Markets | NGI All News Access | NGI Data

Weekly Quotes Remain Flat In Ho-Hum Trading

Weekly natural gas trading elected to mark time for the week ended June 16 as few points traded much beyond a penny or two from levels posted the week earlier. The NGI Weekly Spot Gas Average was unchanged at $2.70.

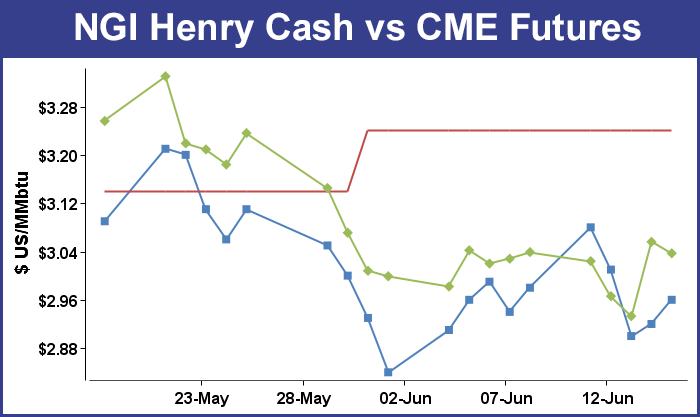

The week’s most significant development was the rebound in July futures which by mid-week were looking at a decline of about 10 cents before a supportive Energy Information Administration (EIA) storage report launched prices back over $3.

Of the actively traded points the greatest gain was Iroquois Zone 2 with a rise of 16 cents to $2.59 and the biggest loss was sustained at Empress with a drop of $C0.20 to $C2.48/Gj.

Regionally, Appalachia brought up the rear with a drop of 9 cents to $2.01 and Rocky Mountain points averaged a decline of 3 cents to $2.54.

Two regions dropped just a penny, East Texas at $2.90 and the Midwest at $2.83.

California was unchanged at $2.86 and South Texas, the Midcontinent, and South Louisiana all rose a penny to $2.90, $2.70, and $2.89, respectively.

The Southeast rose 2 cents to $2.92 and the Northeast gained a nickel to $2.53.

July futures slipped two-tenths to $3.037.

Futures bulls Thursday got a boost with the 10:30 a.m. EDT release of storage figures from the EIA that were significantly less than what the market was expecting. Once traders had time to digest the figures, July futures vaulted to $3.034, and at 10:45 a.m. July was trading at $3.025, up 9.2 cents from Wednesday’s settlement. At the close, July had added 12.3 cents to $3.056, and August had tacked on 12.5 cents to $3.078.

The EIA reported a storage injection of 78 Bcf, about 8 Bcf less than consensus estimates, and prices wasted no time moving higher after the number was released.

During the same week last year 68 Bcf was injected and the five-year average stands at 87 Bcf. Citi Futures Perspective calculated a 91 Bcf injection and ION Energy was looking for an 86 Bcf increase. A Reuters survey of 28 traders and analysts showed a sample mean of 86 Bcf with a range of plus 77-94 Bcf.

The market needs to hold $2.99 to $3.01, a New York Floor trader told NGI. “If it starts to touch the $2.99 area, I think it slips back down. Although the market bounced back, I don’t think it’s a rebound. The whole complex feels heavy.”

“The 78-Bcf net injection for last week was smaller than expected and below the 87 Bcf five-year average for the date with no reclassifications or other asterisks, a clear bullish surprise,” said Tim Evans of Citi Futures Perspective. “With warmer than normal temperatures this week and next also limiting the rate of injections, the market may be set up for a short-covering rally back above the $3.00 level, with potential to move back up to $3.20-3.25 in our view.”

The Wells Fargo Securities analyst team lead by David Tameron said the smaller than expected build backs up their long-held projection of an undersupplied natural gas market. “This week’s figure marked a reversal of a four-week trend in which the storage injection was higher than forecasted by 6 Bcf on average each week,” the team wrote in a post-storage Thursday morning note. “Additionally, this data point provides further confirmation that the natural gas markets are at least 2 Bcf/d undersupplied.”

Looking at current weather forecasts, the Wells Fargo model indicated a 102 Bcf cumulative injection over the next two weeks, which would bring the storage surplus (versus the five-year average) down to just 182 Bcf. “As a reminder, our forecast for end-of-injection season storage is 3.88 Tcf, which is in-line with the five-year average and incorporates 3 Bcf/d of lost power generation demand due to gas-to-coal switching driven by higher summer natural gas prices.”

Inventories now stand at 2,709 Bcf and are 322 Bcf less than last year and 228 Bcf above the five-year average.

In Friday’s trading natural gas for weekend and Monday delivery rose modestly as gains in the East, Rockies and California outdistanced flat pricing in South and East Texas and weakness in Appalachia.

The NGI National Spot Gas Average rose 7 cents to $2.72, but futures couldn’t muster enough oomph to reach a positive close. At the close, July settled at $3.037, down 1.9 cents after trading at a new high of $3.082, and August slid 1.8 cents to $3.060. July crude oil rose 28 cents to $44.74/bbl.

Surging Monday on-peak power prices on both the East and West coasts provided plenty of incentive to make incremental gas purchases for weekend and Monday power delivery viable. Intercontinental Exchange reported that on-peak Monday power at the ISO New England’s Massachusetts Hub rose a stout $11.93 to $34.21/MWh, and power at the New York ISO Zone G (eastern New York) delivery point rose $15.00 to $40.00/MWh.

Gas at the Algonquin Citygate gained 31 cents to $2.42, and deliveries to Iroquois Waddington gained 27 cents to $2.56. Gas on Tennessee Zone 6 200 L added 28 cents to $2.41.

Gas bound for New York City on Transco Zone 6 gained 16 cents to $2.37, but packages on Dominion South added just a penny to $1.87.

The West Coast was little different. Intercontinental Exchange reported that on-peak Monday power at NP-15 jumped $20.59 to $53.59/MWh, and power at SP-15 added $16.58 to $52.43?MWh.

Gas priced at the PG&E Citygate rose 9 cents to $3.17, but deliveries to the SoCal Citygate added 11 cents to $3.25, and gas priced at the SoCal Border Average was quoted 11 cents higher at $2.90. Gas on El Paso S Mainline changed hands 8 cents higher at $2.89.

“It’s getting hot and the next marginal megawatt is natural gas,” said EnergyGPS principal Jeff Richter. “You’ve got to keep sliding up the stack.”

He noted that heat rates are around 14.5 MMBtu/MWh. “It’s high but not exorbitant, and kind of right where it should be with the load that’s out there.”

Gains at other market points were lower. Deliveries to the Chicago Citygate rose a nickel to $2.84, and gas at the Henry Hub added 4 cents to $2.96. Deliveries to El Paso Permiancame in 8 cents higher at $2.74, and gas at Northern Natural Demarcation rose 3 cents to $2.73.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

July futures opened off a couple of pennies Friday morning at $3.03, even though weather forecasts remain supportive and market technicians get a new lease on life with Thursday’s settle well above $3.

Weather models Thursday overnight maintained the overall pattern of above-normal temperatures but with a high degree of uncertainty. Friday’s six-to-10 day forecast was generally warmer than Thursday’s forecast over the south-central and eastern United States, as well as the West Coast,” said WSI Corp. in its Friday morning report to clients.

“The Interior West, Rockies and Plains are cooler.” Continental U.S. (CONUS) population-weighted cooling degree days “are up 0.6 to 56.3, which are 12.8 above average. Given the inconsistency and inherent uncertainty with tropical activity, the forecast has risks in either direction.

“The northern half of the CONUS has generally cooler risks, while the southern states have minor warmer potential.”

Thursday’s surge above $3 may be a shot across the bow by the bulls. Analysts longer term see the market vulnerable to the upside.

“Underlying fundamentals remain tight with core summer exposed to upside price risk, and core winter 17/18 highly exposed in anything other than a mild winter scenario,” said Societe Generale (SG) analyst Breanne Dougherty in a report.

The market, she said, “is seemingly attempting to incentivize production growth with short-term price upside. With mid/small caps now the dominant U.S. producers, SG sees production base as only marginally influenced by 2017 prices; near-term growth should hinge on 2018/2019 contract prices, which are predominantly below $3/MMBtu.”

SG analysts are more positive on the market’s post 1Q2018 price view, reflecting the thesis that the market will struggle to bounce back after extended fundamental tightening. Year/year demand growth, residential/commercial, Mexico exports, liquefied natural gas exports all require strong production growth to restore equilibrium to the market in 2018.

“SG’s near-term price view, and risk bias, does not reflect a cost of supply methodology,” Dougherty said. Cost of supply is an “appropriate consideration” when assessing long-term equilibrium price for the market, which is reflected in the post-2018 price outlook.

However, she said SG “does not see it as an appropriate measure when assessing near-term price behavior/risk given the extreme vulnerability of the market to weather, the limited elasticity within the market during peak demand periods, the supply skew created by hedging programs, and the lag between price signals and volume response from the now predominantly shale derived production base.”

A revival in production growth and stability “hinges heavily on the messages being provided by the New York Mercantile Exchange curve going forward,” said the SG analyst. “The unlikelihood of a perfectly complemented supply/demand growth profile in the near term gives rise to near-term tightening, but also to backwardation and loose balances in 2019/2020.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |