Markets | NGI All News Access | NGI Data

Physical NatGas, Futures Part Company As Bears Undeterred By Positive Storage Stats

Physical natural gas for Friday delivery managed to outdo a futures market that seemed to have had its fill of bullish weather reports. Gains in the Northeast, Appalachia, and California were able to offset softer quotes in the Midwest, Midcontinent, and Louisiana, and the NGI National Spot Gas Average rose 4 cents to $2.77.

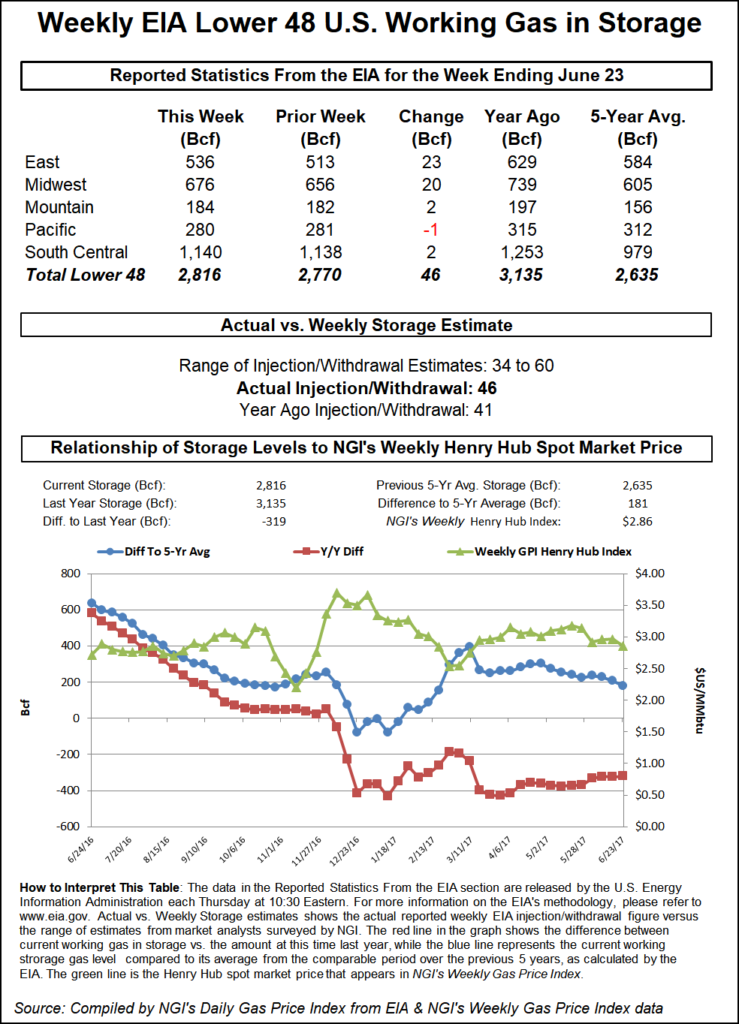

The Energy Information Administration (EIA) reported a storage build of a miserly 46 Bcf, about 6 Bcf less than expected, but the futures market nonetheless turned lower. At the close August had lost 5.2 cents to $3.042 and September was down 5.0 cents to $3.037. August crude oil added 19 cents to $44.93/bbl.

The newly-minted spot August future took what should have been construed as a supportive Energy Information Administration (EIA) natural gas storage report and turned it into a negative despite figures that were well below market expectations.

The EIA reported a storage injection of 46 Bcf, about 6 Bcf less than consensus estimates. Following the release of the figures, August futures rose to $3.122, and at 10:45 a.m. August was trading at $3.097, up three-tenths from Wednesday’s settlement.

Prior to the report traders were looking for a somewhat larger storage build. Last year 41 Bcf was injected and the five-year average stands at 72 Bcf.

Citi Futures Perspective calculated a 54 Bcf injection and IAF Advisors estimated a 51 Bcf increase. A Reuters survey of 22 traders and analysts showed an average of 52 Bcf with a range of +40 Bcf to +60 Bcf.

“The market came up a bit, but fell off its highs,” said a New York floor trader. “The market really didn’t do much of anything, but it’s holding above $3, which is a positive, and that’s probably where it is going to hold for now.”

Longer term, traders are optimistic.

The Denver analytical team at Wells Fargo said the storage data “provides further confirmation that the natural gas markets are at least 2 Bcf/d undersupplied. Over the last 9 weeks, this state of undersupply has caused the surplus to fall by 120 Bcf from 307 Bcf at the end of April.

“Based on current weather forecasts, our model indicates a 102 Bcf cumulative injection over the next 2 weeks, which would bring the storage surplus (versus the five-year average) down to just 147 Bcf. As a reminder, our forecast for end-of-injection season storage is 3.88 Tcf, which is in-line with the five-year average and incorporates 3 Bcf/d of lost power generation demand due to gas-to-coal switching driven by higher summer natural gas prices.”

“The 46 Bcf build for last week was smaller than both the 52 Bcf consensus estimate and the 72-Bcf five-year average, a clear bullish surprise,” said Tim Evans of Citi Futures Perspective. “In our view, this keeps the market on track for further gains, with failed technical support at $3.25, and the $3.50 level last tested in mid-May as possible targets in the weeks ahead.”

Inventories now stand at 2,816 Bcf and are 319 Bcf less than last year and 181 Bcf greater than the five-year average.

In the East Region, 23 Bcf was injected, and the Midwest Region saw inventories rise by 20 Bcf. Stocks in the Mountain Region were 2 Bcf higher, and the Pacific Region was down 1 Bcf. The South Central Region increased 2 Bcf.

The physical market saw healthy weather-driven advances as eastern highs going into the weekend were expected as much as 10 degrees above normal. AccuWeather.com forecast that Boston’s Thursday high of 79 would jump to 90 by Friday before ebbing slightly to 88 on Saturday, well beyond the normal high of 80. New York City’s high Thursday of 82 was also expected to jump to 90 on Friday but ease to 86 by Saturday. The normal high this time of year in the Big Apple is 83. Philadelphia’s Thursday high of 88 was forecast to reach 92 on Friday and hold at 90 on Saturday, 4 degrees above normal.

Gas at the Algonquin Citygate jumped 51 cents to $3.22 and gas on Iroquois Waddington gained 9 cents to $3.03. Deliveries to Tennessee Zone 6 200 L added a stout 45 cents to $3.10.

Packages priced at Tetco M-3 Delivery added 11 cents to $2.16 and gas bound for New York City on Transco Zone 6 rose 23 cents to $2.79.

The National Weather Service in New York City reported that a warm front remains well to the north as high pressure sits over the western Atlantic through Friday. “A cold front will slowly approach during the day on Saturday, eventually moving offshore late in the day on Sunday. The front remains nearby on Monday before weak high pressure builds in from the northwest for the middle of next week.”

Other market points were mostly lower. At the Chicago Citygate deliveries Friday shed a penny to $2.83 and gas at the Henry Hub also eased a penny to $3.00. Gas on El Paso Permian dropped a penny to $2.63, and gas on Northern Natural Demarcation came in 2 cents lower at $2.74.

Gas on Kern Receipt lost 3 cents to $2.60 and gas priced for Friday delivery at the PG&E Citygate was quoted a penny lower at $3.18.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |