California Leads NatGas Cash Lower; Futures Steady Post Storage Stats

Physical natural gas broke to the downside Thursday as next-day price gains in the Northeast and Appalachia were unable to stave off broad declines in the Rockies, California, Texas, Louisiana, the Midcontinent and Midwest. Particularly hard hit was southern California as the recent heat wave in the region was forecast to dissipate. The NGI National Spot Gas Average fell 5 cents to $2.67.

July futures took an initial dip Thursday morning but quickly turned tail higher once the Energy Information Administration (EIA) reported a storage injection for the week ending June 16 that was slightly greater than what traders were expecting.

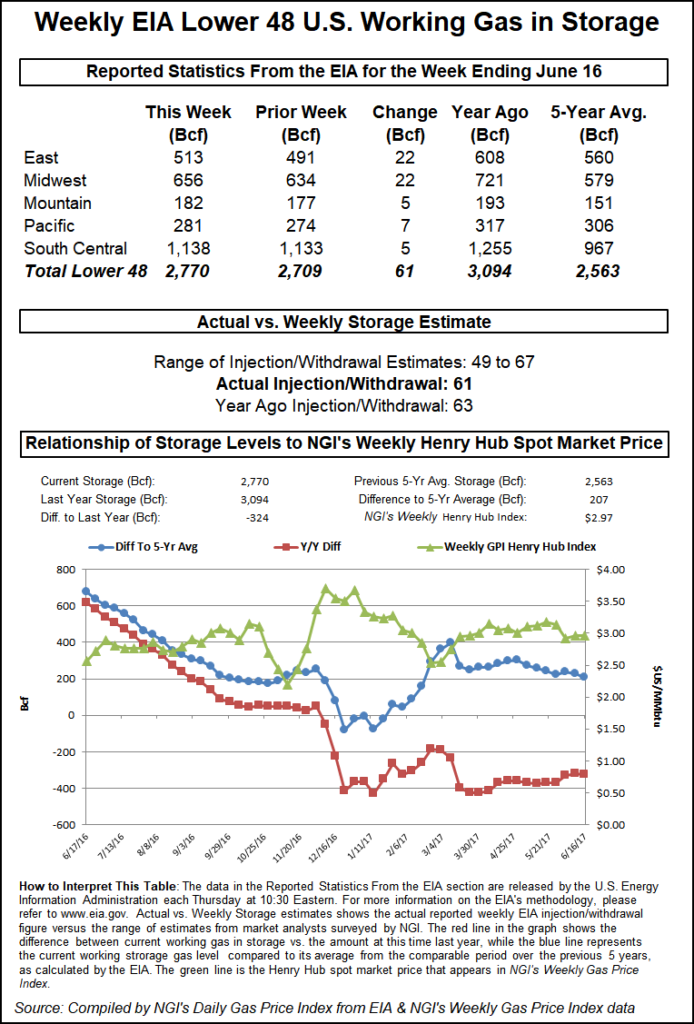

The EIA reported a storage build of 61 Bcf, about 3 Bcf greater than what the market was looking for, but futures managed to hold. The July contract settled at $2.894, up one-tenth of a penny and August was unchanged at $2.915. August crude oil managed to stop the hemorrhaging at least temporarily and rose 21 cents to $42.74/bbl.

Once traders had time to digest the storage figures July futures dropped to a low of $2.855, but within a minute started to advance. At 10:45 a.m. July was trading at $2.942, up 4.9 cents from Wednesday’s settlement.

Last year 63 Bcf was injected and the five-year average stands at a stout 82 Bcf. Citi Futures Perspective calculated a 51 Bcf injection and Ritterbusch and Associates estimated a 67 Bcf increase. A Reuters survey of 22 traders and analysts showed a sample mean of 58 Bcf with a range of +50 Bcf to +67 Bcf.

“We were hearing a 58 Bcf number and after the number came out we are trading at the highs. Why? I don’t know,” said a New York floor trader.

“If you look at this market, it has been so depressed lately. We are still below $3 and that is the hurdle. It has to settle above that at least a couple of times to generate any upward momentum.”

“The build for last week was more than the 55-58 Bcf consensus and so a minor bearish surprise,” said Tim Evans of Citi Futures Perspective. “At the same time, however, we note the storage injection was less than the 82-Bcf five-year average for the date and so still confirms some tightening of supplies on a seasonally adjusted basis.”

Wells Fargo Securities analysts lead by David Tameron called Thursday’s storage report “neutral,” but noted that the firm’s undersupplied forecast remains intact. “The reported figure was 6 Bcf above consensus but 1 Bcf below last year and 19 Bcf below the five-year average of 80 Bcf,” the team wrote in a post-storage morning note. “This data point provides further confirmation that the natural gas markets are at least 2 Bcf/d undersupplied.”

If current weather forecasts hold true, Tameron’s team expects a 116 Bcf cumulative injection over the next two weeks, which would bring the storage surplus over the five-year average down to just 189 Bcf.

Inventories now stand at 2,770 Bcf and are 324 Bcf less than last year and 207 Bcf greater than the five-year average. In the East Region 22 Bcf was injected, and the Midwest Region saw inventories rise by 22 Bcf also. Stocks in the Mountain Region were greater by 5 Bcf and the Pacific Region was up 7 Bcf. The South Central Region increased 5 Bcf.

The searing heat wave over southern California and the desert Southwest was forecast to moderate and next-day gas prices plunged. Friday gas at Malin shed 2 cents to $2.66 and gas at the PG&E Citygate fell 4 cents to $3.15.

Packages at the SoCal Citygate tumbled 62 cents to $3.37 and gas priced at the SoCal Border Average skidded 55 cents to $2.85. Gas on El Paso S Mainline dropped 93 cents to $2.88 and Kern Delivery was quoted 66 cents lower at $2.96.

AccuWeather.com forecast that Los Angeles high Thursday of 79 would rise to 81 Friday and slide to 80 by Saturday, right at the seasonal norm. Phoenix’ toasty 113 high of Thursday was seen easing to 111 by Friday before climbing to 114 Saturday, 8 degrees above normal. Albuquerque’s 102 Thursday high was predicted to fall to 97 Friday and 89 by Saturday, one degree below normal.

CAISO forecast that Thursday’s peak load of 45,029 MW would reach just 41,425 MW Friday.

“Late this week and into the weekend, temperatures will come down a little bit from their extreme levels,” said AccuWeather.com meteorologist Ken Clark. “The high pressure area responsible for the buildup of heat will weaken and change its orientation.”

Tropical Storm Cindy made landfall along the Texas-Louisiana border about 3 a.m. CDT Thursday and was quickly downgraded to a tropical depression by 10 a.m. The impact on the natural gas market was likely to be short term demand reduction as temperatures cool and residents recover from power outages and other dislocations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |