Markets | NGI All News Access | NGI Data

July Typically Warmest Month, But Weekly NatGas Prices Decline

For the holiday-abbreviated Wednesday-Friday natural gas trading week weather factors kept traders on their toes as searing heat in California lifted prices, but broader declines throughout the rest of the nation dampened market hopes that weather-driven gains would be in full swing by now.

All Midwest, Midcontinent, and Louisiana points were in the red, many by solid double digits, and the NGI Weekly Spot Gas Average fell 6 cents to $2.65. The West Coast took the honors as having the market point with the greatest gain, El Paso S Mainline up 38 cents to $3.15 and the East Coast saw the week’s largest losses in a drop of 37 cents at the Algonquin Citygate to $2.23.

Regionally Appalachia and California saw advances. Appalachia added 7 cents to $2.07 and California rose 13 cents to $3.01.

The Northeast saw the week’s steepest decline with a drop of 20 cents to $2.33 and the Midwest shed 11 cents to $2.73.

Three Regions all skidded a dime, South Texas, East Texas,and South Louisiana to $2.82, $2.83, and $2.81, respectively, and the Southeast came in 9 cents lower at $2.85.

The Midcontinent fell 8 cents to $2.61, and the Rocky Mountains almost made it to the plus column with a drop of just 2 cents to $2.52.

August futures settled the week down 17.1 cents to $2.864 with most of the drop taking place Monday and Wednesday.

In Friday trading physical natural gas for weekend and Monday delivery ended the shortened week on a soft note as weak pricing in California and the Rocky Mountains dominated otherwise nominal price changes at Midwest market points as well as in producing zones. The NGI National Spot Gas Average dropped 2 cents to $2.63.

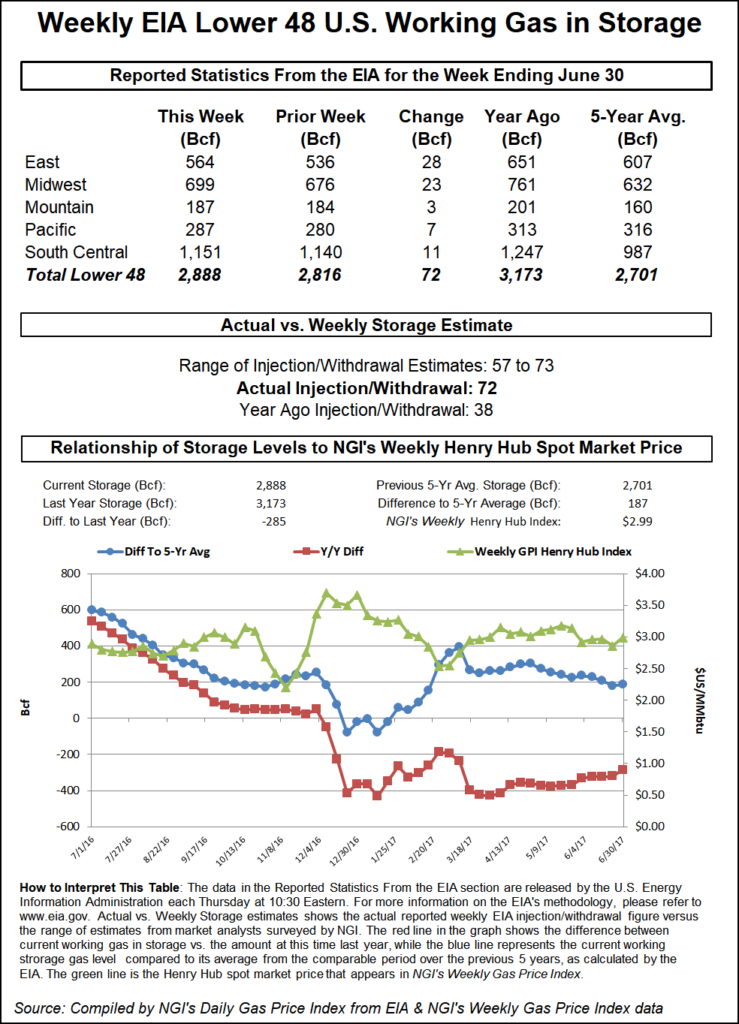

Futures traders were somewhat surprised that the stout 72 Bcf injection reported by the Energy Information Administration (EIA) didn’t have more of a bearish impact than it did. Analysts were expecting a figure about 8 Bcf less. At the close August had fallen 2.4 cents to $2.864 and September had dropped 2.4 cents as well to $2.857. August crude oil tumbled $1.29 to $44.23/bbl.

August futures showed great resilience Friday morning following the EIA storage report for the week ended June 30 that by all accounts was bearish in nature and well above industry estimates.

Following the 10:30 a.m. EDT release of the figures, August futures dipped to $2.880, and at 11:30 a.m. EDT August was trading at $2.900. Just prior to 1 p.m. EDT, the prompt-month contract was hovering around $2.865.

Prior to the report, traders were looking for a somewhat smaller storage build. Last year 38 Bcf was injected for the week and the five-year average build stood at 66 Bcf. FCStone INTL calculated a 59 Bcf injection and ION Energy estimated a 66 Bcf increase. A Reuters survey of 21 traders and analysts showed an average build of 64 Bcf with an injection range of 57 Bcf to 68 Bcf.

Traders saw a weaker supply demand balance, but also suggested a correction from the prior week’s less than expected build.

“The 72 Bcf in net injections for last week was somewhat more than the consensus expectation for a 64-66 Bcf build, and marginally above the 66-Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “This implies a somewhat weaker background supply/demand balance or at least a correction after the smaller-than-expected 46 bcf refill in the prior week.”

“The market did trade down off the number but bounced back,” said a New York floor trader. “How much lower do we think the market can go at this point?”

Inventories now stand at 2,888 Bcf and are 285 Bcf less than last year and 187 Bcf greater than the five-year average. In the East Region 28 Bcf was injected, and the Midwest Region saw inventories rise by 23 Bcf. Stocks in the Mountain Region were greater by 3 Bcf and the Pacific Region was up 7 Bcf. The South Central Region increased 11 Bcf.

The highly anticipated Rover Pipeline, a massive 3.25 Bcf/d Appalachian takeaway project scheduled to come online later this year, will likely begin partial service this month, backer Energy Transfer Partners LP (ETP) confirmed Friday. (see related story)

“The Phase 1 section of the Rover Pipeline from Cadiz, OH, to Defiance, OH, is expected to be in service in July,” ETP spokeswoman Alexis Daniel told NGI. “We do not anticipate any delays to the November 2017 in-service date on Phase 2.”

Falling forecast power loads and weak Monday on-peak power prompted lower southern California prices. CAISO forecast that Friday’s peak forecast load of 45,666 MW would slide to 43,201 MW Saturday.

Intercontinental Exchange reported that on peak Monday power at COB fell $10.41 to $29.45/MWh and power at Palo Verde dropped $21.61 to $41.62/MWh. On-peak Monday power at SP-15 skidded $10.27 to $42.69.

Weekend and Monday packages for delivery to the PG&E Citygate were unchanged at $3.16, but deliveries to SoCal Citygate gave up 37 cents to $3.22. Gas priced at the SoCal Border Average changed hands 37 cents lower at $2.85 and Kern Delivery was quoted at $2.88, down 39 cents.

Other market points were mixed. Gas at the Algonquin Citygate rose 11 cents to $2.29 and deliveries to Dominion South added a penny to $1.99. Packages bound for New York City on Transco Zone 6 were down a cent to $2.18.

Gas at the Chicago Citygate were flat at $2.70 and deliveries to the Henry Hub added a penny to $2.89. Gas on Panhandle Eastern came in flat at $2.51 and packages at Opal were seen 8 cents lower at $2.58.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

Overnight weather models turned ever so slightly warmer. “Changes to the six- to 10-day period forecast are mixed,” said WSI Corp. in its morning report to clients. “There are warmer changes across the South and portions of the Mid Con, but the Northeast, Texas and West are generally cooler.” Continental United States population-weighted cooling degree days “are up 1.1 to 64 for the period, which are 8.4 above normal.

“The case can be made for risks in either direction given the inconsistency and divergent solutions with the operational model runs.”

Although prices have recovered a small portion of the early-week 20-cent drop, the thinking is that the weather will have to become significantly more aggressive to prompt a significant price advance. “[W]e have been emphasizing that temperature deviations from normal don’t appear sufficient to sustain significant price advances,” said Jim Ritterbusch of Ritterbusch and Associates in a morning report to clients.

The plump storage build may ultimately prove to be too much for the market to handle. All eyes were on the 10:30 a.m. EDT release of storage data delayed a day by the holiday, and “industry ideas were favoring an injection of around 64 Bcf that would imply a slight decline of about 2 Bcf in the supply surplus against five year average levels. We feel that a 50 handle increase will be needed in order to sustain today’s early rally. We also believe that further contraction in the supply overhang will be seen in next week’s EIA report given this week’s warmer than normal temperatures.

“But unless this weekend brings some significant bullish adjustments to the weather views that will be extending into the fourth week of this month, further advances will likely prove limited for a few more days. But we have shifted our stance from neutral to bullish as we suggested purchases of nearby futures earlier this week on pullbacks into the $2.87-2.92 zone. This change in stance was predicated largely on the ongoing narrowing in the supply overhang and our perception that the sharp price plunge seen earlier this week was simply overcooked with our technical indicators swinging into oversold territory.”

Broad physical market losses Thursday countered soaring California prices and the NGI National Spot Gas Average fell a penny to $2.65.

Most points followed by NGI fell anywhere from a few pennies to upwards of a dime or more, but healthy double digit gains in California boosted the average into the black. Futures managed a successful test of market support in the low $2.80s and at the close August had settled at $2.888, up 4.8 cents, and September rose 4.4 cents to $2.881.

Western quotes jumped. Gas at the PG&E Citygate rose a penny to $3.16, but gas at the SoCal Citygate gained 27 cents to $3.62. Deliveries priced at the SoCal Border Average soared 30 cents to $3.22 and gas on Kern Delivery vaulted 38 cents to $3.27.

Other market centers were a few pennies lower. Gas at the Algonquin Citygate shed 5 cents to $2.18 and packages on Dominion South rose 1 cent to $1.98. Gas on Transco Zone 6 New York fell 4 cents to $2.19 and Chicago Citygate fell a nickel to $2.70.

Deliveries to the Henry Hub fell 2 cents to $2.88 and gas on Panhandle Eastern gave up a penny to $2.51. Gas at Opal added 3 cents to $2.66.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

August natural gas opened 5 cents higher Thursday morning at $2.89 as weather models turned slightly more constructive.

MDA Weather Services in its morning 11- to 15-day client forecast said, “The forecast trends slightly warmer in the East at mid-period while continuing to favor pattern variability across the Eastern Half. This lends near normal temperatures for the region overall, while areas farther west from the Plains points west see aboves persisting.

“Within the atmospheric background is a MJO [Madden Julian Oscillation] signal tracking across its Pacific phases, phases which correlate with cooler variability from the Midwest to the East this time of year. However, a warmer signal associated with the +AO [Arctic Oscillation] is a limiting factor behind the cooler MJO. Confidence remains lowest from Midwest to East due to these mixed indicators.”

MDA also reported that Tropical Depression 4 has formed in the central Atlantic and was expected to continue to move west-northwest before weakening this weekend as it crosses to the north of the Leeward Islands. It noted that conditions were quiet elsewhere and put the threat to Gulf production facilities at 0%.

Tim Evans of Citi Futures Perspective saw Wednesday’s 11 cent price plunge as the result of “near-term temperature outlook trend[ing] cooler, subtracting some cooling demand from the current fundamental equation.”

Tom Saal, vice president at FCStone Latin America LLC in Miami in his work with Market Profile said, “The recent sell-off has produced two Market Profile Double Distribution Trend Days separated only by Tuesday’s holiday. Trend Days infer ‘exhaustion’ in the direction of the price move — could be near the end of this down cycle.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |