E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Goodrich Says Haynesville NatGas Output to Grow After Two Long-Lateral Wells Online

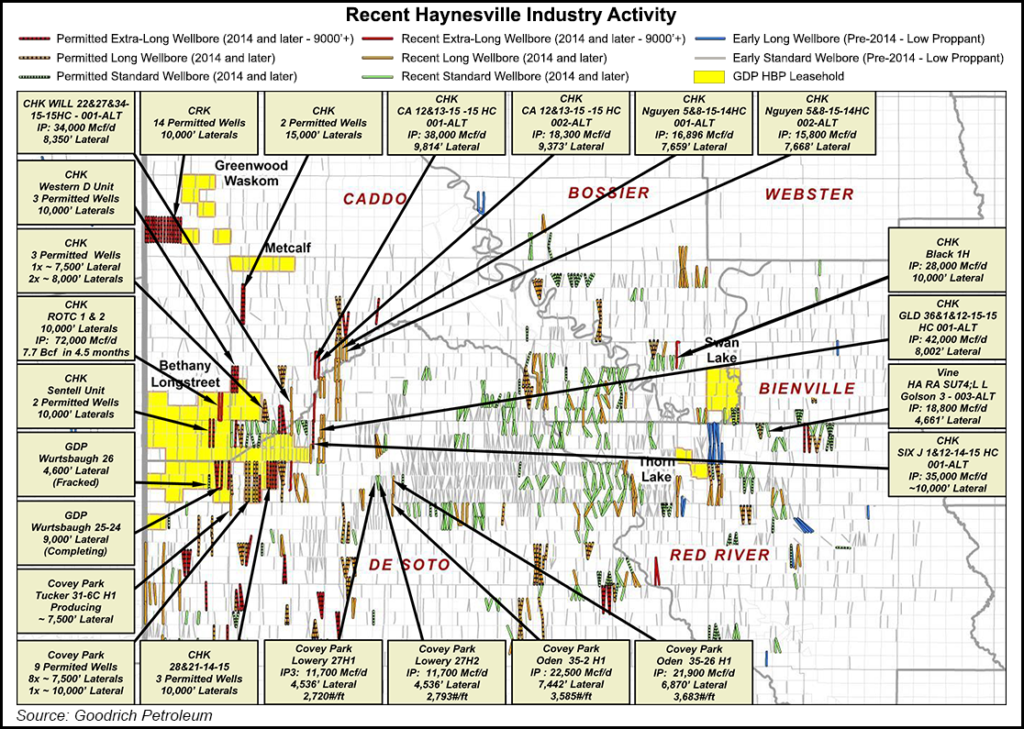

Goodrich Petroleum Corp. said it expects its natural gas production volumes will “grow significantly” once it brings a pair of operated, long-lateral wells targeting the Haynesville Shale in North Louisiana online by the end of next month.

The Houston-based company said it drilled the Wurtsbaugh 26H-1 Alt in DeSoto Parish, LA, with a 4,600-foot lateral, and completed it with 5,000 pounds of proppant/foot. Initial production is expected by mid-May. Meanwhile, a second well, Wurtsbaugh 25&24H-1 Alt, was drilled with a 9,000-foot lateral and is currently being completed. The company holds a 74% working interest (WI) in the former well and a 69% WI in the latter.

Goodrich said it plans to add three additional long-lateral wells in the Haynesville during the second half of 2017. During an earnings call Tuesday to discuss 1Q2017, executives said the three future wells will all have 10,000-foot laterals.

“We’ve not seen any diminishing returns [by using] up to 5,000 pounds per foot,” CEO Gil Goodrich said about proppant during the question-and-answer session. “In fact, the industry-leading wells have been up around 5,000 pounds, and obviously they are longer laterals.

“Where we go from here I think will be interesting to see. Could we go to 6,000 or 7,000 pounds? Perhaps, but we start running across some cost and design issues in terms of how much profit we can pump over a given interval stage length. I think what you’re going to see from us is 4,000-5,000. That range probably makes the most sense. It seems like that’s a sweet spot right now.”

The company indicated it has 235 gross (96 net) potential drilling locations in North Louisiana on 880-foot spacing. Capital expenditures are estimated at $40-50 million for a drilling program focused on the Haynesville, with plans to drill nine to 12 gross (four to five net) wells targeting the play in 2017.

The company is focused primarily on oil and natural gas targets in the Haynesville in North Louisiana and East Texas, the oil window in the Eagle Ford Shale in South Texas, and the Tuscaloosa Marine Shale (TMS) in eastern Louisiana and southwestern Mississippi. Specifically, it holds 35,000 gross (16,000 net) acres in the core of the Haynesville; 13,000 gross (7,000 net) acres in the Angelina River Trend area of the Haynesville; 176,000 gross (128,000 net) acres in the TMS; and 32,000 gross (14,000 net) acres in the Eagle Ford.

Goodrich reported production of 2.3 Bcfe during 1Q2017, with average production of about 26 MMcfe/d, 79% of which was natural gas. Current production is averaging around 29 MMcfe/d, with 80% gas. Goodrich said it expects natural gas production volumes “to grow significantly by the end of June” when the two aforementioned wells reach their peak rate.

The company reported a net loss of about $5.73 million (63 cents/share) in 1Q2017, which included an operating loss of $3.49 million.

Goodrich voluntarily filed for Chapter 11 in U.S. Bankruptcy Court for the Southern District of Texas in April 2016. It had the same assets when it emerged last October but with reduced debt, a new board of directors, $40 million in new capital and new common stock. The company reported a cash balance of $38 million at the end of the first quarter, with total debt of $59 million and net debt of $21 million.

Industry interest in the Haynesville Shale has been rising, with the rig count, over the last few months. For more on its re-emergence, check out the NGI special report “Haynesville 2.0,” which was released last week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |