E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

BHP’s U.S. Petroleum Business Should Still Go, Activist Says

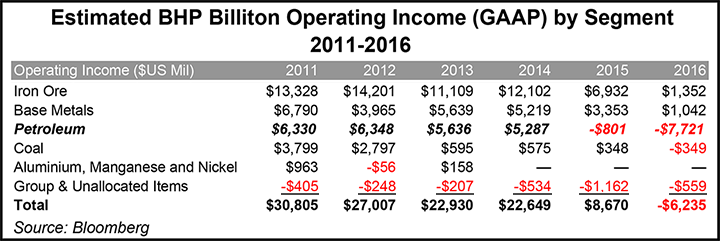

BHP Billiton Ltd. concedes that its investment in U.S. shale plays was poorly timed but wants to make a go of it with cost-cutting and increased efficiencies. Meanwhile, an activist investor targeting the Australian mining conglomerate for reform would still like to see the U.S. petroleum business jettisoned.

The Elliott Funds calledlast month for the sale or demerger of BHP’s U.S. petroleum business, both onshore and offshore. On Tuesday Elliott responded to BHP’s “do nothing” approach since its April appeal to management and directors.

“We recognize that there are a number of obvious possible solutions to unlock the latent value of BHP’s petroleum business, including a sale or demerger of the U.S. petroleum business and a sale or ASX listing for the Australian and other remaining petroleum assets,” Elliott said Tuesday.

Demerger of petroleum is preferred, but at the least a strategic review of the business by an independent committee should be launched, the hedge fund said.

In early 2011 BHP acquired the Fayetteville Shale assets of Chesapeake Energy Corp. for $4.75 billion in cash. Later that year it acquired Petrohawk Energy Corp. for $12.1 billion. Asset writedowns followed a few years later. BHP, according to its website, currently holds more than 838,000 net acres in the Eagle Ford Shale, Permian Basin, and Haynesville Shale, as well as the Fayetteville.

The company was already active in the U.S. Gulf of Mexico where it operates two fields: Shenzi (44% interest) and Neptune (35%). It holds nonoperating interests in three other fields: Atlantis (44%), Mad Dog (23.9%) and Genesis (4.95%).

Speaking Tuesday at the Bank of America Merrill Lynch Global Metals, Mining & Steel Conference in Barcelona, BHP CEO Andrew Mackenzie defended the viability of the company’s shale operations.

“Substantial advances in the operating capability and capital productivity of our shale assets continue to lower drilling and completion costs, supporting returns on invested capital in excess of 30% on incremental investments,” Mackenzie said.

“All options to fully realize the value of our shale acreage will be pursued, including further appraisal, new technology and additional asset sales and swaps. We will be flexible with our plans and commercial in our approach.”

In a conference presentation slide, the company said, “price and timing of entry [into U.S. onshore] were not optimal and initial pace of investment was too rapid.”

However, BHP has learned and enjoyed “substantial advances in operating capability and capital productivity,” it said. The U.S. onshore business is “well placed” to compete for capital within the company. Rig activity is expected to increase from four units to 10 in fiscal 2018, and new wells are expected to add incremental volumes of up to 120 million boe.

Late last month, in conjunction with the release of first quarter earnings, the company detailed BHP plans for the U.S. petroleum business, including the possible sale of Fayetteville Shale assets.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |