Infrastructure | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Cameron LNG Project on Track, Sempra Execs Say

Weather-related construction delays and recent global market developments are not curbing the bullishness of Sempra Energy executives toward the company’s plans for exporting liquefied natural gas (LNG) from the Gulf Coast, they said Tuesday.

At stake for Sempra are plans to launch the export terminal at its Cameron LNG site in Louisiana next year, and pursue permitting of a second facility at Port Arthur, TX, with its Australian joint venture partner Woodside Petroleum Ltd. CEO Debra Reed and President Joe Householder told analysts on an earnings call that both projects are on track and longer-term global markets favor both U.S. export projects.

The Sempra senior officials were asked by analysts to comment on news reports from late last month that Australia, one of the world’s biggest LNG exporters, plans to introduce export control restrictions to tackle an acute domestic gas shortage that has pushed up prices and threatened local industry. They said they see this as a positive for LNG from the United States.

Similarly, they responded positively to questions about whether the construction delays at the Cameron project are under control.

Reed assured that Sempra and its partners are committed to the current Cameron timeline calling for the first of three LNG production trains to be online early next year and a second one by the end of the year.

“The commitment of each of our partners and customers to get the project finished and into operation is completely there,” Householder said. “We’re all going to the site to view the progress next month, and we’re all engaged in getting this important project done.”

In response to the Australian move, Reed said it further supports Sempra’s analysis that calls for the global market for LNG ramping up in the 2021-23 period. “We have been saying all along that we see a marketing opportunity in that period.

“I think the ‘herd mentality’ is where we have been all along, and that’s why we have moved forward trying to get Port Arthur into the marketing stage, and to get the issues of a fourth production train at Cameron resolved. So what you are seeing is what we have been predicting all along that there is going to be a demand need in the market for that type of time frame.”

Householder added that long-term buyers of LNG are looking for long-term solutions, so they want to make sure they are going to a source they can count on long term. “The meetings we had together with Woodside jointly marketing the Port Arthur facility went very well, and there is quite a lot of interest in that facility,” he said, adding that he doesn’t know if the Australia move will have much of an immediate impact.

Reed said the recent developments point up the advantage of U.S. LNG projects because they are not tied to single supply sources. “In the U.S. market you don’t have one dedicated supply source for the gas and you also have the ability to sell off the gas at liquid points if you don’t want to take the gas,” she said.

“I actually think what is taking place in Australia and in some of these other locations where the supply source is getting more constrained makes it way better for the United States in marketing our projects. That’s the opportunity we see right now, and I think Woodside has the same view and is very excited about our Port Arthur project.”

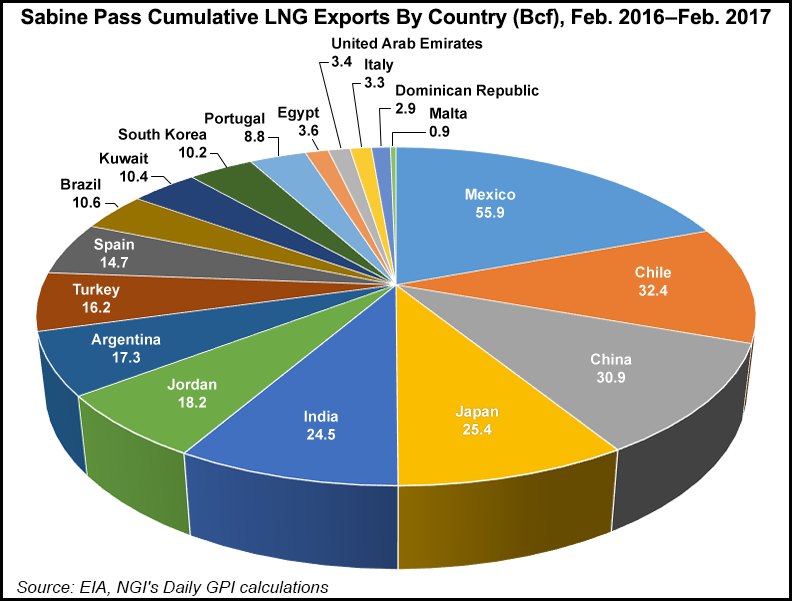

Given that Cameron LNG’s neighbor, Sabine Pass, has already been finding it economical to ship LNG to countries also served by Australia (Japan, India and China), it is likely that Cameron will target those countries as well. Together, China, Japan and India account for 28% of the gas that Sabine Pass has exported during its first year of operation.

Global LNG trade last year reached a record 258 million tonnes — up 5% from 2015, according to the International Gas Union (IGU).

IGU’s 2017 World LNG Report was released at this year’s Gastech conference in Tokyo, where the organization noted that the latest increase in LNG trade stands out, in particular, compared with the average growth rate of 0.5% that was seen over the previous four years.

For 1Q2017 Sempra reported adjusted net income of $438 million ($1.74/share), compared to $404 million ($1.60) for the year-earlier quarter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |