western Canada and lower offshore revenue.

Schlumberger’s plan to capture more North American fracturing share from leader Halliburton Co. also remains on track, Kibsgaard said. The OneStim joint venture with Weatherford International Ltd. should be completed before the end of the year, allowing the partners to “capitalize on the recovery in North America land unconventional activity.”

At the same time, increasing investments in Schlumberger Production Management, including projects focused on liquefied natural gas and exploration and production ventures, provide not only “additional short-term opportunities for our various product lines, but also a long-term activity baseline with superior full-cycle financial returns for the company as a whole.

“Based on these, we continue to be optimistic about the future of Schlumberger, as we maintain an attentive watch and flexible approach to the shape and pace of the emerging oil market recovery.”

In the international markets, revenue increased 4% sequentially. Latin America revenue climbed on higher reservoir characterization and drilling activities in the Mexico and Central America geomarket, along with increased unconventional land activity in Argentina, where the Vaca Muerta shale play is drawing more prospectors, and hence more OFS business.

Strength in the international markets so far has been concentrated around land activity in Western Siberia and in countries that are members of the Organization of the Petroleum Exporting Countries, “but we are now also seeing an increasing number of new offshore projects being prepared for tendering and final investment decision (FID) in many of the world’s shallow water basins,” said Kibsgaard.

“Among the business segments, growth in the second quarter was led by the Production and Drilling Groups, where revenue increased sequentially by 14% and 6%, respectively, as hydraulic fracturing and directional drilling activity in U.S. land accelerated,” Kibsgaard said.

Production Group results benefited from a series of new technology deployments and transformation initiatives. In North America land, Well Services used BroadBand Sequence fracturing service to increase production in a horizontal shale well in the Wolfcamp formation of the Permian basin.

“Nearly one year after deploying the BroadBand service, the well produced 42% more hydrocarbons compared with the average production of three offset wells with the same lateral length, stage count, and volume of proppant and fluids,” Schlumberger noted.

In West Texas, Schlumberger also used a combination of technologies for Manti Tarka Permian to optimize well completions in the Wolfcamp. Data from field measurements and modeling helped to optimize the completions design, leading to a 60% increase in the fracturing surface area. The customer achieved a 25% improvement in oil production compared with offset wells in the field, the company said.

In North America land, Schlumberger said it established an artificial lift technology equipment benchmark in shale oil operations. Its REDA Continuum unconventional extended-life electrical submersible pump (ESP) technology, designed for unconventional reservoir horizontal well challenges, has been installed in more than 180 operations since its introduction in September 2014 “and has demonstrated run lives of 18 months, surpassing historical averages of six to nine months.”

Schlumberger recorded a 2Q2017 net loss of $74 million (minus 5 cents/share), sharply lower from the year-ago loss of $2.16 billion (minus $1.56). Excluding one-time charges, net income surged 54% and was 41% higher sequentially to $488 million (35 cents/share).

Revenue climbed 4% from 2Q2016 and rose 8% from 1Q2017 to $7.46 billion. Pre-tax operating income increased 27% from a year ago and by 231 basis points (bp), and was 25% higher sequentially (175 bp) to $950 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |