Markets | NGI All News Access | NGI Data

Stout Northeast Gains Lift NatGas Cash; August Futures Sag 2 Cents

Natural gas for delivery Thursday was mixed in Wednesday trading as outage-induced gains in the Northeast, along with firm pricing in the Midcontinent and Midwest, were able to counter weakness in the Rockies, Appalachia and West Texas.

The NGI National Spot Gas Average rose 2 cents to $2.95. Futures were held to a minuscule 4-cent range as weather forecasts calling for seasonal warmth were unable to offer much encouragement to the bulls.

Traders are groping for a catalyst to move the market higher or lower, and at the close August had given up 2.2 cents to $3.066, and September had eased 1.8 cents to $3.055. August crude oil continued its foray higher gaining ground in seven of the last eight sessions with a gain of 72 cents to $47.12/bbl.

Northeast prices got a spark in large part because of pipeline restrictions posted by Algonquin Gas Transmission (AGT). The company said it had restricted 100% of interruptible, secondary out of path, secondary in path and about 7% primary firm nominations sourced from points west of its Southeast Compressor Station for delivery east of Southeast.

“No increases in nominations sourced west of Southeast for delivery east of Southeast, except for primary firm no-notice nominations, will be accepted,” AGT said. AGT also reported restrictions on eastbound gas flow from its Oxford Compressor Station, as well as gas from the Tennessee Gas Transmission interconnect at Mendon.

Gas at the Algonquin Citygate jumped 39 cents to $3.92, and deliveries to Iroquois Waddington added a nickel to $3.22. Gas on Tennessee Zone 6 200 L gained 34 cents to $3.80.

Tetco M-3 Delivery came in a penny lower at $2.37, and gas bound for New York City on Transco Zone 6 added 8 cents to $3.23.

Marcellus basis continued to widen as the industry grappled with the construction delays incurred by Energy Transfer Partners LP’s Rover Pipeline. When completed the 3.25 Bcf/d, 710-mile greenfield project, which would carry Marcellus and Utica shale gas to markets in the Midwest, Gulf Coast and Canada, could uncork large volumes of Appalachian production and reshape the natural gas supply landscape once in service. The project is scheduled to come online in two phases this year.

Gas at the Henry Hub added 1 cent to $3.10, but deliveries to Dominion South were quoted 3 cents lower at $2.24. Gas on Tennessee Zone 4 Marcellus shed 6 cents to $2.18, and deliveries to Transco Leidy dropped 4 cents to $2.26.

Other market centers were mixed. Gas at the Chicago Citygate was up a penny at $3.01, and gas on Panhandle Eastern rose a penny to $2.71. Deliveries to El Paso Permian shed 5 cents to $2.69.

Gas at Opal changed hands 6 cents lower at $2.70, and Kern Delivery fell 6 cents to $2.70. Gas priced at the SoCal Border Average dropped a penny to $2.83.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

August gas had opened unchanged Wednesday morning at $3.08, and traders were lamenting the lower volatility compared to 2016.

“It seems like it’s a cyclical thing that never becomes uncyclical,” a New York floor trader told NGI. The market, he said, had been oscillating between the low $2.80s and just above $3 for a while.

According to NGI figures, volatility for the prompt month contract is indeed down so far in July 2017 versus July 2016. However, interestingly, it appears that this year is more the norm than the exception, at least when only considering the last six Julys.

The average of the daily historical annualized volatilities so far in July is 34.1%, down from the 47.4% seen in July 2016, but still in line with the 28-34% range seen in 2013, 2014 and 2016.

Traders still had to deal with a weather forecast showing little in the way of incremental cooling demand.

Wednesday’s six- to 10-day forecast was warmer than Tuesday’s for portions of the southern and eastern United States. “But the north central U.S., Northwest and West Coast are cooler,” said WSI Corp. in its Wednesday morning report to clients. “Some of these changes offset each other,” so continental U.S. population-weighted cooling degree days “are up 0.2 to 57.7 for the period, which are only 2.5 above average.”

WSI forecasters were confident of their predictions.

“Medium-range models are in reasonably good agreement with the break down and shift with the large scale pattern,” they said. “There are some technical differences and inherent uncertainty with rain chances over the eastern U.S.”

Technical analysts are a bit leery that the current market strength is sustainable. The Relative Strength Indicator, or RSI, “is a bit high, but no bearish divergence yet,” said analyst Walter Zimmermann following Tuesday’s market close. He said that his first resistance point had already been reached in Tuesday’s trading and if the market could clear upwards of $3.10, the “room opens up” to upwards of $3.25.

“All of these potential resistance points are candidates for a summer peak and the start of a sharp decline into the fall. So buyers beware.”

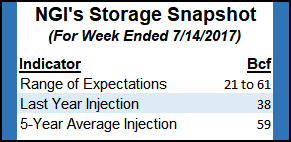

Perhaps Thursday’s Energy Information Administration (EIA) storage report can move July volatilities to higher levels. Last year 38 Bcf was injected and the five-year pace stands at 59 Bcf. Ritterbusch and Associates is looking for a 47 Bcf injection. A Reuters survey of 23 traders and analysts showed an average 32 Bcf with a range from +21 Bcf to +47 Bcf.

Ritterbusch is looking for an adjustment to last week’s below expectation 57 Bcf injection. Analysts “feel that Thursday’s EIA storage report will offer a bearish figure that could potentially push nearby futures back to below the $3.00 level,” he said in a report Tuesday. “Our expected injection will likely prove significantly larger than most street ideas as we anticipate that the prior week’s much smaller than normal build will see some upward adjustment.

“With this in mind, we will look for additional gains to the $3.12 area prior to the issuance of the EIA report as an opportunity to accept profits and stand aside.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |