Markets | E&P | Mexico | NGI All News Access | NGI The Weekly Gas Market Report

As Waha Basis Grows, Existing Takeaway Not Fully Tapped, Says RBN

Natural gas takeaway from the Permian Basin’s Waha Hub still has room to grow on existing pipelines, with “considerable upside” on potential exports across the border to Mexico, according to an analysis by RBN Energy LLC.

But as associated gas output from the oil wells in West Texas and southeastern New Mexico continues to climb, Waha will have to sell at a discount to compete during low-demand periods, and “constraints aren’t too far off” when it comes to getting Permian gas out of the basin when demand is high, the consulting firm said.

Permian dry gas output has surged as drillers have flocked to the play in recent years to take advantage of its attractive crude oil economics, creating a major new source of production.

RBN estimates that over the last three years it has grown by close to 40% to average about 6.3 Bcf/d thus far in 2017. That number could double to nearly 12 Bcf/d in the next half decade, the firm said.

The rapid growth in crude-directed drilling in the Permian — and the resulting associated gas — has fed concerns that Waha will see a repeat of the crushing basis differentials that have afflicted Marcellus and Utica shale supply points.

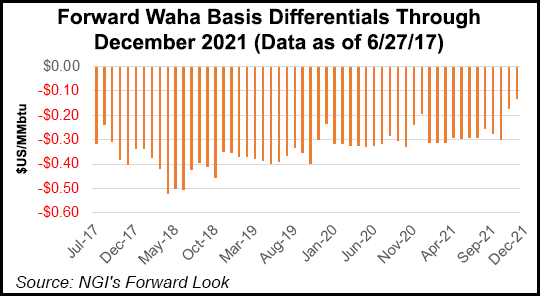

After selling at roughly a 10- to 20-cent discount to Henry Hub for much of June 2016, Waha basis differentials climbed as high as negative 52 cents for June 13 delivery, NGI‘s Daily Gas Price Index shows.

![]()

“The basis differentials in West Texas have widened in recent months,” said NGI Director of Strategy & Research Patrick Rau. “More importantly, they’re expected to continue blowing out over the next year.

“Longer-term, West Texas differentials are expected to improve somewhat, most likely once more pipeline takeaway capacity is built out of Waha. The takeaway capacity from Waha to Mexico is nice, but there is no guarantee all that capacity will be used. Expanding the Texas intrastates and building new lines to Agua Dulce will open Permian gas to more markets, but that is at least a year away.”

Macquarie Global Oil & Gas Strategist Vikas Dwivedi, speaking at the LDC Gas Forums Northeast conference in Boston earlier in June, predicted that Waha basis would soon rival the $1-plus/MMBtu negative differentials that have been routinely observed at Dominion South.

“Will the Permian look like Dominion South? It will, but with one big difference. It will look a lot worse,” Dwivedi said. “Dominion South’s going to look like a shining beacon when you compare it to Texas in terms of gas prices. One of the big reasons is at Dominion South you actually have economics related to gas. If you’re continually not making money, you’ll slow down, throttle, do whatever you need to do, taking a couple Bcf/d off here and there.

“In the Permian, so much of this is going to be associated gas. You’re not going to shut that in without affecting oil production. You only can flare it for so long, so we think it will just keep coming, and it’s going to have to find a place to go.”

According to RBN, using flow data from Genscape Inc. for its analysis, transportation out of Waha comprises about 10.8 Bcf/d, which can be divided into four corridors:

“With increasing amounts of Marcellus/Utica shale gas moving west on the Rockies Express Pipeline (REX) and that in turn pushing out Rockies and Midcontinent supply from those markets, the North corridor out of Waha has gone underutilized,” RBN said, noting that northbound flows out of Waha have averaged about 300 MMcf/d in recent years.

Capacity utilization to the west is already around 70%, according to RBN, averaging around 2 Bcf/d of 2.9 Bcf/d total capacity, reaching about 2.5 Bcf/d during peak demand periods.

“There is more room to grow during the low-demand months, such as in the springtime, when flows dip and utilization falls closer to 50% or 60%,” RBN researchers said. “Notably, those troughs also have been rising each year because of a combination of higher Permian production and northbound flows being redirected, in part, to the west.” But competition from hydroelectric generation and renewables in California has limited gas demand west of the Permian.

To the east, flows out of Waha “have shot up in the past couple of years as growing demand and higher prices have been attracting Permian gas to the Texas Gulf Coast,” RBN said, noting that flows along this corridor increased by 1 Bcf/d to 2.6 Bcf/d in 2016, climbing further to average 2.9 Bcf/d thus far in 2017 (about 84% utilization).

“Similar to the West corridor, utilization in the East corridor is seasonal, butting up against capacity constraints during the hot summer months and dropping well below capacity in the winter months,” RBN said. “But also like the West route, East corridor utilization during the lower demand periods is now gaining — a trend that’s likely to continue, especially given the pipeline projects recently proposed to expand Waha-to-Gulf Coast connectivity.”

As for Mexico, “a flurry of takeaway project completions” recently, including the Roadrunner, Comanche Trail and Trans-Pecos pipelines, has added 3 Bcf/d of capacity traveling from Waha to the border. “These are all intrastate pipelines that don’t publicly report their pipeline flows. We know, however, that much of this capacity is dependent on newly built interconnects and takeaway capacity on the Mexico side of the border, some of which is still not operational,” RBN said.

Add it all up, and it seems “outbound flows from the Waha Hub have some room to grow on each of the corridors. But during low-demand periods, flows to the west and north face significantly greater gas-on-gas competition with the Rockies and Midcontinent supply. That means Waha gas will need to price itself lower to remain competitive,” the firm said. “Also, constraints aren’t too far off moving Permian gas east and west, especially during high-demand periods.

“Both the Mexico and East routes…provide access to attractive and growing markets with less supply competition. Waha’s exports to Mexico are poised to grow sooner rather than later, given that the pipeline capacity from Waha to the international border is in place.”

To stay up to date on Mexico’s deregulating natural gas market as developments unfold, sign up and be one of the first to receive NGI‘s Mexico Gas Price Index, set to debut in July.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |