E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

OPEC to Extend Production Pullback as U.S. Shale Output Soars

The global oil glut, created in part by surging U.S. unconventional production, has again forced the hand of the Organization of the Petroleum Exporting Countries (OPEC), which on Thursday agreed to extend supply reductions for another nine months beginning July 1.

Investors, perhaps anticipating deeper reductions, were nonplussed, and sent oil prices down nearly 5% on Thursday. West Texas Intermediate futures plunged Thursday by 4.8% to end at $48.90/bbl, while Brent slumped 4.7% to $51.44.

The agreement is a bet that worldwide prices will trend higher as the market rebalances. OPEC’s agreement extends the formal moratorium put in place that began Jan. 1., which was to temporarily reduce total output by around 1.8 million b/d. OPEC members control about 60% of world oil production.

OPEC members and their non-OPEC (NOPEC) allies “recognized the need for continuing cooperation among oil exporting countries in order to achieve a lasting stability in the oil market,” the cartel said. The 14 OPEC member countries and 10 participating NOPEC producing countries underscored the importance of continuing efforts to help stabilize the oil market, in the interests of all oil producers and consumers.

“The cut we have made last December is working,” Saudi Energy Minister Khalid al-Falih said Thursday in Vienna on the opening day of the 172nd OPEC meeting. “Nine months with the same level of production that our member countries have been producing at is a very safe and almost certain option to do the trick.”

The agreement now in place is to withhold 1.8 million b/d from the market. The goal is to siphon off the surfeit of oversupply wrought not only by an abundance of U.S. shale output but also from record OPEC production in 2016.

Global Oil Market ”Markedly Improved’

“Since our last meeting in November, the oil market situation has markedly improved,” Falih said. “We started with a bearish sentiment, but the market is now well on its way toward rebalancing. We have more work to do in lowering inventories toward the last five-year average, but we are on the right track. Stakeholders across the spectrum are benefiting from the improved situation — not only the producers who are part of the supply agreement but other countries as well.”

International oil companies, for example, “are also posting their best quarterly earnings in two years,” Falih said. “Investment flows into the upstream sector have picked up, albeit at a slower pace than required to meet forecast long-term demand. And despite potential volatility, I expect the situation to continue improving,” assisted by a more robust global economy and higher gross domestic product growth in 2017, “as well as fairly healthy oil demand growth this year, particularly in Asia.”

The Saudi energy minister said “vigilance should be the watchword of the day, and it is critical that we do not become complacent…Nurturing a constructive and stable market environment is our highest priority. This goal is important not only for us but also for consumers, as it ensures a sustainable future for oil supply and demand — the absence of which may produce seriously unwelcome outcomes such as price spikes and risks to global energy security…”

OPEC, he said, also has a “fundamental interest in the health of the global economy and the worldwide energy industry, so that appropriate levels of investment are maintained and technological progress continues to be encouraged and nurtured.”

The cartel plans to “proactively deal with emerging challenges, and the institution will further evolve as a highly respected organization able to deal with growing complexity and accelerating change.”

U.S. Production Still Seen Moving Higher

OPEC’s extension would give U.S. shale producers more visibility about how to plan in the near-term, analysts said.

“A nine-month extension rather than a repeat of a six-month duration is warranted to maintain a stronger price environment and allow the time necessary for inventories to draw down over the balance of the year,” said Andrew Slaughter, executive director of the Deloitte Center for Energy Solutions.

“Compounded by seasonal demand growth, the cuts should help accelerate global inventory drawdowns over the balance of the year and will likely set a new floor for crude oil prices in the low $50/bbl range,” he said.

“Inventory drawdowns could become visible as early as August or September, although it could take until the first quarter of next year to return to a more normal historical range. Deeper cuts would have likely weakened the incentive for high compliance across OPEC while encouraging NOPEC producers to accelerate production growth.”

Deloitte’s team expects the market to “remain more dependent on inventory drawdowns than U.S. production trends. We do expect U.S. production to continue on an upward trend stimulated by the continued OPEC cuts, but it’s clear that U.S. production increases will not offset OPEC cuts, despite rig count growth and swelling drilled and uncompleted (DUC) well inventories.”

The U.S. rig count since OPEC first announced the pullback “has risen by about 270 units since the end of November, quickly responding to the improved price environment and resulting better cash flows for operators,” Slaughter said. “Most of the rig count increase has come from unconventional plays, led by the Permian, but also the Eagle Ford Shale has shown a pick-up in activity since the end of last year. We expect this momentum to continue into second half of the year.

“The number of DUCs has also increased by about 500 in recent months, which represents an economic opportunity for U.S. producers to maintain or grow production with better economics than with full-cycle costs,” he said. “The pace at which operators can exploit this resource will depend on how quickly the services sector can bring back completion capacity and crews.”

The output reduction by OPEC “is a big one because it shows a commitment to support oil prices into 2018 — and potentially for all of next year,” said Wood Mackenzie’s Ann-Louise Hittle, vice president of macro oils research. “The firmer oil price will, we expect, further support the U.S. tight oil industry into 2018,” while the decision also “sends a signal of continued support for oil prices from OPEC, which helps U.S. onshore drillers make plans.”

OPEC’s decision would have “little” impact on Wood Mackenzie’s crude oil price forecast, which is for an annual average of $55/bbl Brent. Into 2018, prices are expected to average “at least” $55/bbl on a monthly basis. “With oil prices at or above $55/bbl during 2018, rig additions in all tight oil plays would be higher than in our base case.”

The focus now turns to the United States for its response, said Wunderlich Securities Inc. analyst Jason Wangler. “The U.S. has continued to be problematic to OPEC and the overall balancing of the market in the short-term given its quick response and growth in production since the decision in November 2016.

“That said, the ramp in the U.S. seemingly has already occurred and many companies are happy with their current activity, and funding of that activity, at the current oil prices around $50/bbl, so we don’t expect an uptick in activity in the near-term, though production should keep moving higher and increased activity could occur in 4Q2017, according to current expectations.”

Wangler noted that U.S. crude inventories have begun to improve.

“While this has taken longer than most anyone, including OPEC, expected, there are signs of improvement for U.S. inventories as the declines have been piling up of late,” he said.

“While U.S. production is growing, there are still good indications of continued inventory declines in the U.S. as well as lower offshore inventories; meaning OPEC’s moves have been working, though they have taken more time than expected. Ironically the extended time period is very similar to OPEC’s initiative that started in November 2014 as well, but hopefully the current plans provide traction for the oil market.”

Higher Prices Unlikely

Coker Palmer Institutional said continued OPEC cuts “probably take ‘sub $45/bbl oil’ off the table. On the other hand, the specter of OPEC cuts eventually dumping up to 1.8 million b/d on the market, coupled with continued U.S. shale growth (600,000 b/d increase in 2017/2018) might cap crude prices at $55/bbl, as that level might accelerate U.S. shale growth.”

BTU Analytics senior energy analyst Erika Coombs said OPEC was put between a rock and a hard place. The first pullback in output, which started early this year, had begun to work down the global supply glut.

“That’s good news for prices,” she said. However, the supply shortage wasn’t expected to draw down inventories fast enough to bring it in line with normal historical levels before the temporary reduction ended this month. Saudi Arabia also has to consider the outlook for its planned initial public offering (IPO) of Saudi Aramco in early 2018, expected to be the biggest launch ever, and that has put the Kingdom in an awkward position, said Coombs.

The Saudis had to agree to extend the cuts in an effort to support higher prices that would make the IPO more attractive, but they risk “continued growth from the U.S.,” she said. Or the Saudis could have allowed production cuts to roll off in July, “and let prices collapse in the hopes that U.S. producers are hit hard and respond with declines in production…”

The International Energy Agency in its Oil Market Report for May said year-to-date through April, cuts by OPEC and NOPEC together had removed an average of 1.4 million b/d from global markets, noted ClearView Energy Partners LLC.

“We believe that actual production cuts could continue at similar levels for the remainder of 2017,” said the ClearView team. In conjunction with seasonal demand increases, Brent oil prices could rise to $55-60/bbl.

RBN Energy LLC in a note said OPEC and and its allies in general had kept their reduction commitments to date, “which has been extremely good news for U.S. producers; they are enjoying higher prices, steadily improving economics and above all, the opportunity to capture market share from OPEC/NOPEC.”

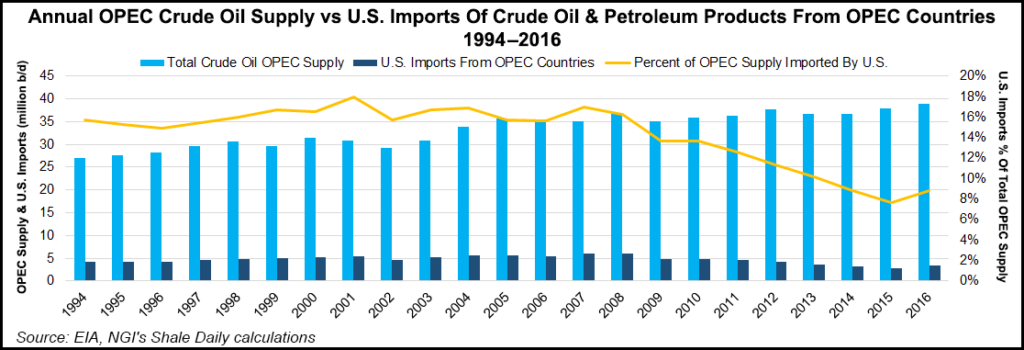

Since last November, U.S. production is up 600,000 b/d, about half of OPEC’s promised cut “and at this rate, U.S. producers will have grabbed all of OPEC’s forgone market share by the end of the year,” RBN said.

Will OPEC’s strategy work? It hasn’t yet, said Matt Smith of ClipperData, which tracks global cargoes of crude oil, refined products and petrochemicals.

“For all the talk of near-perfect compliance from OPEC, we have consistently highlighted how the cartel has kept global markets well-supplied, as apparent production cuts have not been reflected through to broad-based and consistently lower exports,” Smith wrote in a note.

OPEC deliveries to the United States “have now lifted above year-ago levels, meaning OPEC deliveries have been higher than year-ago levels for every month of this year, up 11% on aggregate,” he noted. “This theme of stronger imports into key demand regions is playing out across the board.”

OPEC flows into China “continue to outpace year-ago levels,” Smith said. “China is the leading destination of OPEC barrels, and imports into the largest emerging market are up over 13% compared to the first five months of last year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |