Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Antero Posts Record Production, Sees Benefits From Activity During Downturn

Antero Resources Corp. posted record production, mostly from Appalachia, in the first quarter, with management crediting a strategy of hedging and firm transportation commitments for helping maintain momentum through the recent downturn, avoiding some of the problems peers face as it looks to ramp up in 2017.

The Denver-based, Appalachian-focused exploration and production company’s aggressive approach to managing its hedgebook and transportation portfolio helped it access more favorable commodity prices during a downturn that hit constrained Marcellus and Utica shale price points especially hard.

Even as Appalachian pricing has strengthened in 2017, Antero’s strategy continues to provide an advantage, management said during a conference call Tuesday to discuss 1Q2017 results.

Antero grew production 22% year/year in the first quarter, CFO Glen Warren said. “As we said at the time, by maintaining a considerable level of activity through the downturn, we were able to lock in more favorable terms on service contracts and keep the very best crews in place.”

Service providers “place a lot of value in operators like Antero, as we fit nicely into their portfolio of clients that can continue development activity through the market ups and downs,” he said. “This has, of course, proven to be very meaningful, as we see a number of peers that are finding it difficult to line up necessary crews to meet their ramp in development activity.”

Production for the quarter averaged 2.144 Bcfe, including 99,199 b/d of liquids, a 45% year/year increase. Management said this made Antero the largest producer in Appalachia during the quarter on a gas-equivalent basis.

For the quarter Antero realized prices averaging $3.80/Mcfe, including natural gas liquids (NGL), oil and hedges.

Warren said 100% of the company’s 2017 targeted gas production is hedged at $3.47/MMBtu, with 96% hedged in 2018 at $3.91/MMBtu and 84% hedged at $3.72/MMBtu through the end of the decade.

On the transportation side, Antero is looking ahead to a number of projects both for its gas output and its strong liquids production growth. The company holds 800,000 MMBtu/d on the Rover Pipeline project, which is slated to come online in two phases this year in July and November. Phase 1 would connect Antero’s Seneca processing facility in Ohio to Midwest and Gulf Coast markets, while Phase 2 will connect to the company’s Sherwood facility in West Virginia, CEO Paul Rady said.

“A number of Utica locations are currently in the process of being completed in anticipation of the Rover Phase 1 start-up,” Rady said. “Once Phase 2 is placed in service connecting the Sherwood facility with Rover, we will likely fill Rover with Marcellus gas while our Utica production continues to grow into the capacity.”

As for liquids, Antero is an anchor shipper on the Mariner East 2 pipeline, which was cleared to begin construction in February. Combined with commitments to Royal Dutch Shell plc’s planned ethane cracker in Pennsylvania and to the Atex Pipeline, Antero has firm NGL takeaway capacity for 111,500 b/d, Rady said.

Also during the quarter, Antero committed to two more plants — the 10th and 11th — at the Sherwood facility as part of a 50/50 joint venture with MPLX LP subsidiary MarkWest Energy Partners LP. “This secures an additional 400 MMcf/d of processing capacity to support our liquids-rich production,” Rady said.

The two Sherwood plants are scheduled to come online in the second half of 2018, with the eighth and ninth plants scheduled for service in the third quarter.

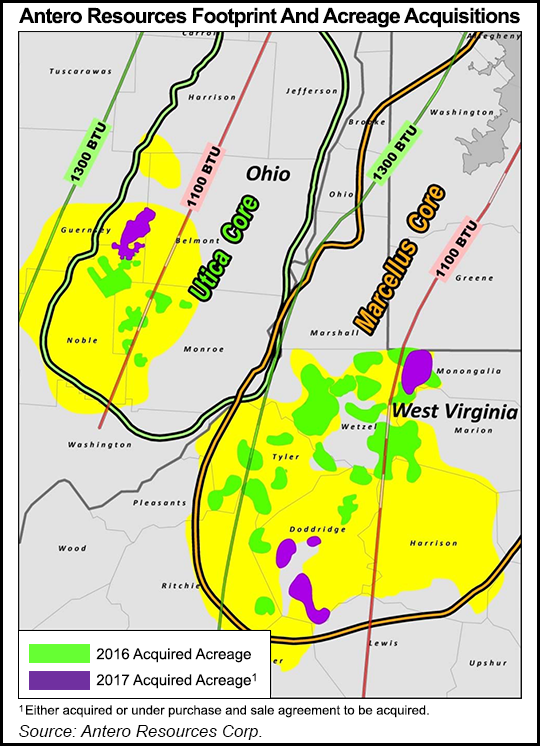

As it continues to consolidate its acreage positions in the Marcellus and Utica, Antero expects to grow production by 20-25% to reach 2.2 Bcfe/d in 2017, with targets of 20-22% annual growth through 2020, Warren said.

“The ability to maintain these production growth levels while also deleveraging speaks to our integrated business strategy that includes the best quality rock, firm transport to favorable price indices, owning our midstream business, selling gas forward at fixed prices and the highest exposure to liquids pricing upside in Appalachia,” Warren said.

Asked about the long-term value of Antero’s firm transportation portfolio in light of all the new Appalachian takeaway capacity slated to come online over the next few years, Rady said he expects the company to need all its capacity commitments to accommodate its growth outlook.

“Today the differentials are shrinking at Dominion South and Tetco M2 relative to some of the other indices, and that’s because the more distressed gas in those pools is being bought to fill available capacity on some of the new projects,” Rady said. “…With our growth plans, we definitely need the firm transport that we’ve signed up for. I think a number of people are looking at rig counts and trying to judge whether there is going to be available capacity, available firm transport longer-term, for people to move into unused space or whether the pipes are going to fill up.”

Add in “utility-pull projects” like the Atlantic Coast and Nexus Gas Transmission pipelines and Antero is “watching the environment. We know that we’ll be moving quite a bit more gas, but will it be us that sponsors the project or signs up or will it be doing longer-term deals into utility-pull projects? We’ve got a number of years to judge how that all unfolds.”

Warren said the company is already thinking about what’s next transportation-wise.

“We feel very good about our capacity…we fill it all by 2021 based on our growth plan. So we’ll be looking for what’s next, whether it’s taking out space on some of the pipe being built out there right now — there’s some available, there may be some that becomes available. Or potentially longer term maybe there needs to be another project that we could be involved with,” he said. “We’re looking three years, four years, five years out on that.”

Antero reported a quarterly net income of $268.4 million (85 cents/share), compared with a net loss of $5 million (minus 2 cents) in the year-ago quarter.

Antero Midstream Partners LP, in which Antero owns a 59% limited partner interest, reported net income for the quarter of $75 million (35 cents/unit) versus net income of $43 million (23 cents) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |