E&P | NGI All News Access | NGI The Weekly Gas Market Report

ConocoPhillips Exiting Gassy Granddaddy Barnett in $305M Deal

ConocoPhillips on Thursday continued its turn away from natural gas and to more oil-weighted projects after snagging $305 million from an affiliate of Miller Thomson & Partners LLC for its legacy gas-rich Barnett Shale portfolio.

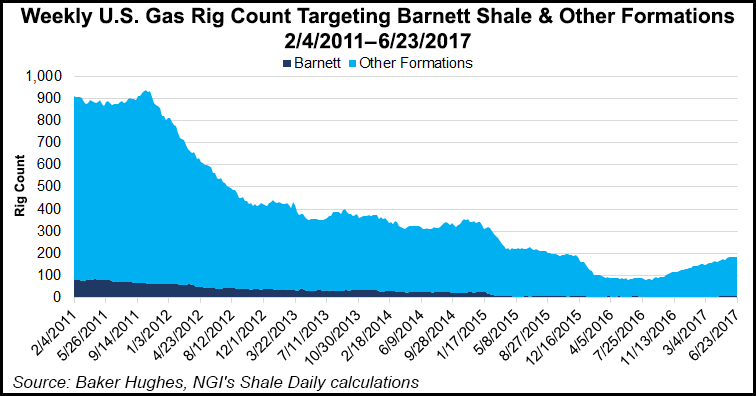

The Houston producer, like its colleagues, has directed less funding to the granddaddy Barnett and in general, all gas-heavy projects in recent years, as shale oil has become more profitable and less difficult to extract.

The Miller Thomson unit, based in Lafayette, LA, is a gas property acquirer, known for buying producing properties and related pipeline gathering and processing facilities. It markets natural gas to large-scale end users, primarily the gas-fueled chemical, electric-generating, and liquefied natural gas industries along the Gulf Coast and in Mexico.

“The environment and timing for capitalizing on the U.S. shale gas opportunity are excellent,” according to Miller Thomson. “The U.S. oil and gas economic and legal structure and the new federal administration support U.S. independent oil and gas operators such as Miller Thomson & Partners LLC. Additionally, today’s financial stress in the oil and gas industry creates ideal timing for these acquisitions.”

Miller Thomson management “believes that natural gas prices have bottomed and are in the beginning of a multi-year recovery, making this the time for acquisitions. This view is based on long-term trends in demand coupled with declining production.”

ConocoPhillips’ Barnett production for 2016 was 11,000 boe/d, 55% weighted to gas and 45% to natural gas liquids. Year-end 2016 proved reserves were estimated at 50 million boe. At the end of May, the estimated book value of the assets was about $9 million net.

“The impact to full-year 2017 production guidance is expected to be less than 5,000 boe/d dependent on timing of closing,” ConocoPhillips management said.

During the second quarter, the No. 1 independent in the world concentrated most of its Lower 48 dollars to the Eagle Ford and Bakken shales, as well as the Permian Basin.

Production in the Lower 48 overall averaged 221,000 b/d in 2Q2017, with output from the Eagle Ford around 133,000, the Bakken at 59,000 and the Permian at 17,000 b/d.

A one-time impairment on the Barnett assets is expected to be recorded for 2Q2017, but ConocoPhillips does not expect any material impact to 2017 cash flow or guidance.

The transaction is expected to close by the end of September.

According to Tudor, Pickering, Holt & Co. the transaction value for the Barnett assets “is blocking and tackling relative to the recent Canada and San Juan divestments” by ConocoPhillips.

In late March the explorer made a $13.3 billion deal with Cenovus Energy Inc. to sell its half-stake in the Foster Creek Christina Lake oilsands partnership and most of its Western Canada Deep Basin gas assets, including within the Montney Shale. Two weeks later, the largest producer in the gassy San Juan Basin agreed to sell the entire portfolio for up to $3 billion to an affiliate of Hilcorp Energy Co.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |