Markets | NGI All News Access | NGI Data

Futures Unimpressed With Bullish Natural Gas Storage Stats

August futures took a supportive Energy Information Administration (EIA) natural gas storage report in stride and moved little following an inventory build that was well below market expectations.

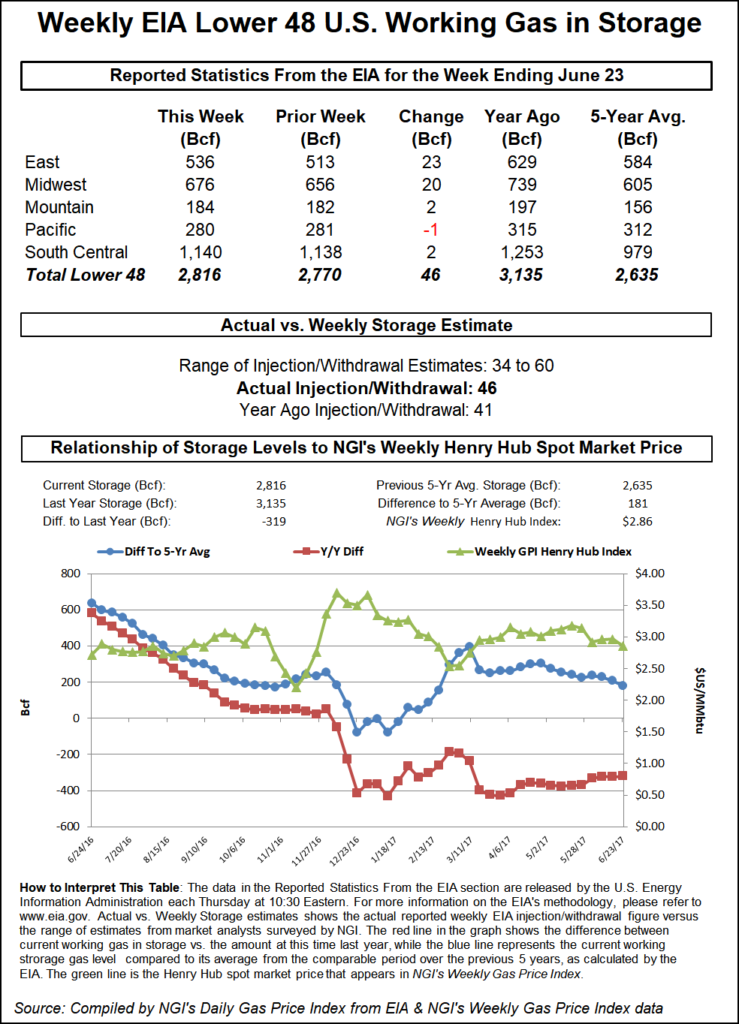

The EIA reported a storage injection of 46 Bcf, about 6 Bcf less than consensus estimates. Following the release of the figures, August futures rose to $3.122, and at 10:45 a.m. August was trading at $3.097, up three-tenths from Wednesday’s settlement.

Prior to the report traders were looking for a somewhat larger storage build. Last year 41 Bcf was injected and the five-year average stands at 72 Bcf.

Citi Futures Perspective calculated a 54 Bcf injection and IAF Advisors estimated a 51 Bcf increase. A Reuters survey of 22 traders and analysts showed an average of 52 Bcf with a range of +40 Bcf to +60 Bcf.

“The market came up a bit, but fell off its highs,” said a New York floor trader. “The market really didn’t do much of anything, but it’s holding above $3, which is a positive, and that’s probably where it is going to hold for now.”

Longer term, traders are optimistic.

“The 46 Bcf build for last week was smaller than both the 52 Bcf consensus estimate and the 72-Bcf five-year average, a clear bullish surprise,” said Tim Evans of Citi Futures Perspective. “In our view, this keeps the market on track for further gains, with failed technical support at $3.25, and the $3.50 level last tested in mid-May as possible targets in the weeks ahead.”

Inventories now stand at 2,816 Bcf and are 319 Bcf less than last year and 181 Bcf greater than the five-year average.

In the East Region, 23 Bcf was injected, and the Midwest Region saw inventories rise by 20 Bcf. Stocks in the Mountain Region were 2 Bcf higher, and the Pacific Region was down 1 Bcf. The South Central Region increased 2 Bcf.

Salt storage fell by 2 Bcf to 341 and nonsalt increased 5 Bcf to 799 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |