Markets | NGI All News Access | NGI Data

Plump NatGas Storage Report Elicits Ho-Hum Market Response; June Adds 2 Cents

June futures slumped Thursday morning when the Energy Information Administration (EIA) reported a storage injection that was greater than what traders were expecting.

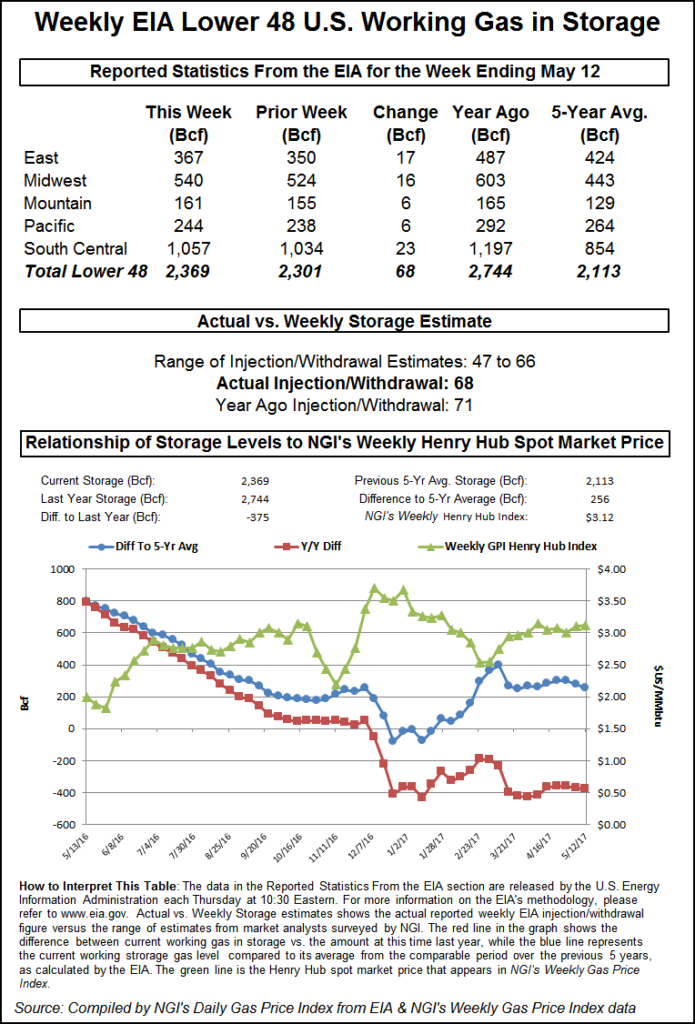

EIA reported a storage injection of 68 Bcf, about 7 Bcf greater than consensus estimates and perhaps indicating less of a changed supply dynamic than a statistical correction to last week’s bullish 45 Bcf (8 Bcf less than expectations).

Prices fell after the number was released. Once the number had been digested by traders, June futures dropped to the morning’s low at $3.161, and at 10:45 a.m. EDT June was trading at $3.210, up 1.8 cents from Wednesday’s settlement.

Prior to the report, traders were looking for a storage build well below historical norms. During the same week last year 71 Bcf was injected, and the five-year average stands at a hefty 87 Bcf. Citi Futures Perspective calculated a 59 Bcf injection, and IAF Advisors was looking for a 64 Bcf increase. A Reuters survey of 22 traders and analysts showed a sample mean of 61 Bcf with a range of +47 Bcf to +66 Bcf.

Traders were not impressed by the market’s response. “It’s kind of sitting in this weird little range,” said a New York floor trader. “People are protecting the $3.15 area and the $3.25 to $3.26 area, but the market doesn’t feel like anything.

“It looks to me that some traders saw the large number and sold, but when it failed to move lower they had to cover. They got burned,” said a trader with FCStone Latin America LLC in Miami.

Others saw the report as neutral. “The reported figure was 6 Bcf above consensus but 5 Bcf below last year and 18 Bcf below the five-year average of 86 Bcf,” said Wells Fargo analysts in Denver. “Based on our storage model, this data point indicates that the natural gas markets are still running about 2.5 Bcf/d undersupplied, and our analysis shows that this state of undersupply will persist throughout the summer. Based on the current weather outlook, we forecast a cumulative build of 142 Bcf over the next two weeks, 47 Bcf below the five-year average and 11 Bcf below last year.”

Inventories now stand at 2,369 Bcf and are 375 Bcf less than last year and 256 Bcf greater than the five-year average. In the East Region 17 Bcf was injected, and the Midwest Region saw inventories rise by 16 Bcf. Stocks in the Mountain Region were greater by 6 Bcf and the Pacific Region was up 6 Bcf. The South Central Region increased 23 Bcf.

Salt storage rose by 6 Bcf to 337 and non-salt increased 18 Bcf to 720 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |