E&P | Eagle Ford Shale | NGI All News Access

Lonestar Adds 30,000 South Texas Acres For $117M

Lonestar Resources US Inc. said Tuesday it is acquiring more than 30,000 gross (21,238 net) acres in the Eagle Ford Shale in South Texas for a total purchase price of $116.6 million.

The acreage is in Karnes, Gonzales, DeWitt, Lavaca and Fayette counties and would add 31.4 million boe to the Forth Worth, TX-based exploration and production company’s proved reserves portfolio, an increase of 70%.

“The acquisitions announced…are transformational for Lonestar,” CEO Frank D. Bracken said. “We have scaled our business with Eagle Ford Shale properties that are located in our core area, which our technical team understands extremely well. Despite increasing our asset base by over 50% on most metrics, we expect to add little to no overhead to integrate these assets.”

Lonestar plans to go from one to two rigs in the Eagle Ford by Jan. 1, “which will allow us to scale our drilling program and obtain a dedicated frack spread, which we believe will afford us greater economies of scale, cost savings and better precision and timing of execution.”

The acreage is 94% held by production. Lonestar would acquire 115 gross (80.3 net) producing oil and gas wells, owning an average 70% working interest in the producing wells while operating 81 wells at 93% working interest.

The acquisitions, including 25.4 million bbl of crude oil, 3.1 million bbl of natural gas liquids and 17.5 Bcf of natural gas, would weight Lonestar’s proved reserves mix more heavily to oil, going to 69% from 62%, the company said.

The acquired acreage increases Lonestar’s net production by 39% (from 5,266 boe/d to 7,318 boe/d) and its net leasehold by 59% (from 36,069 net acres to 57,330) pro forma for 1Q2017.

Lonestar plans to finance the acquisitions through a combination of stock and debt. The transactions are expected to close in late June.

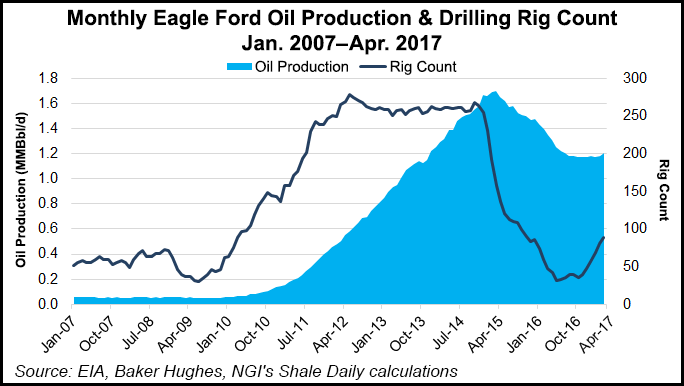

While the Permian Basin has attracted the most attention and drillbits recently, the Eagle Ford has quietly been on the ascent. The South Texas play has nearly tripled its rig count over the past year, ending last week at 86 rigs, up from 29 one year ago.

Dry gas production out of the Eagle Ford is also well-positioned to soak up growing demand from Mexico, and a number of South Texas players are looking to seize the opportunity.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |