Markets | NGI All News Access | NGI Data

Lack of Heat Results in Across-the-Board Natural Gas Price Drops

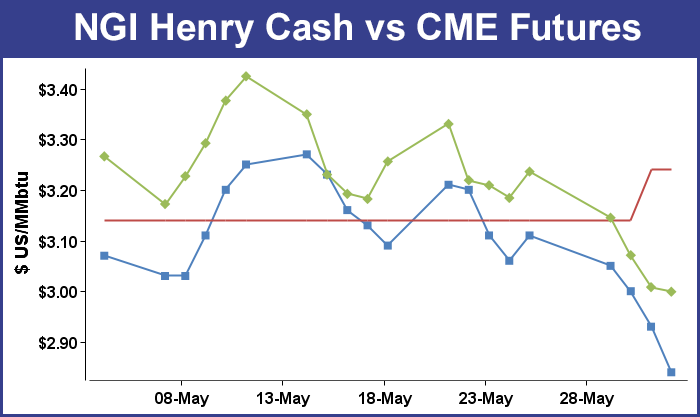

Natural gas cash and futures traders were seeing a lot of red during the short week as moderate temperatures combined with bearish storage data to produce double-digit losses across the physical market and the financial screen.

Led by losses of a half-dollar or more at many Appalachian and Northeastern price points, NGI‘s Weekly National Spot Gas Average plummeted 31 cents to average $2.64 while the July futures contract came off a near-identical 31.1 cents to record a $2.999 finish.

Chamber of Commerce weather was responsible for the large physical and financial declines. Algonquin Citygate notched the largest decline of U.S. liquid points tracked by NGI — posting a $2.21 average, down 64 cents. Transco Zone 5 South posted one of the smallest losses at 17 cents to average $2.95.

On a regional basis, Appalachia and the Northeast were the two largest drops, posting 50-cent and 49-cent declines, respectively, to average $2.16 and $2.35.

The next largest decline was of 32 cents, which could be found in California ($2.76), the Rockies ($2.46) and West Texas/SE New Mexico ($2.53).

Beyond that, the Midcontinent dropped 31 cents to average $2.57 and the Midwest knocked off 29 cents to average $2.76.

The region reporting the smallest decline was the Southeast, which slipped 19 cents to average $2.92.

Friday was no different than the rest of the week as NGI‘s National Spot Gas Average collapsed 13 cents lower to average $2.53.

Not to be outdone, July natural gas futures spent the majority of Friday’s regular trading session wrestling on both sides of the psychological $3 support level, with natural gas bulls remaining penned in by unremarkable temperatures nationwide and Thursday’s doubly bearish storage report. On Thursday, the Energy Information Administration (EIA) reported that 81 Bcf was injected into underground stores for the week ending May 26, but a reclassification pushed the implied flow for the week to 85 Bcf. Both figures were larger than the industry had been expecting.

After finishing Thursday’s regular session at $3.008, July natural gas futures on Friday traded between $2.989 and $3.051 before closing out the session at $2.999, down nine-tenths of a penny from Thursday.

“This whole move lower is pretty easy to explain,” said Tom Saal, vice president of FCStone Latin America LLC in Miami. “The market was expecting some hot weather by now and we just haven’t seen it yet.

“The other thing going on here is the funds have been at a near-record net-long, and they have been letting a little air out of the tires by selling off. Those two things were the background to this sell-off we’ve seen.”

Saal told NGI he believes $3 support will likely hold up. “It hasn’t broken yet, and I think it will probably remain intact. Everyone needs to remember that summer has not even started yet. We just haven’t had the weather yet.”

Patrick Rau, NGI director of commodity research, said $3 support is key for a number of reasons, real and perceived.

“The $3 mark is more than just a psychological support level, it’s the previous reactionary low last observed in late April,” Rau said. “July is now trading below the 50-, 100- and 200-day moving averages, so that is bearish from a pure technical standpoint.

“Slow stochastics are a bit oversold, and that may provide some temporary relief, especially since the July contract has fallen pretty far, pretty fast. Longer-term, strong support exists at $2.50, which is the previous reactionary low seen in August 2016, November 2016, and February 2017.”

In the minutes leading up to the 10:30 a.m. EDT storage release on Thursday, the July contract was hovering around $3.070, which is near where it finished Wednesday’s regular session. In the minutes that immediately followed the report, the prompt-month contract plunged and notched a $2.994 low just before 11 a.m. EDT.

Still, some analysts see supply balancing out by fall.

“We continue to see the storage glut being drawn down through the summer months, with a Nov. 1 storage estimate of 3.8 Tcf,” wrote Jefferies LLC analysts Zach Parham and Michael Hsu, who added that they remain bullish on gas prices.

“Despite our recent reduction in our 2018 gas price forecast (to $3.30, from $3.50), we remain bullish on natural gas on a tighter supply/demand balance (excluding weather), with a $3.50/MMBtu long-term price forecast.”

Wells Fargo Securities LLC analysts deemed the report “slightly bearish” but said the market is still undersupplied.

“The reported figure was 4 Bcf above consensus but 1 Bcf below last year and 17 Bcf below the five-year average of 98 Bcf,” Wells Fargo analysts said Thursday. “This marks the third week in a row that storage has come in above consensus estimates, missing by an average of 5 Bcf per week. But despite that bearish sign, based on our storage model this data point continues to indicate that the natural gas markets are running more than 2 Bcf/d undersupplied, and our analysis shows that this state of undersupply will likely persist throughout the summer.”

According to EIA, reclassifications from working gas to base gas resulted in decreased working gas stocks of approximately 4 Bcf in the Mountain region for the week ending May 26. As a result, the implied flow for the week is an increase of 85 Bcf to working gas stocks.

Heading into the report, most consensus industry estimates were for a build in the 66 to 78 Bcf range. A Bloomberg survey predicted an injection ranging from 66 to 78 Bcf with a median build of 69 Bcf for the week ended May 26. IAF Advisors called for a 73 Bcf injection, while Stephen Smith Energy Associates revised upward its weekly gas outlook estimate to call for a 79 Bcf build. A Reuters survey called for an injection ranging from 73 to 86 Bcf with an expectation that 78 Bcf would be injected.

Last year’s injection for the corresponding week was 80 Bcf, while the five-year average build stands at 97 Bcf.

As of May 26, working gas in storage stood at 2,525 Bcf, according to EIA estimates, which is 370 Bcf less than last year at this time and 225 Bcf above the five-year average of 2,300 Bcf.

Over in the next-day physical market, losses on Friday ranged from a couple of pennies along the Gulf Coast and through the Midcontinent and Midwest to double-digit cent drops at eastern, Rocky Mountain and California points.

Mild temperatures contributed to 30-plus-cent declines in Appalachia and the Northeast. Dominion South caved 32 cents to average $1.91, while Tennessee Zone 4 Marcellus came of 39 cents to $1.75.

Most declines in the Northeast were even larger, where Transco Zone 6 NY declined by 65 cents to average $1.83 and Transco Zone 6 non-NY dipped 59 cents to $1.92.

In the West, Kern River declined 13 cents to average $2.39 and Cheyenne Hub dropped 7 cents to $2.41, while in California, SoCal Border Average dipped 13 cents to average $2.47, and PG&E Citygate slid 11 cents to $2.99.

Looking to alleviate a bottleneck and allow more gas to flow into Florida, Sabal Trail Transmission LLC could begin service on its line as early as next week.

Sabal, a joint venture of Spectra Energy Partners LP, NextEra Energy Inc. and Duke Energy, consists of about 515 miles of pipeline, six compressor stations and six meter stations across Alabama, Georgia and Florida. The project, combined with Transcontinental Gas Pipe Line Co.’s (Transco) Hillabee Expansion on one end and the Florida Southeast Connection (FSC) project on the other, would open up additional deliveries of gas into Florida from the Transco Zone 4 pool.

In late May FSC filed a letter with FERC stating that because of additional time for commissioning on Sabal Trail, and given FSC’s operation is contingent on Sabal, the exact in-service date for FSC was not known and would be communicated in a future filing. FSC says it has been advised that Sabal Trail now estimates that it will be ready to place its facilities into service on or about June 5.

“Accordingly, FSC requests that the Commission grant the in-service request, as supplemented, by June 5, 2017 in order to allow the FSC Project to be placed into service at the earliest possible date thereafter,” FSC said in the letter. Anchor customer Florida Power & Light is anxious to get deliveries started as summer temps rise.

Transco Zone 4 on Friday dropped 8 cents — about average on the day for Southeast regional points — to average $2.79.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

After taking a considerable amount of pounding during the week, natural gas price bulls received a slight glimmer of hope after EIA released March data from the EIA-914, Monthly Crude Oil, Lease Condensate, and Natural Gas Production Report. According to the government agency, U.S. dry natural gas production was down for a 13th consecutive month in March, reaching 2.22 Tcf (71.6 Bcf/d), a 2.4% decline from 2.28 Tcf (73.4 Bcf/d) in March 2016.

Domestic dry gas production declines began early last year, and for all of 2016 production was an estimated 26.5 Tcf (72.4 Bcf/d), down compared with the record 27.1 Tcf (74.2 Bcf/d) in 2015, but still greater than the 25.9 Tcf (71.0 Bcf/d) recorded in 2014, according to EIA’s latest Natural Gas Monthly report.

While dry gas production trends downward, natural gas consumption increased in March, EIA said, reaching 2.51 Tcf (80.8 Bcf/d), a 6.2% increase compared with 2.36 Tcf in March 2016. Consumption ended 2016 at 27.5 Tcf (75.1 Bcf/d), an increase from 27.3 Tcf (74.7 Bcf/d) in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |