Markets | NGI All News Access | NGI Data

NatGas Futures Float Higher Following EIA Storage Data

August natural gas futures inched higher Thursday morning once the Energy Information Administration (EIA) reported a storage injection for the week ending July 7 that was slightly less than what traders were expecting.

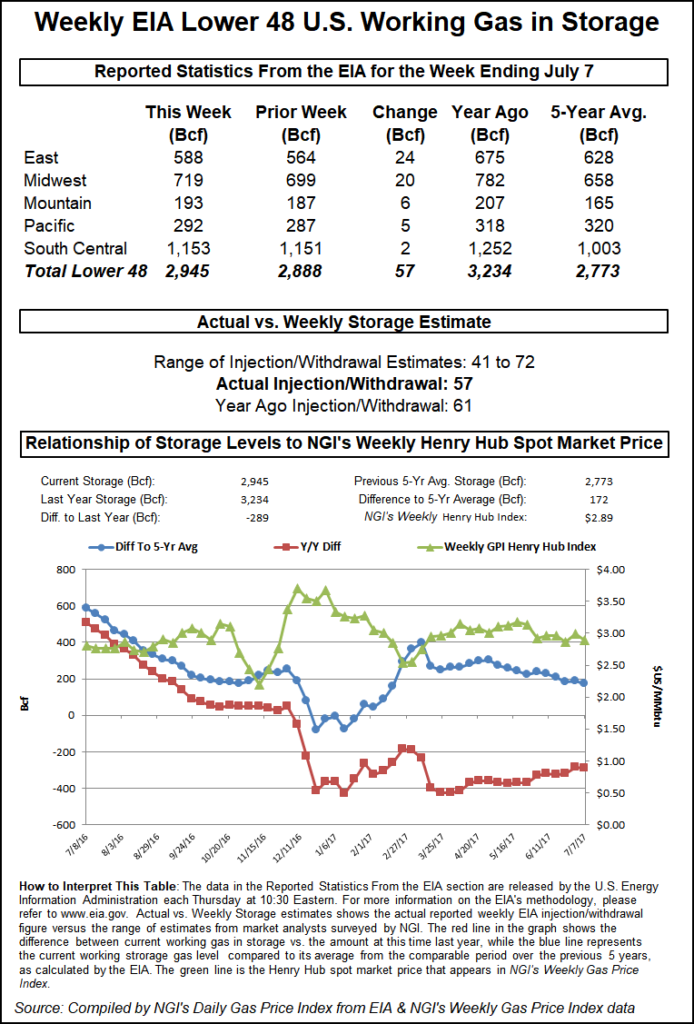

The EIA reported a storage injection of 57 Bcf, about 2 Bcf less than consensus estimates. Once traders had time to digest the figures, August futures rose to $3.009, but at 10:45 a.m. August was trading at $2.991, up six-tenths from Wednesday’s settlement.

Prior to the report traders were looking for a storage build not far from the actual figures. Last year 61 Bcf was injected and the five-year average stands at 72 Bcf. Wells Fargo calculated a 56 Bcf injection and Raymond James estimated a 65 Bcf increase. A Reuters survey of 24 traders and analysts showed a sample mean of 59 Bcf with a range of +43 Bcf to +65 Bcf.

“It wasn’t a great surprise. We were hearing a 59 Bcf number,” said a New York floor trader. “We really have to maintain above $3 if this market is going to do anything, and a one-day settlement over $3 is meaningless. The market has no steam at this point.”

Tim Evans of Citi Futures Perspective saw the 57 Bcf increase as “supportive compared with the 72 Bcf five-year average, but this was not what we’d call a surprise or a shock. Mostly, the report just removes the risk of a storage surprise for another week.”

The Wells Fargo Denver-based analytical team sees the market still undersupplied by 2 Bcf/d and “with hot temperatures forecasted for the next two weeks across most of the continental U.S., we expect the pace of storage injections to slow even further.

“Based on current weather forecasts as well as elevated power burn levels thus far in July (34.1 Bcf/d month-to-date versus 33.7 Bcf/d month-to-date in July 2016), our model projects a 76 Bcf cumulative storage build over the next 3 weeks. This would be substantially below the five-year average of 143 Bcf and would reduce the storage surplus to just 108 Bcf by the end of July.”

Inventories now stand at 2,945 Bcf and are 289 Bcf less than last year and 172 Bcf greater than the five-year average. In the East Region 24 Bcf was injected, and the Midwest Region saw inventories rise by 20 Bcf. Stocks in the Mountain Region were greater by 6 Bcf and the Pacific Region was up 5 Bcf. The South Central Region increased 2 Bcf.

Salt storage fell by 5 Bcf to 336 and non-salt increased 7 Bcf to 817 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |