E&P | NGI All News Access | Permian Basin

For Marathon Oil’s Permian, Oklahoma Plays, Shorter Laterals May Be Just Fine

With a large rig addition and a move into the Permian Basin as a fourth U.S. onshore play in its portfolio, Marathon Oil Corp. is obviously eyeing growth unconventionals, but it may choose to expand using shorter hydraulic fracturing (fracking) laterals, company executives said on an earnings conference call Friday.

Marathon CEO Lee Tillman cautioned that it is too early in the company’s Permian experience to draw any firm conclusions, but so far it looks to acquire more acreage in the basin and to think in terms of “shorter” 7,500-foot laterals, instead of the 10,000-foot or longer ones that are now becoming more common.

“Keep in mind it is early, but early results would suggest that the combination of shorter laterals and our completion design is yielding a bit better productivity,” Tillman said. “That is consistent with what we saw in earlier wells where the single laterals were competing favorably, and in many cases that was from a returns basis, which is really our focus. They were outperforming the extended laterals, and we don’t see anything to date that would disqualify that thinking.”

Earlier this year, Marathon’s Canadian subsidiary, which holds a 20% stake in the Athabasca Oil Sands Project, sold its stake to a unit of Royal Dutch Shell plc and Canadian Natural Resources Ltd. for $2.5 billion. In turn, the Houston-based operator agreed to pay BC Operating Inc. and other entities $1.1 billion for 70,000 net acres in the Permian, including 51,500 acres in the Northern Delaware sub-basin of New Mexico with current output of 5,000 boe/d net.

The company already has substantial stakes in Oklahoma’s resource basins (44,000 boe/d in 1Q2017), the Eagle Ford Shale (99,000 boe/d), and the Bakken Shale (48,000 boe/d). Marathon closed its purchase of the Permian acreage, including the Northern Delaware sub-basin, last Monday, and it is looking to acquire more.

Operations chief Mitch Little said that even in these early days, “our asset team is already focused on the opportunity to continue to consolidate and core up our acreage position,” while adding the caveat that Marathon is “very happy” with the initial position it has established.

Little was specifically asked about “target lengths” for laterals, and he indicated they could be longer. “We’re certainly stepping out to the 7,500-foot length,” he said, but noted that the company still does not have a lot of horizontal wells yet in the Permian play.

“I think it is still a bit too early to draw any direct conclusions, but certainly having the optionality to push lateral length out farther is desirable,” Little said.

Separately, Tillman stressed that there are other well completion improvements the company is eyeing that go beyond lateral length, such as improving completion designs. “As we compare and contrast designs, we see a lot of running room there and a lot of opportunity for further optimization.”

At the time of the Permian purchase, Tillman characterized the Northern Delaware as having “outstanding well economics that compete at the top of our organic portfolio and is experiencing a positive rate of change in well performance unrivaled in U.S. unconventional basins.”

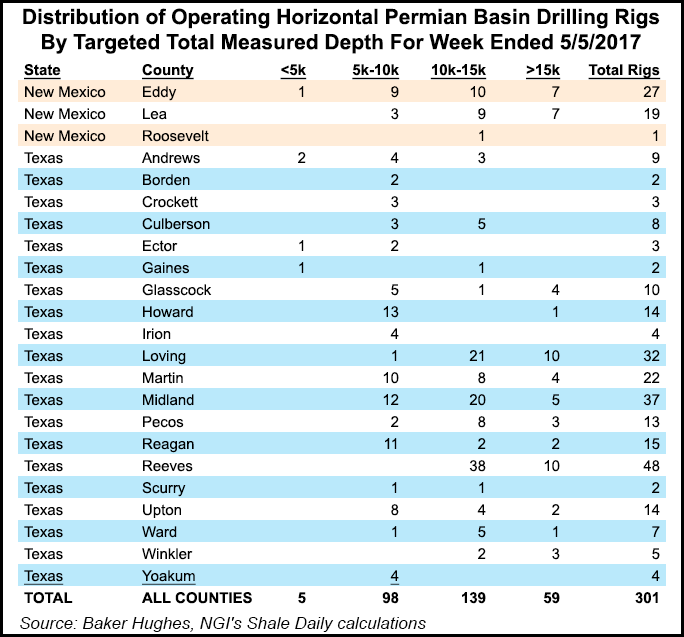

Marathon currently has 22 active rigs, including one in the Northern Delaware, and it stepped up in 1Q2017, ending the quarter with 20 rigs, compared to the 12 operating at the end of last year. The company expects to have three rigs operating in the Northern Delaware by mid-year.

“While we can’t predict future commodity prices, we have purposefully designed our 2017 business plan to be flexible and retain the ability to respond to the macro environment with many levers at our disposal should we feel the need to adjust,” Tillman said.

“I still think our belief is 2017 is going to be very volatile, probably in a bit tighter band if we continue to see OPEC discipline,” he said of the temporary reductions in output by the Organization of the Petroleum Exporting Countries. “We do feel that supply and demand have come back largely into balance.”

For 1Q2017, Marathon reported a net loss of $50 million (minus 6 cents/share), compared with a loss of $360 million (minus 49 cents) for the year-earlier quarter. The Canadian oilsands sale resulted in a one-time impairment charge of $4.96 billion from discontinued operations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |