Markets | Infrastructure | Mexico | NGI All News Access | NGI Mexico GPI | NGI The Weekly Gas Market Report

Mexico, United States Increasingly Linked by Natural Gas Trade

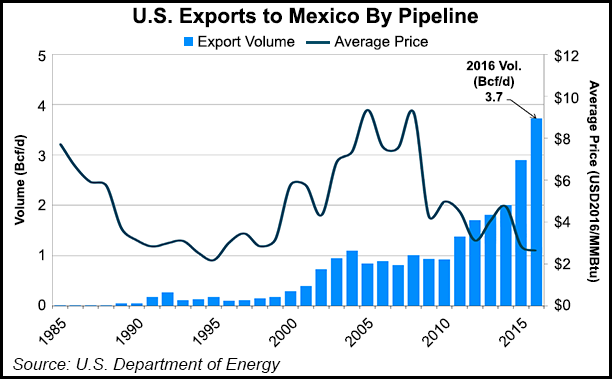

During the fourth quarter, pipeline exports to Mexico and Canada were up about 22% each from the year-ago quarter, according to the U.S. Department of Energy (DOE). Mexico, in particular, is increasingly a destination for U.S. gas as shale supplies grow and pipeline capacity increases.

“U.S. exports to Mexico have grown substantially in the past 20 years, especially in the past year,” DOE said. “Growing demand for power generation and industrial uses in Mexico and an increase in pipeline capacity have been widely cited as the main drivers for this trend.”

The outlook for continued growth in gas exports to Mexico from the United States is good if economic data from Mexico is a reliable indicator. “Mexico’s economy grew solidly in the first quarter despite higher inflation, interest rates and uncertainty over trade relations with the U.S.,” the Federal Reserve Bank of Dallas said in a recent note.

Mexico’s economy expanded during the first quarter, the Fed said. Gross domestic product (GDP) expanded at a 2.4% annualized rate, and data on fourth quarter output was revised higher to 2.9%.

“The consensus 2017 GDP growth forecast was revised up from 1.5% to 1.7%,” the Fed said. “Recent data on exports, industrial production, retail sales and employment showed continued expansion but at a slower pace.” While inflation was up, the peso recovered some strength against the dollar in April for the third consecutive month, the Fed said.

“Exports of natural gas to Mexico under long-term contracts were negligible until 2003. Since then, long-term contract exports have plateaued with the recent increase in exports to Mexico occurring almost entirely under short-term authorizations,” DOE said.

In the fourth quarter Mexico eclipsed Canada as a destination for total natural gas exports by pipeline from the United States, with 54.8% going to Mexico and 33.2% to Canada,” DOE said in a report released Tuesday. The remaining 12% was LNG trucked to Canada or Mexico as well as LNG exported by vessel to Chile, China, Egypt, India, Italy, Japan, Jordan, Mexico, South Korea and Turkey.

Compared to the third quarter of 2016, pipeline imports to the United States from Canada decreased by 3.4%, while pipeline imports from Mexico also decreased by 12.9% from a small base, DOE said.

Total U.S. exports during the fourth quarter were 648.9 Bcf, 8.5% higher than the third quarter. A 4.5% decrease in U.S. exports by pipeline to Mexico was offset by a 29.4% increase in U.S. exports by pipeline to Canada. Prices of U.S. pipeline exports to Mexico increased by 7.1% and prices of U.S. pipeline exports to Canada increased by 17.2%.

Comparing the fourth quarter with the year-ago quarter, U.S. exports increased 36.3%. U.S. pipeline exports to Canada increased by 21.4%, and U.S. pipeline exports to Mexico increased by 22.8%. Total trucked exports increased by 61.9%.

“Overall, U.S. exports by pipeline increased by 22.3% while prices also increased by 29.8%, compared to the fourth quarter of 2015,” DOE said. Average prices for exports to Canada by pipeline were “slightly higher” than for Mexico.

Exports to Mexico rose in every month last year compared with 2015, DOE said. The increase steadily grew during the beginning of the year and continued through the end of the year.

Prices of pipeline exports to Mexico were lower in 2016 than the year before until September. The difference in prices was the widest during the beginning of the year, it but narrowed toward the middle of the year and summer months, DOE said.

In the fourth quarter of last year the majority of LNG exports by vessel went to Mexico (20.5 Bcf) and China (14.1 Bcf).

During the fourth quarter the United States also imported more gas from Mexico and Canada than during the year-ago quarter.

Total U.S. imports were up 10.0% from the fourth quarter of 2015. Pipeline imports from Canada increased 10.1% while pipeline imports from Mexico increased 5.0% from a small base, DOE said. LNG imports to the United States by vessel increased 8.7% from the year-ago quarter. Trucked imports decreased 13.7%.

“U.S. net imports have steadily declined since 2008 until a slight uptick in 2016,” DOE said. “In 2008, the U.S. saw the reversal of increasing net imports. This is partly due to the increase in exports to Mexico as imports from Canada continue generally to trend downward.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |