NatGas Cash, Futures Lurch Lower; July Drops 3 Cents, Hits 3-Month Low

Physical natural gas for delivery Thursday was a tale of two cities — or two sections of the country — in Wednesday’s trading.

Double digit gains were the rule for West Texas, Rockies, and California points as a heat wave along with elevated power loads were forecast to engulf the desert Southwest. Otherwise stout losses dominated eastern, Midwest, Midcontinent, and Louisiana locations. The NGI National Spot Gas Average fell 2 cents to $2.63.

Futures slid lower along with the physical market, as forecasts of warmth gave way to more moderate outlooks. At the close July had fallen 3.3 cents to $2.933, the lowest close in 3 months, and August was off 3.6 cents to $2.953. July crude oil tumbled $1.73 to $44.73/bbl.

Midwest market points were under the microscope as exports from Canada were reduced as a result of northern rain storms that triggered an emergency inspection and possibly repairs on Alliance Pipeline to Chicago from British Columbia (BC) and Alberta, officials said. Industry analysts predicted gas exports could be cut by as much as 500 MMcf/d, or 30% of Alliance’s 1.6 Bcf/d flow average.

Prices for the moment seem unaffected. Deliveries to the Chicago Citygate fell a dime to $2.75, and packages at Joliet slipped a nickel to $2.79. Gas on MichCon was quoted 12 cents lower at $2.80 and gas on Consumers fell 8 cents to $2.82.

A heat wave in the desert Southwest lifted quotes from Waha to the PG&E Citygate. AccuWeather.com forecast that Los Angeles’ high of 85 Wednesday would rise to 88 Thursday before hitting 90 on Friday. The normal high in Los Angeles is 78. San Diego’s high of 75 Tuesday was forecast to climb to 77 Thursday and 81 by Friday, 10 degrees above normal. Las Vegas’ 98 high Wednesday was seen advancing to a toasty 105 Thursday and 106 by Friday, 9 degrees above normal.

West Texas, Rocky Mountain, and California quotes soared. Gas on El Paso Permian rose 13 cents to $2.62, and gas at Waha was quoted at $2.69, up 13 cents. Gas at Opal rose 11 cents to $2.60, and deliveries priced at the SoCal Border Average added 10 cents to $2.70.

Elsewhere prices were less exuberant. Gas at the Algonquin Citygate fell 2 cents to $2.12 and gas on Dominion South eased 3 cents to $1.82. Gas at the Henry Hub fell 11 cents to $2.90, and deliveries to Panhandle Eastern added 4 cents to $2.59.

July futures put in the high of the day at $2.989 after opening 2 cents lower Wednesday morning at $2.96 as traders saw a deflating weather environment ahead of a storage report expected to show above-average storage builds.

Weather forecasters continue to call for moderation going forward. “Overall, next week is still favored to verify cooler than the current week across the Midwest and East thanks to a strong shift of bigger heat into the Western U.S,” said Matt Rogers, president of Commodity Weather Group.

“However, there are definitely model differences regarding timing of cool fronts and daily temperature details for the Midwest and East that inch confidence slightly lower today. The West becomes the big heat target next week and we edge California and the Southwest slightly hotter compared to yesterday (Pacific Northwest slightly cooler). Interior Texas is also a hotter spot as we raise Dallas temperatures middle to late next week again.”

Not only have weather forecasts not lived up to expectations, but analysts note power usage at less than anticipated levels.

“Heading into this week the natural gas and power markets were filled with anticipation as the first real heat wave was set to hit the US,” said Jeff Richter, principal with EnergyGPS, a Portland, OR-based energy and consulting firm. “As a result, the market had high expectations for gas demand with the consensus calling for power burns to settle in the low to mid 30s Bcf for Monday and Tuesday. Fast forward to today, we reflect back on the past two days as the heat came but the power burn numbers were rather disappointing as both Monday and Tuesday averaged just 30 Bcf.”

Tim Evans of Citi Futures Perspective calculates a 91 Bcf injection for Thursday’s Energy Information Administration (EIA) storage report, about in line with industry expectations of 85 to 90 Bcf. His figures show the year-on-five-year surplus, currently at 237 Bcf, shrinking to 194 Bcf by June 30.

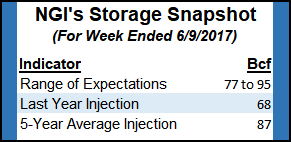

Thursday’s storage report is expected to show a build above historical averages. Last year 68 Bcf were injected and the five-year pace is for an 87 Bcf increase. ION Energy is looking for a 86 Bcf build and a Reuters survey of 28 traders and analysts showed an average 86 Bcf also. The range on the survey was +77 Bcf to +94 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |