Infrastructure | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Mountaineer NGL Ready to Line Up Contracts for Appalachian Storage Project

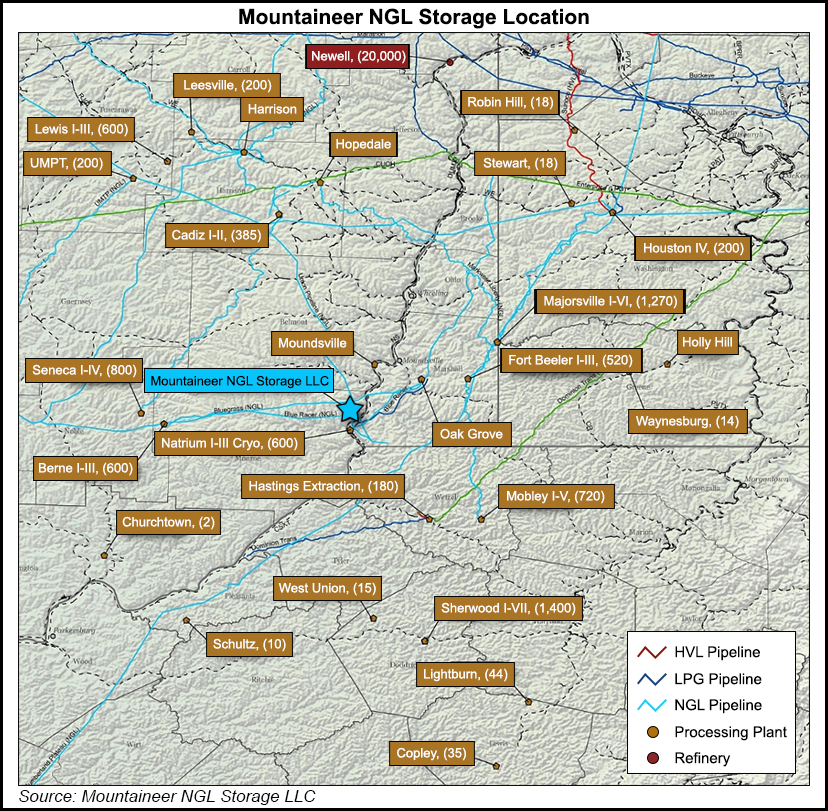

Mountaineer NGL Storage LLC, a first-of-its-kind project in the Appalachian Basin to serve growing volumes of natural gas liquids (NGL), has completed its technical validation phase and preliminary engineering work, and now hopes to land customers in the coming months.

“Right now, it’s my job to get some commercial contracts lined up,” said Tim Hanley, vice president of business development for parent company Energy Storage Ventures LLC. “We’re fairly optimistic that we’ll be able to pull this off in the next 30 to 60 days and get this project moving.”

Hanley delivered his update before an audience at the Appalachian Storage Hub conference on Thursday near Canonsburg, PA, that was organized by the consultancy TopLine Analytics and Shale Directories. Momentum is building for a substantial storage hub investment in the basin, as industry interest has piqued with a major petrochemical project announced by a Royal Dutch Shell plc affiliate last year, and more recently as U.S. lawmakers have introduced legislation to study the prospect, provide funding and expedite the permitting process.

Hard rock caverns in Ohio and West Virginia provide storage for oil refineries throughout the region, while the first of other underground fuel storage caverns at the Marcus Hook Industrial Complex in eastern Pennsylvania were built decades ago. Marcus Hook, a former oil refinery, has been repurposed by Energy Transfer Partners LP to store, process and distribute NGLs to international and domestic markets.

A larger hub, though, would bring Appalachian shale production closer in line with the Gulf Coast, home of Mont Belvieu and one of the world’s largest centers of NGL trade and movement. Supporters want to link up Appalachian shale formations with a network of pipelines, equipment and underground storage that could ease supply and demand imbalances and help create more regional buyers and sellers of the commodities.

Mountaineer, backed by a Goldman Sachs investment fund, announced the project early last year with a nonbinding open season. The company received more than three times the amount of its initial planned capacity, leading it to instead offer up to 2 million bbl of storage capacity in the Salina salt formation. The formation is 6,300-6,700 feet underground at a site along the Ohio River near Clarington, OH, in Monroe County.

Hanley said Thursday the company is now targeting 3.25 million bbl of capacity and is “commercially focused” on getting about 1 million bbl operational. “Our development is limited by how much disposal we can accomplish.” The caverns would store ethane, propane, butane and y-grade products below a 200-acre site nestled in an area along the river that hosts an expanding network of pipeline, rail, truck and barge infrastructure that has cropped up to serve shale development.

The site would require a 3.25 million bbl brine pond for fluids from Salina. Hanley said the project has secured all the local and state permits to store NGLs underground, but it anticipates it may take another two months before receiving approval from the Ohio Department of Natural Resources for the pond because of the monitoring, containment and host of other regulatory requirements the impoundment would need to meet.

Mountaineer’s phase one design calls for four 500,000 bbl NGL storage caverns to be in service by 4Q2018. It typically takes six months to develop a storage well, Hanley said. The site is near another proposed by PTT Global Chemical pcl (PTTGC), which is expected to make a final investment decision on a multi-billion dollar ethane cracker in Belmont County later this year. Hanley said the site would provide a true underground storage facility for the petrochemical company’s facility if it’s constructed.

The storage caverns would also be near Blue Racer Midstream LLC’s Natrium Complex in Marshall County, WV, which processes and fractionates NGLs. Hanley said the company wants to link up with Natrium to load-in and load-out. Two eight-inch pipelines would feed ethane to caverns at the site, which would also have transloading capability with trucks and rail.

In addition to PTTGC and Shell, three other crackers have been proposed for the region over the years. A Pennsylvania-commissioned study released earlier this year found that the Marcellus and Utica shales hold enough ethane to accommodate up to four more crackers in addition to Shell’s. But that analysis also estimated that the region needs 3.5-7 million bbl of liquids storage to foster more development.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |