Markets | NGI All News Access | NGI Data

NatGas Cash, Futures Flip Flop; Cash Tumbles, But June Down Only A Penny

Natural gas cash and futures reversed roles from Tuesday’s trading on Wednesday, with the physical market for Thursday delivery plunging and spot June futures easing just a bit. In the physical market only one point followed by NGI made it to positive territory and the NGI National Spot Gas Average fell by 10 cents to $2.93.

Futures traders seem surprised that the market has held the way it has, but at the close June had slipped 1.0 cents to $3.209 and July was off 1.2 cents to $3.300. July crude oil eased 11 cents to $51.36/bbl.

Once again physical traders are having to put up with a weakening supply demand balance. “Another slightly looser market balance today,” said industry consultant Genscape. “As with yesterday, sharp drops in gas burns are larger than supply-side declines.”

Production is down, but demand is down further. “Today’s declines are led by Gulf Coast followed by Rockies and Northeast. Gulf region drops are dispersed across onshore and offshore points. Rockies declines are in the Denver-Julesburg due to a 50% drop in CIG receipts from Lancaster. Northeast drops are concentrated in Southwest PA. Imports from Canada and exports to Mexico are flat to yesterday at 5.5 Bcf/d and 4.1 Bcf/d, respectively.

Demand wise “there is about 0.4 Bcf/d less [residential/commercial] demand. But the major swing is on the power side, where burns are down again at 23 Bcf/d, a 0.6 Bcf/d reduction from yesterday. In addition to the mild temperatures we noted yesterday, restoration of nuclear capacity and increased renewables generation are grabbing a share of generation stacks.”

Major trading points were all lower. Gas at the Algonquin Citygate shed 7 cents to $2.95 and deliveries on Dominion South were quoted 11 cents lower at $2.66. Gas bound for New York City on Transco Zone 6 eased 3 cents to $2.90, and packages at the Chicago Citygate fell 10 cents to $3.03.

Gas at the Henry Hub skidded 9 cents to $3.11 and gas on El Paso Permian changed hands 9 cents lower at $2.80. Kern River came in at $2.81, down 8 cents and deliveries priced at the PG&E Citygate shed a dime to $3.38.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

Traders see a resilient futures market. “It’s showing me a little bravado. It’s holding up pretty well and has stayed the course,” a New York floor trader told NGI.

“I am really shocked that it held $3.20, and I wouldn’t go short. The crude numbers show that the bulls are still out there. I think there is room to the upside, maybe $3.30.”

June futures opened about 3 cents lower Wednesday morning as traders factored in almost non-existent weather conditions along with a deteriorating technical environment.

Overnight weather models offered little in the way of anything traders could sink their teeth into. “The only part of the country seeing more stable and sometimes stronger heat over the next two weeks is the Pacific Northwest,” said Matt Rogers, president of Commodity Weather Group, in a morning note to clients.

“Other areas experience some warmer to hotter volatility at times, but nothing durable, with closer to normal or cooler outcomes being more common. We continue to track a fairly notable split between the European and American ensemble guidance for the six-10 day with the European running much cooler from the Midwest to the South, while the American aims hotter for the Pacific Northwest in contrast.”

In more quantitative terms, data from the National Weather Service (NWS) confirms the diminishing weather component, at least temporarily, on heating and cooling demand for major East and Midwest energy markets. For the week ending May 27, New England is expected to see a combined 41 degree days (DD), or seven fewer than normal. New York, New Jersey and Pennsylvania are expected to deal with all of 22 DDs, or 21 fewer than normal, and the greater Midwest from Ohio to Wisconsin is predicted to experience 35 DDs, or 20 fewer than its normal seasonal tally.

Given Tuesday’s 11-cent plunge in the June contract, market technicians are wondering if bigger changes might be afoot. “Are we witnessing the onset of a summer-to-fall seasonal decline?” queried Brian LaRose, a market technician at United ICAP. LaRose points out if that is the case, prices could drop into the low $2 area.

In the meantime, the bears have a lot of work to do. According to LaRose’s figures, the market needs to trade decisively lower by another 6 cents and ultimately fall another 10 cents beyond that. “Have no case for the start of a seasonal slide otherwise,” he said in closing comments Tuesday.

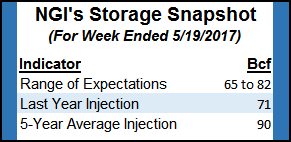

The consensus on Thursday’s storage report has loosened since the beginning of the week. An earlier survey by The Desk revealed an average 69 Bcf, but currently estimates have eased a couple Bcf.

Last year 71 Bcf was injected, and the five-year pace stands at 90 Bcf. ICAP Energy calculates a build of 74 Bcf and IAF Advisors see an injection of 69 Bcf. A Reuters survey of 22 traders and analysts showed an average 71 Bcf with a range of +65 Bcf to +82 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |