Most Natural Gas Forward Curves Weaken on Storage News, Uncertain Temps

Natural gas forward prices fell at most locations across the United States for the period between May 19 and 25 as bearish storage news and a lack of clarity in long-term weather forecasts pressured markets, according to NGI’s Forward Look.

Nymex futures led the way as the June futures contract lost about 7 cents during that time to settle Thursday at $3.184. The rest of the futures curve moved lower as well, with July shedding 8 cents to $3.28, the balance of summer (July-October) falling 7 cents to $3.31 and the winter 2017-2018 sliding 6 cents to $3.50.

Most pricing hubs posted similar declines as the forward markets responded to a combination of bearish factors. Most notable are weather models that remain at odds with each other regarding temperature trends for June.

The overnight global weather model was again to the warm/hot side, just not quite as impressively so compared to recent runs, and thus a very slight cooler trend, according to NatGasWeather. The European weather model was again on the cool side, just not quite as cold compared to previous runs, thus a slight warmer trend.

“Essentially, both weather models gave up a small amount of ground to be slightly closer to each other, but still quite far apart. How the markets interpret this is difficult to say since neither came close to conceding to the other,” NatGasWeather said.

While weather patterns will be critical going forward, the forecaster said, weekend production and export trends are also important heading into the Memorial Day holiday weekend.

On the LNG front, deliveries to Cheniere’s Sabine Train 1 appear to be ramping up following an unexpected outage earlier in the week. Data and analytics company Genscape Inc. said its monitors on May 23 detected an unexpected shutdown of Cheniere’s Sabine Train 1. The cause was unknown, but aggregate pipeline nominations to the facility then dropped below 2 Bcf/d for the May 23 and May 24 gas days. As of May 25, pipeline nominated deliveries to Sabine were at 1,839 MMcf/d, 414 MMcf/d below the month-to-date average prior this outage. Genscape noted that inbound ships are available in the Gulf to offtake any volumes. In addition, the company estimates that there is more than 6 Bcf of storage capacity available.

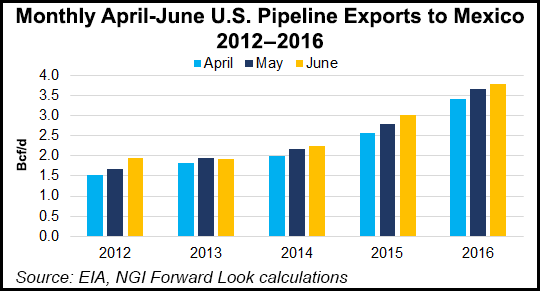

Meanwhile, exports to Mexico are on the rise, a trend typical for this time of year, as northern states start seeing temperatures hit the 90s and low 100s. On Friday, exports were just shy of 4.3 Bcf/d, about 0.2 Bcf/d above the last week’s average. Genscape’ proprietary monitor of flows on the NET Mexico pipeline show that system back to full capacity, though maintenance after the holiday weekend will disrupt about 0.3 Bcf/d of flow.

Historically (during the past three- and five-year periods), May exports average about 5% greater than April. So far this month-to-date, exports are running 14% above April, but that number is radically skewed by the maintenance on NET, which cut exports on that line by as much as 1.3 Bcf/d. June exports continue climbing with hot weather in Mexico, historically averaging 7% greater than May.

Genscape’s grossed up estimate for total exports is up to 4,126 MMcf/d, about 200 MMcf/d above the April average following the conclusion of the NET pipeline maintenance. The interstate pipeline sample is at its highest point since last August. The gains are most noticeable on the North Baja and SoCal pipeline systems, which feed power plants in Sonora and Baja Norte.

While demand just south of the border is on the rise, demand in the U.S. has thus far failed to impress. In fact, when the U.S. Energy Information Administration released its weekly storage inventory report, the injection was above what the market expected.

The EIA reported a 75 Bcf build for the week ending May 19, compared to a market consensus of 70 Bcf. The injection, which was close to the 71 Bcf that was injected a year ago but well below the five-year average of 90 Bcf, brought inventories to 2,444 Bcf.

Despite the bearish storage build, NatGasWeather forecasters said builds in supplies should remain slightly under five-year averages, keeping surpluses in gradual decline. “It’s really about whether it’s going to be viewed as fast enough to the markets liking,” NatGasWeather said.

Taking a closer look at the forward markets, most markets followed Nymex futures to the downside. Among those is Consumers Energy, one of 26 new locations recently added toNGI’s Forward Look product. The recent additions are part of NGI’s continual efforts to enhance market visibility.

The Consumers Energy pricing location is made up of deliveries into the Consumers Energy LDC system in Michigan. June forward prices there fell 3.8 cents from May 19 to 25 to reach $3.094, July forward prices slid 4 cents to $3.144, the balance of summer (July-October) dropped 5 cents to $3.18 and the winter 2017-2018 lost 4 cents to hit $3.46.

Some markets hubs posted more significant declines than others. For example, Algonquin Gas Transmission Citygates continue to experience volatility amid a summerlong maintenance event that has reduced capacity along several of the Algonquin pipeline’s major compressor stations.

For the period between May 19 and 25, AGT CG June forward prices fell 12 cents to $3.057, July dropped 14 cents to $3.44, the balance of summer (July-October) slid 14 cents to $3.27 and the winter 2017-2018 strip lost 10 cents to hit $7.05. The rest of the forward curve shed less than a nickel, according to Forward Look.

Meanwhile, a handful of markets saw the prompt month end the week in the black after quite a bit of a volatility during the week. Both Houston Ship Channel and Katy saw June pick up about 2 cents between May 19 and 25 to reach $3.30 at both hubs. The rest of the forward curves moved lower, but losses were more muted than at the Nymex benchmark.

At the Houston Ship Channel, July forwards slid 4 cents during that time to $3.325, the balance of summer (July-October) shed 4 cents to $3.34 and the winter 2017-2018 slipped 4 cents to $3.43, Forward Look data shows.

Katy July forward prices were down 4 cents to $3.32, balance of summer prices were down 4 cents to $3.33 and the winter 2017-2018 was down 4 cents to $3.42.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |