NatGas Cash Steady, But Futures Slump Ahead of Inventory Report

Physical natural gas for Thursday delivery were unchanged in Wednesday’s trading, with prices having trouble gaining any traction, and the NGI National Spot Gas Average was up a cent to $2.73. Modest gains in Texas, Louisiana, the Midcontinent and Midwest offset slight weakness in the Northeast.

Futures trading was equally lackluster, with July falling 2.2 cents to $3.020, and August skidded 2.2 cents also to $3.054. July crude oil imploded $2.47 to $45.72/bbl on a bearish government inventory report.

Northeast gas pricing was mixed as cool, wet weather was forecast. “Parts of the first full week of June will feature cool and unsettled conditions in the northeastern United States, prior to a change in the weather pattern,” said AccuWeather.com meteorologist Alex Sosnowski.

Gas on Algonquin Citygate fell 6 cents to $2.24, but deliveries to Iroquois Waddington added 8 cents to $2.50. Gas on Tennessee Zone 6 200L shed 6 cents to $2.24.

“Similar to what has occurred multiple times during May, the jet stream will dip southward over the region this week,” said AccuWeather.com meteorologist Elliot Abrams. “The bulk of showers and thunderstorms are likely to settle farther to the south and west from Pennsylvania and New Jersey to portions of Ohio, eastern Kentucky, West Virginia and Virginia on Wednesday. On any day where the sun fails to make an appearance, temperatures will average 10 degrees or more below normal. Temperatures may be no higher than the 50s in the mountains and the 60s at lower elevations.”

Marcellus points were firm. Gas on Dominion South was quoted flat at $2.00, but packages on Tennessee Zone 4 Marcellus rose 2 cents to $1.99. Deliveries to Transco Leidy also added 2 cents to $2.00.

Major market centers rose moderately. Gas at the Chicago Citygate rose a penny to $2.86, and gas at the Henry Hub came in 3 cents higher at $2.99. Gas on Panhandle Eastern changed hands 4 cents higher at $2.71, and packages on El Paso Permian were quoted 2 cents higher at $2.70. Deliveries to Opal rose a nickel to $2.74 and gas priced at the SoCal Citygate added 6 cents to $3.17.

Sky-high physical quotes on Transco Zone 6 during the winter may be a thing of the past.

“New York is subject to capacity constraints with gas vying for access to Manhattan, Brooklyn and Queens,” said Morningstar Commodities analyst Trey Dott. “Due to these capacity constraints, prices in Transco Zone 6 have historically reached levels approaching Algonquin in winter months, [but] the New York Bay Expansion will add much-needed gas capacity to this demand center. National Grid has subscribed the full capacity of 115 MMCf/d,” in support of local distribution company (LDC) growth.

“Full capacity should be utilized in winter once available,” Dott said. “Although this project is in support of LDC growth, Zone 6 gas prices in winter imply that additional capacity will be utilized. The project is demand-funded. Even though National Grid is the designated destination, part of this expansion should become available. The firm transportation agreement is for 15 years and should support significant future LDC growth that will become available in the interim.

“The market reflects the additional gas that should be available this winter. The project is smaller than many of the recent large expansions but should still have an impact on winter pricing. Transco Zone 6 New York January/February strip prices have been trending down indicating the value of this project has been taken into account.”

July futures opened 3 cents higher Wednesday morning at $3.07 as weather forecasts heated up and technical factors have lost some of their bearish luster. Forecasters see model trends heading in the direction of greater heat in key population centers.

“For yet another day, the model momentum continues in the hotter direction with net demand increases across the board, focused on the heat event next week from the Midwest to the East Coast,” said Commodity Weather Group President Matt Rogers in a Wednesday morning report to clients. “Just like the episode from middle May, this high-pressure heat ridge spike travels north across the Midwest to the Northeast, leaving the South largely out of it and threatening a few days where the Northeast could be hotter than the Middle Atlantic.

“Rain risks seem really low in the East early next week but start to pick up by Wednesday onward to start to pull back the heat a bit; however, humidity should remain moderate to high so that every day next week is considerably hotter than the current. Otherwise, the models are favoring a return of western hot ridging in the 11-15 day that trends the Midwest to South and then East cooler for the 11-15 day.”

Bulls may be able to find some solace because even with the recent dive in July futures, forecasters are calling for only a modest adjustment to 2017 and 2018 pricing. New natural gas export capabilities and growing domestic consumption will help Henry Hub natural gas spot prices increase from an average of $3.16/MMBtu this year to $3.41/MMBtu in 2018, according to the Energy Information Administration’s (EIA) latest Short-Term Energy Outlook (STEO). Those estimates are down marginally from EIA’s previous STEO, which included forecasts of $3.17/MMBtu in 2017 and $3.43/MMBtu next year.

Since more deferred contracts seem to be holding ratio support levels, analysts are thinking prices may move higher.

“At this time, I would be inclined to treat any such price action as a pause in the down trend though,” said United ICAP analyst Brian LaRose. His figures showed that if the bulls can’t muster enough momentum to push prices higher, the July contract could easily trade down to the mid $2.80s.

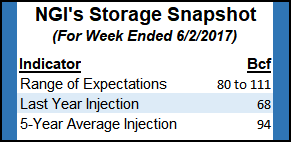

Prices may trend lower following Thursday’s EIA storage report as estimates are falling above historical averages. Last year 68 Bcf was injected and the five-year average is for a 94 Bcf increase. Ritterbusch and Associates is looking for a 90 Bcf injection. A Reuters survey of 25 traders and analysts revealed a 98 Bcf average with a range of 80 Bcf to 111 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |