Markets | NGI All News Access | NGI Data

Weekly NatGas Cash Inches Its Way To $3, Yet Futures Post Ominous Decline

It was a struggle, but for the week ended May 19, weekly natural gas finally huffed and puffed its way to $3 with individual market points generally trading within a nickel of unchanged. A spring heat wave in New England provided much of the impetus for prices to clear the $3 barrier, and the NGI Weekly Spot Gas Average rose 3 cents to $3.00.

The individual market point showing the greatest gain was Algonquin Citygate with a rise of 36 cents to $3.54, and the location with the greatest setback was Northern Natural in West Texas with a decline of 13 cents to $2.72.

Regionally, Appalachia was down the most falling 6 cents to $2.80 and the Southeast posted the greatest gains advancing 9 cents to $3.20. Quotes in the Midcontinent averaged 2 cents lower at $2.85, California was a penny lower at $3.03, and the Rocky Mountains gained a penny to $2.73.

South Texas and the Midwest rose 3 cents to $3.09 and $3.05, respectively, and East Texas and South Louisiana added 5 cents to $3.11 and $3.12, respectively.

The Northeast stood atop the leader board with a rise of 8 cents to $3.21.

June futures, however, fell 16.8 cents on the week to $3.256.

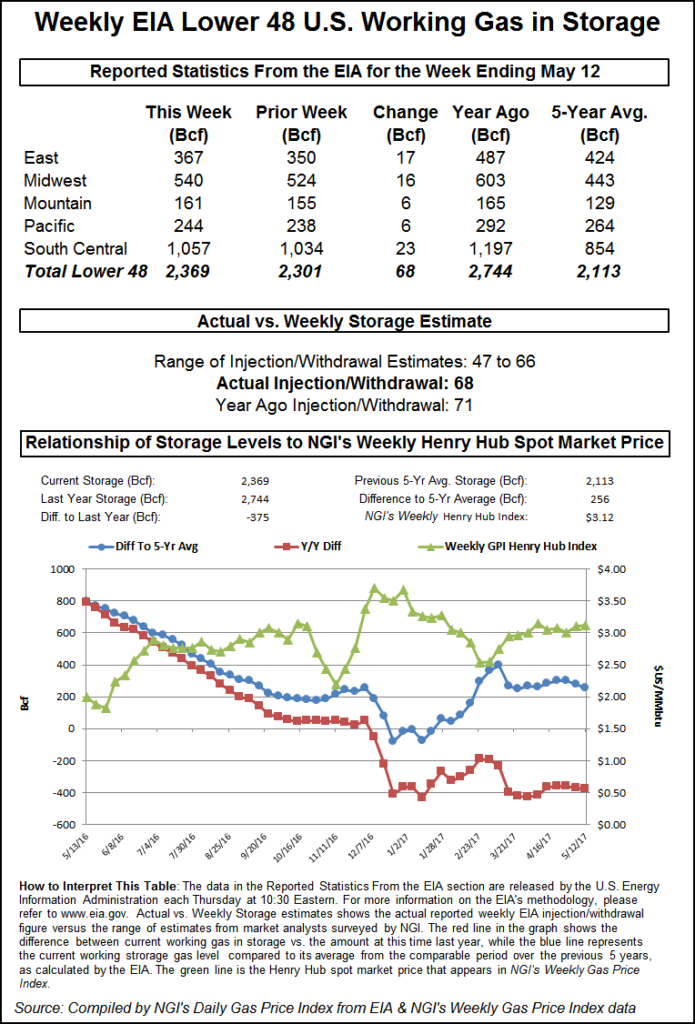

Thursday saw the Energy Information Administration (EIA) report a larger-than-expected 68 Bcf storage injection for the week ending May 12, but prices drifted higher after the number was reported. At the close, June was down a penny to $3.182 and July was lower by three-tenths of a cent to $3.283.

The 68 Bcf was about 7 Bcf greater than consensus estimates, perhaps indicating less of a changed supply dynamic than a statistical correction to last week’s bullish 45 Bcf (8 Bcf less than expectations). Once the number had been digested by traders, June futures dropped to the morning’s low at $3.161, and at 10:45 a.m. EDT June was trading at $3.210, up 1.8 cents from Wednesday’s settlement.

Prior to the report, traders were looking for a storage build well below historical norms. During the same week last year 71 Bcf was injected, and the five-year average stands at a hefty 87 Bcf. Citi Futures Perspective calculated a 59 Bcf injection, and IAF Advisors was looking for a 64 Bcf increase. A Reuters survey of 22 traders and analysts showed a sample mean of 61 Bcf with a range of +47 Bcf to +66 Bcf.

Traders were not impressed by the market’s response. “It’s kind of sitting in this weird little range,” said a New York floor trader. “People are protecting the $3.15 area and the $3.25 to $3.26 area, but the market doesn’t feel like anything.

“It looks to me that some traders saw the large number and sold, but when it failed to move lower they had to cover. They got burned,” said a trader with FCStone Latin America LLC in Miami.

Others saw the report as neutral. “The reported figure was 6 Bcf above consensus but 5 Bcf below last year and 18 Bcf below the five-year average of 86 Bcf,” said Wells Fargo analysts in Denver. “Based on our storage model, this data point indicates that the natural gas markets are still running about 2.5 Bcf/d undersupplied, and our analysis shows that this state of undersupply will persist throughout the summer. Based on the current weather outlook, we forecast a cumulative build of 142 Bcf over the next two weeks, 47 Bcf below the five-year average and 11 Bcf below last year.”

Inventories now stand at 2,369 Bcf and are 375 Bcf less than last year and 256 Bcf greater than the five-year average. In the East Region 17 Bcf was injected, and the Midwest Region saw inventories rise by 16 Bcf. Stocks in the Mountain Region were greater by 6 Bcf and the Pacific Region was up 6 Bcf. The South Central Region increased 23 Bcf.

Despite Thursday’s near-normal storage build, analysts estimate the market is about 2 Bcf/d undersupplied in spite of large gains in the rig count.

“While the Northeast has been the clear production growth engine for the U.S. gas market over the last few years, as we look at recent activity, we see gas growth out of the Permian, and a revitalization of drilling in the Haynesville, as being critical contributors to our near-term growth outlook,” said Breanne Dougherty of Societe Generale in New York in a recent client note.

The rig count continues to increase. During the week ending Friday, the Baker Hughes Inc. U.S. land-based rig count climbed by 14 units to 874. The Marcellus added two rigs and the Utica added one. The Permian Basin rig count grew by four, and the Haynesville added one unit, reaching the milestone of 40 rigs running, which is way more than the 14 it had one year ago.

In Friday’s exchanges prices eased for weekend and Monday physical natural gas deliveries, with weather-driven moderation at Northeast, Southeast, and Appalachia points staving off strong pricing in Texas, the Midwest, and Louisiana. The NGI National Spot Gas Average lost two cents to $2.94.

Although Midwest temperatures over the weekend and into Monday were expected to just make it to seasonal norms, New England temperatures were forecast to plunge as much as 25 degrees Saturday. Futures traders would have none of the sluggish cash market and sent quotes marching higher. At the close June had risen 7.4 cents to $3.256 and July had gained 7.3 cents to $3.353. The about-to-expire June crude oil rose 98 cents to $50.33/bbl, the first settlement of spot crude oil over $50 in a month.

Tumbling temperatures pulled the plug on eastern next-day quotes and sent the overall average into negative territory. AccuWeather.com forecast that Friday’s high in Boston of 89 degrees would plunge to 64 by Saturday and fall further to 58 by Monday, 9 degrees below normal. New York City’s 91 high Friday is expected to drop to 69 Saturday and ease to 68 by Monday, 4 degrees below normal. In the Midwest temperatures were forecast to trend higher. Chicago’s high Friday of 53 was seen advancing to 69 by Saturday and 71 by Monday, the seasonal average.

Gas at the Algonquin Citygate skidded 31 cents to $2.99 and deliveries to Iroquois Waddington shed 4 cents to $3.16. Gas on Tennessee Zone 6 200 L fell 23 cents $2.96.

Gas at Marcellus points weakened as well. Dominion South was quoted at $2.71, down 3 cents and gas on Tennessee Zone 4 Marcellus changed hands 14 cents lower at $2.54. Gas on Transco Leidycame in 8 cents lower at $2.64.

Other market points firmed. Gas at the Chicago Citygate rose 4 cents to $3.04 but gas at the Henry Hub dropped 4 cents to $3.09. Parcels on Northern Natural Demarcation added 2 cents to $2.88 and gas on El Paso Permian tacked on 2 cents to $2.69. Deliveries to Opal were quoted 3 cents higher at $2.77.

Quotes in California rose as CAISO gas-fired generation is showing one of its first month-over-month increases in a while due to warm weather lifting loads and lack of nuclear generation.

Gas priced at the PG&E Citygate rose two cents to $3.35 and gas at the SoCal Citygate added 8 cents to $3.21. Packages priced at the SoCal Border Average were quoted 2 cents higher at $2.82.

[Subscriber Notice Regarding NGI‘s Market-Leading Natural Gas Price Indexes]

“During the past five-years, May gas burns typically increase just 1% from April, but presently are running 16% above last month, with CAISO-reported daily average hourly generation from gas up 651 MWh/d,” wrote industry consultant Genscape in a report. “The gains are a product of an early heat wave lifting loads combined with Diablo Canyon nuclear going offline towards the end of April for refueling and maintenance. “

Futures opened 3 cents higher Friday morning at $3.21 as traders sensed a buying opportunity following Thursday’s bearish storage report. Following the less than expected decline Thursday after the release of a bearish inventory build, traders are thinking bulls were waiting in the wings ready to initiate buying. “Otherwise, we saw no significant change today in weather forecasts or other fundamental inputs to drive buying,” Jim Ritterbusch of Ritterbusch and Associates said in closing comments Thursday.

“This looks like a wide-swinging trade capable of frustrating both the bulls and the bears. Although the supply surplus fell less than expected by only around 18 Bcf per today’s data, the market is likely pricing in a larger contraction in the surplus against averages within next week’s EIA data. We are still sidelined from a trading perspective, but we also feel that the 25-cent price plunge seen this week is underscoring an amply supplied market with which to begin the CDD [cooling degree day] cycle. We are leaving a downside target of $3.05 on the table for now while we are also allowing for a price recovery back to around the 3.30 area.”

During the weekend, gas buyers over the ERCOT power pool will have plenty of challenges with regard to renewable offsets. “A wet and stormy pattern will support a cooling trend, and warm and humid conditions in combination with a slow-moving storm system anticipated to traverse the central U.S. will lead to rounds of locally heavy showers and strong thunderstorms during the next two days,” said WSI Corp. in its Friday morning report to clients. “Large hail, damaging winds and tornadoes are risks. Max temps will range in the upper 70s, 80s to near 90. Two additional disturbances will keep the chance of rain and storms in the forecast during Sunday into early Tuesday morning.

“The first storm system will support elevated wind gen [Friday] into early Saturday morning. Output is forecast to peak upward of 8-11 GW. Variable wind gen is expected during Sunday-Monday. A northwest wind should provide a spike of output during Tuesday. Variable cloud cover will impede total solar gen on a daily basis.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |