E&P | Haynesville Shale | NGI All News Access

North Louisiana-Focused PennTex Midstream Mulling $20/Unit Energy Transfer Offer

PennTex Midstream Partners LP, which has assets in North Louisiana, is reviewing an unsolicited cash offer from Energy Transfer Partners LP (ETP) that would give the latter all of the outstanding PennTex common units it doesn’t already own.

PennTex units jumped about 20% on Friday following the $20/unit offer. Houston-based PennTex said it would advise unitholders of its position in the coming days. Dallas-based ETP currently owns 32.4% of the outstanding PennTex common units.

ETP and affiliates would have more than 80% of outstanding PennTex common units if a deal is consummated. ETP said it would then exercise a limited call right that would give the remainder of the outstanding units.

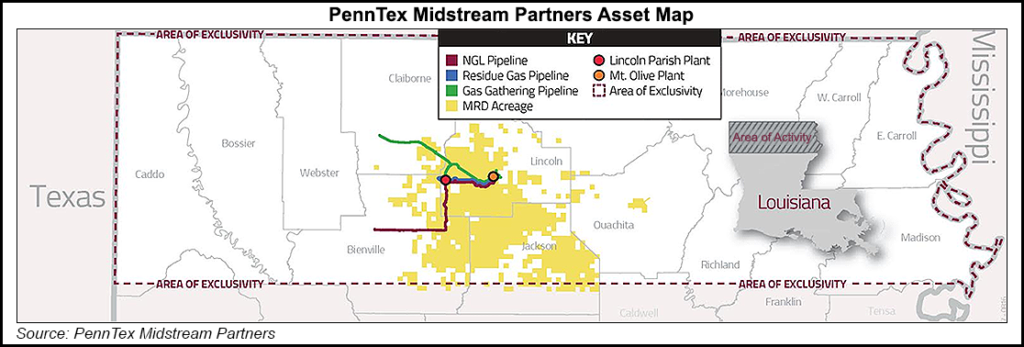

PennTex assets include a cryogenic gas processing plant in Lincoln Parish, LA; a 35-mile rich gas gathering system accessing the Lincoln Parish plant as well as a plant in Minden, LA, owned by DCP Midstream Partners LP; a residue gas pipeline from the Lincoln Parish plant; another processing plant near Ruston, LA, with an associated residue gas pipeline; and a natural gas liquids pipeline connecting PennTex processing plants to third-party pipelines.

Last fall, ETP announced a $640 million deal to acquire an interest in the assets, which serve Range Resources Corp., among other producers. The Haynesville Shale in North Louisiana has seen its rig count climb as producers return to the natural gas-rich play armed with new technology. The play’s location near petrochemical industry demand and liquefied natural gas export terminals is helping to make it attractive. NGI recently published a special report on the re-emergence of the Haynesville.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |