Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

MISO Survey Shows Surplus Through 2022, Increased Role for Natural Gas

Power producers in states across the nation’s midsection told a survey that decreased demand in the region will lead to a surplus through 2022, and that natural gas will account for a significant portion of new base load capacity, based on the fuel’s success rate over the past five years.

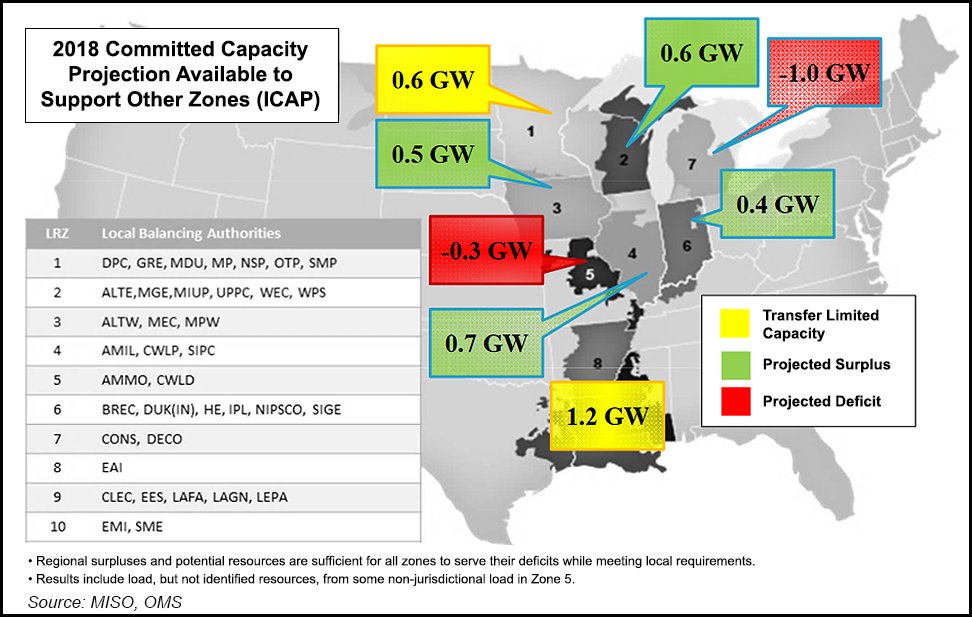

The survey, which was conducted by Midcontinent Independent System Operator Inc. (MISO) and the Organization of MISO States (OMS) and released last Wednesday, found that the region served by MISO — 15 states and the Canadian province of Manitoba — is projected to have a surplus of 2.7 to 4.8 gigawatts (GW) in 2018. The surplus is projected to increase to a range of 3.2-7.3 GW in 2020 before sliding to 0.7-5.4 GW in 2022.

Utilities representing more than 96% of MISO’s load responded to the survey.

According to MISO, 26% of a sample set of natural gas projects that went through the Definitive Planning Phase (DPP) between 2012 and 2016 had also completed a Generator Interconnection Agreement (GIA), and were deemed a success by the regional transmission organization (RTO). Conversely, 37% of natural gas projects in the DPP queue withdrew during that timeframe.

“That leaves a potential success rate [for natural gas projects] somewhere in the middle, between 26-63%, for those projects still in the DPP study,” MISO said in a slide presentation that accompanied the survey results. The RTO added that after a discussion with its stakeholders, it decided to add 35% of projects in DPP to the survey’s zonal and regional values as potential resources.

The survey showed that 19 natural gas interconnection requests between 2012 and 2016 moved on to the DPP study cycle. Of those, five projects completed a GIA, seven were withdrawn and another seven were either still in the study cycle queue or had a GIA in progress.

Capacity retirements, which MISO classified as potentially unavailable resources and presumably would include coal- and nuclear-powered generation, were projected to total 1.56 GW in the 2018 planning year and 2.62 GW in 2022. The reductions would be partially offset by 1.37 GW of potential new capacity in 2018, and fully offset by 4.1 GW of potential new capacity in 2022.

MISO said all projected capacity is not available to serve load outside certain local resource zones (LRZ) due to north-south transfer limitations. Excluding MISO’s 8th, 9th and 10th LRZs — which cover Arkansas, East Texas/Louisiana and Mississippi, respectively — the region is projected to see 1.08 GW of potential new capacity in 2018, offsetting about 0.99 GW in retirements. For the 2022 planning year, the region is expected to have 2.8 GW of potential new capacity, offsetting 1.94 GW of retirements.

Low commodity prices, abundant supplies and increased regulatory scrutiny on coal and nuclear power have helped boost natural gas for power generation in recent years. Despite the trend, some utilities with nuclear power plants have approached state governments for subsidies.

Earlier this month, Exelon Corp. warned that it would permanently shutter the single operating unit at its troubled Three Mile Island nuclear reactor in Pennsylvania — which is outside of MISO’s purview — by 2019 unless the state agreed to subsidize the plant. In order to preserve some nuclear power plants, and the jobs that go with them, Illinois and New York recently enacted such subsidies.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |