Markets | NGI All News Access | NGI Data

NatGas Futures Post Counterintuitive Response Following EIA Storage Report

July futures moved higher Thursday morning once the Energy Information Administration (EIA) reported a storage injection for the week ending June 16 that was slightly greater than what traders were expecting.

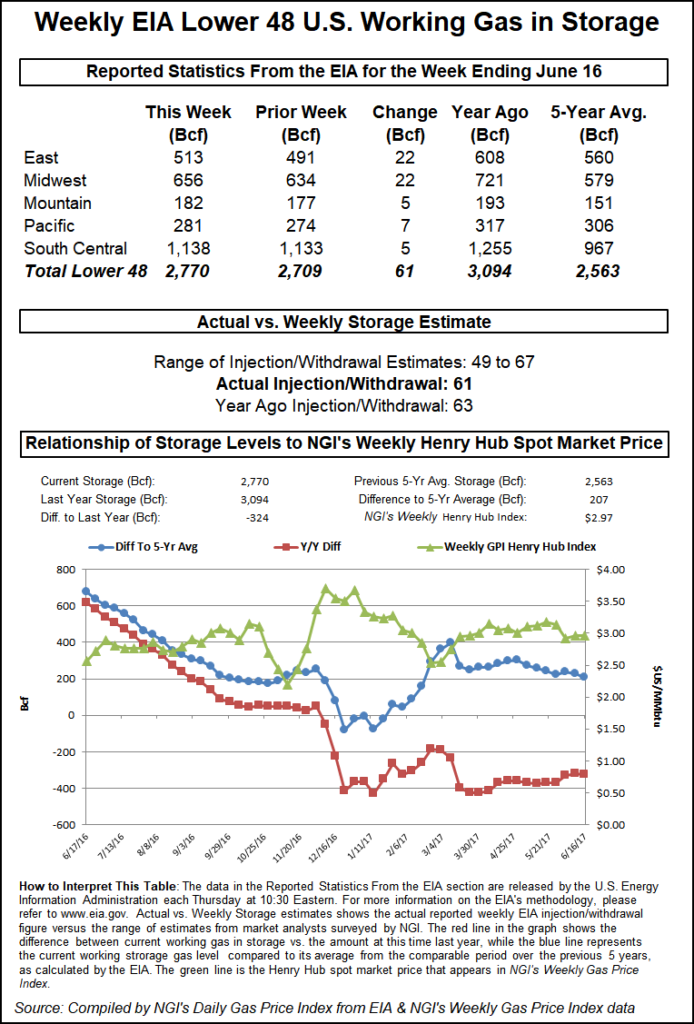

EIA reported a storage injection of 61 Bcf, about 3 Bcf greater than consensus estimates. Once traders had time to digest the figures July futures rose to $2.962, and at 10:45 a.m. July was trading at $2.942, up 4.9 cents from Wednesday’s settlement.

Prior to the report traders were looking for a storage build not far from the actual figures. Last year 63 Bcf was injected and the five-year average stands at a stout 82 Bcf. Citi Futures Perspective calculated a 51 Bcf injection and Ritterbusch and Associates estimated a 67 Bcf increase. A Reuters survey of 22 traders and analysts showed a sample mean of 58 Bcf with a range of +50 Bcf to +67 Bcf.

“We were hearing a 58 Bcf number and after the number came out we are trading at the highs. Why? I don’t know,” said a New York floor trader.

“If you look at this market, it has been so depressed lately. We are still below $3 and that is the hurdle. It has to settle above that at least a couple of times to generate any upward momentum.”

“The build for last week was more than the 55-58 Bcf consensus and so a minor bearish surprise,” said Tim Evans of Citi Futures Perspective. “At the same time, however, we note the storage injection was less than the 82-Bcf five-year average for the date and so still confirms some tightening of supplies on a seasonally adjusted basis.”

Wells Fargo Securities analysts lead by David Tameron called Thursday’s storage report “neutral,” but noted that the firm’s undersupplied forecast remains intact. “The reported figure was 6 Bcf above consensus but 1 Bcf below last year and 19 Bcf below the five-year average of 80 Bcf,” the team wrote in a post-storage morning note. “This data point provides further confirmation that the natural gas markets are at least 2 Bcf/d undersupplied.”

If current weather forecasts hold true, Tameron’s team expects a 116 Bcf cumulative injection over the next two weeks, which would bring the storage surplus over the five-year average down to just 189 Bcf.

Inventories now stand at 2,770 Bcf and are 324 Bcf less than last year and 207 Bcf greater than the five-year average. In the East Region 22 Bcf was injected, and the Midwest Region saw inventories rise by 22 Bcf also. Stocks in the Mountain Region were greater by 5 Bcf and the Pacific Region was up 7 Bcf. The South Central Region increased 5 Bcf.

Salt storage fell by 5 Bcf to 343 Bcf and non-salt increased 10 Bcf to 794 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |