Weekly NatGas Quotes Movin’ On Up

Weekly natural gas quotes managed to recover a portion of the prior week’s 31-cent loss, but still have a long way to go to make it back to the $3 threshold reached just three short weeks ago.

The NGI Weekly National Spot Gas Average rose 6 cents to $2.70 and of the actively traded locations the point showing the week’s greatest advance was Iroquois Zone 2 with a rise of 20 cents to average $2.43. The biggest losers were both Dominion North and Dominion South with losses of 12 cents apiece to averages of $2.00.

Regionally the Northeast proved to be the week’s greatest gainer as late week forecasts calling for sweltering temperatures lifted quotes by an average 13 cents to $2.48. Appalachia proved to be the week’s biggest loser dropping 6 cents to average $2.10.

The Southeast was the only other region in negative territory with a drop of 2 cents to $2.90 and East Texas and South Texas managed to squeak into positive territory with gains of 2 cents and 4 cents to $2.91 and $2.89 respectively.

South Louisiana rose a nickel to $2.88, the Midwest was up 8 cents to $2.84, and all other regions posted double-digit gains for the week.

California rose a dime to $2.86, the Rocky Mountains added 11 cents to $2.57, and the Midcontinent added an even dozen pennies to average $2.69.

July futures added 4.0 cents on the week to $3.039.

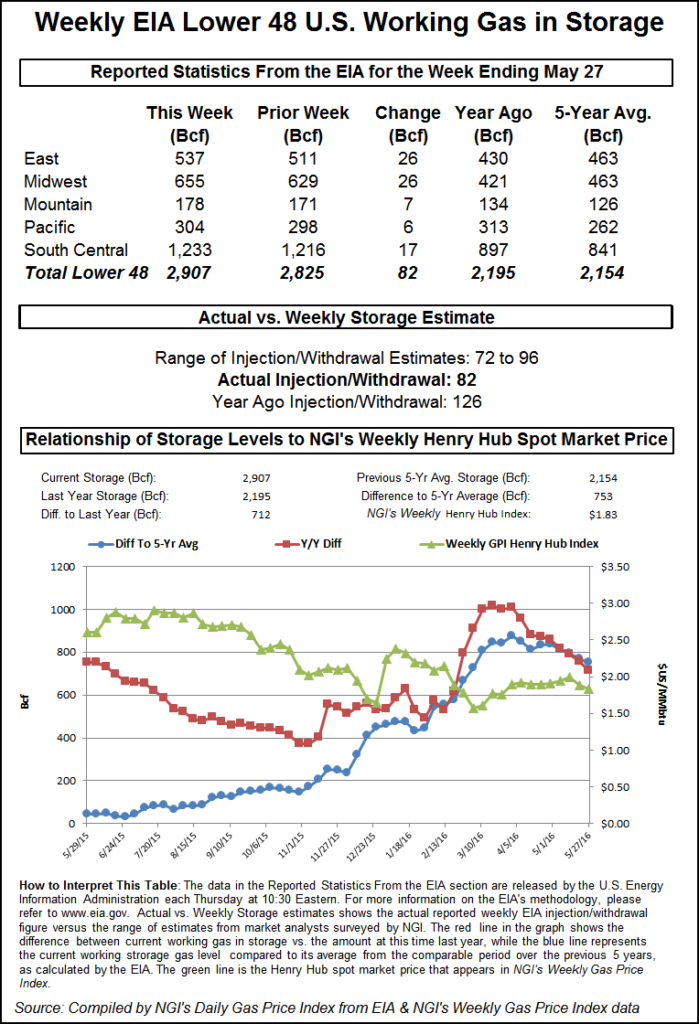

Thursday morning saw the EIA report a storage build of 106 Bcf for the week ending June 2, well above expectations, and at first prices plunged. Bulls sensed an opportunity and turned the tide. At the close, July had added eight-tenths of a cent to $3.028 and August had increased eight-tenths as well to $3.062.

The reported 106 Bcf injection put inventories at 2,631 Bcf, and July futures fell to a low of $2.978, but by 10:45 a.m. EDT July was trading at $3.05, up 3.0 cents from Wednesday’s settlement.

Prior to the release of the data, analysts’ estimates were in the high-90 Bcf withdrawal area. Ritterbusch and Associates was looking for a build of 90 Bcf, and a Reuters poll of 25 traders and analysts showed a range from +80 Bcf to +111 Bcf, with an average of 98 Bcf.

“We were expecting a build of 96 Bcf to 98 Bcf, and when the number came out it made a new low, but the subsequent bounce over $3 tells me that there are a lot of buyers out there looking to get long under $3,” a New York floor trader told NGI.

“The 106 Bcf net injection into U.S. natural gas storage for last week was at the top end of the range of expectations and more than the 94 Bcf average, a bearish surprise,” said Tim Evans of Citi Futures Perspective. “The build also suggests some weakening of the underlying supply/demand balance, although we note the reporting period did span the Memorial Day holiday, which may have had a one-time effect in suppressing commercial and industrial demand.”

The Denver-based analytical team at Wells Fargo said, “The reported figure was 7 Bcf above consensus, 41 Bcf above last year and 13 Bcf above the five-year average of 93 Bcf. This marks the fourth straight week that the storage injection has been higher than forecasted, exceeding the median estimate by 6 Bcf on average each week. Based on current weather forecasts, our model indicates a 135 Bcf cumulative injection over the next two weeks, which would bring the storage surplus (versus the five-year average) down to just 211 Bcf.

“The East region accounted for the majority of the surplus versus the five-year average as mild temperatures caused a 38 Bcf injection versus the historical average of 27 Bcf,” Wells Fargo said.

Inventories now stand at 2,631 Bcf and are 332 Bcf less than last year and 237 Bcf more than the five-year average.

In the East Region 38 Bcf was injected, and the Midwest Region saw inventories grow by 29 Bcf. Stocks in the Mountain Region increased by 6 Bcf and the Pacific region was up 11 Bcf. The South Central Region added 22 Bcf.

In Friday trading weekend and Monday physical natural gas was higher on average, but the market was highly split. Titanic weather-driven gains in the East overwhelmed losses in the Rockies, California, and the Midcontinent. The NGI National Spot Gas Average rose 7 cents to $2.72.

Futures trading was far less exciting, with the spot July contract rising 1.1 cents to $3.039 and August climbing nine-tenths of a cent to $3.071.

By Monday high temperatures along the Eastern Seaboard are expected to soar. Forecaster Wunderground.com predicted the Friday high in Boston of 76 degrees would climb to 78 but reach a sweltering 92 by Monday, 18 degrees above its seasonal norm. New York City’s Friday peak of 82 was expected to reach 85 Saturday and a searing 95 Monday, 14 degrees above normal. Philadelphia’s max Friday of 84 was anticipated to reach 86 Saturday and 94 Monday, 13 degrees above normal.

Gas at the Algonquin Citygate jumped 62 cents to $2.76 and deliveries to Iroquois Waddington soared 82 cents to $2.95. Packages on Tennessee Zone 6 200 L vaulted 73 cents to $2.85.

Other market points were mostly lower. Gas at the Chicago Citygate rose 2 cents to $2.84 and gas at the Henry Hub advanced 4 cents to $2.98. Gas on El Paso Permian fell 12 cents to $2.51 and deliveries to Panhandle Eastern gave up 6 cents to $2.58.

Parcels at Opal tumbled 12 cents to $2.51 and gas at the PG&E Citygate were quoted a nickel lower at $3.08.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

Bulls are likely viewing the recent rig report with quiet apprehension.

Oklahoma led the states in drilling rig additions during the week ended Friday, adding five units to end at 131 active, according to Baker Hughes Inc. (BHI). That’s up sharply from the year-ago tally of 58 active rigs.

The Midcontinent state is home to the STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties), which was a standout in the Oklahoma pack during the week just ended, adding four rigs to end at 42 running. That’s up from 16 rigs one year ago.

July futures managed to open a penny higher Friday morning at $3.04 as traders digested Thursday’s positive market response to an otherwise bearish storage report and weather forecasts for next week continue hot.

Overnight weather models continued with a warm theme with cooling loads expected to be above average. “[Friday’s] 11-15 day period forecast is warmer than yesterday’s forecast over the West and adjacent portions of the central and southern US,” said WSI Corp. in a morning report to clients.

“The Northeast is a touch cooler.” Continental United States population-weighted cooling degree days (CDD) “are up 1.5 for Days 11-14 and are now forecast to be 53.3 for the whole period, which are 10.9 above average.

“The case can be made for risks in either direction. The northern tier and East have a slight cooler risk, while the West and south central US have the potential to run a touch hotter.”

Analysts see a firm market for the near term. “This market’s ability to work higher in spite of a much larger than expected supply injection attests to a firm undertone that is being facilitated by some warmer temperature forecasts,” said Jim Ritterbusch of Ritterbusch and Associates in a morning note to clients.

“Although the expected above normal temps appear limited mainly to the northeast quadrant, deviations from normal are beginning to appear sufficient to drive a renewed contraction in the supply overhang. And while yesterday’s 12 Bcf expansion in the supply surplus is likely to be followed by another slight increase in the overhang with next week’s EIA, this trend appears temporary.

“Furthermore, warm weather views within heavily populated regions at this early stage of the CDD cycle tend to prompt an exaggerated price response. This show of support is likely sustainable at least for another 2-3 days given some expected hot Midwest temperatures that are likely to strengthen the cash basis in setting the stage for ultimate gain up into the 3.20-3.25 zone.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |