Rover On Pace For Partial Phase 1 Service This Month, Energy Transfer Confirms

The highly anticipated Rover Pipeline, a massive 3.25 Bcf/d Appalachian takeaway project scheduled to come online later this year, is on track to begin partial service this month, backer Energy Transfer Partners LP (ETP) has confirmed.

“The Phase 1 section of the Rover Pipeline from Cadiz, OH, to Defiance, OH, is expected to be in service in July,” ETP spokeswoman Alexis Daniel told NGI. “We do not anticipate any delays to the November 2017 in-service date on Phase 2.”

Despite delays in receiving its FERC certificate, ETP has held to a tight schedule for Rover, maintaining its plans to bring the project online in two phases this year. The full Phase 1 — connecting producing areas of Ohio, West Virginia and Pennsylvania to the Midwest Hub in Defiance, OH, via Rover’s Mainline A segment — was originally scheduled to come online this month.

ETP had to revise its schedule slightly after the Federal Energy Regulatory Commission, responding to a 2 million gallon release of drilling fluids at a Rover horizontal directional drilling (HDD) site near the Tuscarawas River in Stark County, OH, ordered Rover to halt HDD work at multiple crossings for the project pending an independent review. Notably, FERC’s order affects the supply gathering Clarington Lateral, as the lateral’s HDD crossing at Captina Creek in Ohio can’t be completed without FERC lifting its moratorium.

ETP has sought FERC’s blessing to resume work at several crossings, including Captina Creek, but has had little luck in swaying the Commission.

Daniel did not specify when ETP expects the rest of Phase 1, including the Clarington Lateral, to be in service. Daniel previously said ETP hopes to bring the rest of Phase 1 online within 60 days of the initial start-up.

The Cadiz-to-Defiance portion of Rover Phase 1 would add about 211 MMcf/d of capacity, according to recent estimates by East Daley Capital Advisors Inc. The rest of Phase 1 would bump total capacity to 1.35 Bcf/d, according to East Daley.

East Daley’s Matthew Lewis told NGI Friday that the remaining portion of Rover’s Phase 1 is “probably slipping to September, as every day they cannot start that last Phase 1 drill at Captina Creek pushes that out. It’s probably a roughly 50-60 day drill time at Captina, so we are probably pushed out until mid-September if they don’t get HDD approval within the next week or so.”

Phase 2 is still on track based on the progress Rover reports weekly to FERC, Lewis said. Rover’s implementation schedule estimates drill times of two to three months, including 80-day drill times for Phase 2 sites, Lewis noted.

“That number probably includes some setup time, which likely would not be affected by the HDD moratorium. So Rover is probably still in fine shape” even if FERC does not lift the moratorium “until well into August for hitting the November Phase 2 schedule based solely on HDD drill times.”

Phase 2 would bring Rover’s full designed 3.25 Bcf/d of capacity online, adding service to an interconnect with the Vector Pipeline in Michigan and bringing its Mainline B and market segments online.

Genscape Inc. analyst Colette Breshears told NGI Friday that her firm still maintains a projected timeline for Rover that is less optimistic than what ETP has provided.

“The Cadiz Lateral, Supply Connector A and Mainline A are all ready for completion, and we expect to see hydrotesting complete in late July, with line pack receipts starting slightly ahead of an August in-service date,” Breshears said. “Assuming FERC grants Rover the ability to complete the Captina Creek HDD in mid-July, we have the completion of Phase 1 set for September. As the moratorium drags on, our full Phase 1 in-service date will move accordingly.”

As for when the moratorium might start to impact the November Phase 2 service target, “it depends on how much buffer time was set for the HDD rigs to complete the drills,” she said. “We know that the HDDs have been staggered throughout the construction cycle, with one rig responsible for more than one HDD and moving from site to site as needed. If the supply of HDD rigs is limited, then there will be a point at which the HDD completion will begin to delay Phase 2 service; but if there are additional rigs that may be hired, that time will shift accordingly.”

While all Mainline A HDDs have been completed or are on track to be finished soon, “no Mainline B HDDs have begun” for Phase 2, according to Breshears.

Once in service, the $4.2 billion, 713-mile Rover project would open up a major new pathway for Marcellus and Utica shale gas to reach demand centers in the Midwest, Gulf Coast and Canada. With its potential to significantly reshape the natural gas supply landscape, market observers have taken a keen interest in Rover’s progress.

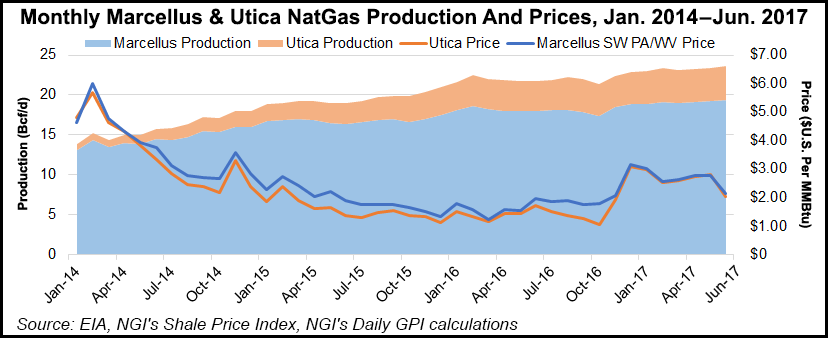

With the first part of Rover scheduled to come online this month, “Northeast production has already begun to surge even prior to its startup,” according to a recent note from BTU Analytics LLC Senior Energy Analyst Marissa Anderson. “New highs have recently been reached in Appalachia, with dry production exceeding 23.6 Bcf/d based on the pipeline flow sample, an increase of about 1 Bcf/d from the end of May.”

The gains have come from Western Appalachia, where recently completed projects have loosened the bottleneck compared to Eastern Appalachia, Anderson said.

The recent production increase could partly be a result of “the decrease in excess backlog in the region coupled with the need for increased drilling activity.” A decrease in the average spud-to-sales time for Appalachia to about six months further suggests the uptick partly reflects a production response to new pipe capacity added at the start of the year, she said.

“The increase in production may also be a reflection of the anticipation of the startup of Rover as producers begin to ramp production to meet transportation commitments,” Anderson said. “…Despite the recent basis weakness, as drilling activity continues to increase, production is poised to grow tremendously when this additional capacity opens up. With the startup of meaningful new Northeast infrastructure finally upon us, questions remain on how quickly production will respond to fill the new capacity, as well as how this potential flood in production will impact and compete with other producing regions in the U.S.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |