Marcellus | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Chesapeake ‘On The Ramp,’ Turning to Oil For Growth

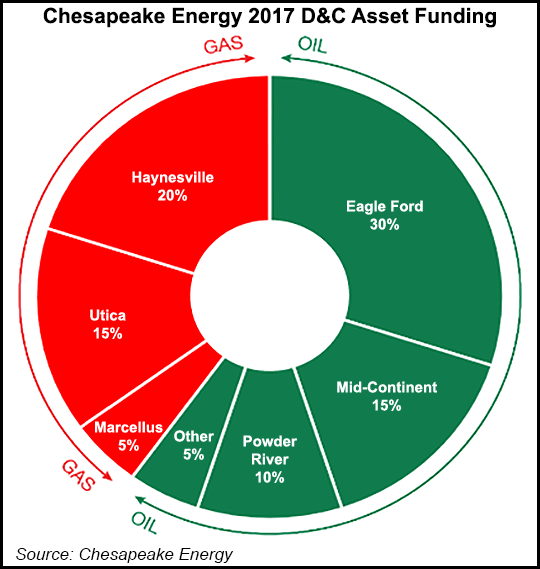

Chesapeake Energy Corp., long a natural gas-focused super independent, is shifting 2017 drilling dollars to oilier assets as it works to reduce debt and strengthen its balance sheet.

Management for the Oklahoma City-based exploration and production (E&P) company said in an overview of 1Q2017 earnings results last week that it’s currently running 19 rigs, more than the 16 the operator averaged during the first quarter and well above the 8 rigs averaged in 1Q2016. Those rigs are heavily weighted to the Eagle Ford Shale (7) and the Midcontinent (5), with the Haynesville Shale (3), the Powder River Basin (2) and Northeast Appalachia (2) accounting for the rest.

Chesapeake highlighted first quarter production of 528,000 boe/d, which came in above the midpoint of its guidance range and included oil production of 83,700 b/d. The E&P said it expects to average 100,000 b/d of oil output by the end of the year.

“Chesapeake has reached an important and pivotal point in our transformation,” CEO Doug Lawler said during a recent conference call to discuss first quarter results. “The company is now returning to production growth from our portfolio of high-quality assets. Importantly, our oil production will be increasing in the second half of the year at a meaningful pace.”

The Eagle Ford, Midcontinent and Powder River Basin will drive this oil production growth in 2017, Lawler said. He said the E&P turned-in-line 76 wells during the first quarter and expects that number to jump to 120 in the second quarter, then average 120-140 for the third and fourth quarters.

“The turn-in-line rate should be a strong indicator of the path and momentum we are building in the latter part of 2017 and as we enter 2018,” Lawler said. “The combined results of these oil-directed investments are delivering. The average oil rate for April is more than 1,000 b/d above our first quarter average and current daily field estimates are approaching 90,000 b/d. We are on the ramp.”

Capital expenditures (capex) for the quarter totaled $576 million, an increase from $463 million in the fourth quarter and $365 million in the year-ago quarter.

As it shifts its production mix to oil, Chesapeake remains committed to improving efficiency and reducing its debt, management said. The E&P ended the quarter with $9.1 billion in debt and $249 million in cash on hand versus $10 billion in debt and $882 million in cash exiting the fourth quarter. Total liquidity as of May 1 was $3.3 billion, which accounts for more than $400 million paid out after the U.S. Supreme Court declined to hear Chesapeake’s appeal in a years-old bond dispute with the Bank of New York Mellon Corp.

Production expenses for the quarter averaged $2.84/boe, while general and administrative (G&A) expenses averaged $1.35/boe. Combined production and G&A costs declined 2% sequentially on a per-boe basis. Gathering, processing and transportation costs averaged $7.47/boe during the quarter, down 5% year/year and 6% quarter/quarter, with the decline driven by 2016 divestitures in the Barnett and Devonian shales.

With capex focused on oil-directed rigs this year, Lawler was asked how the company views its assets in the Appalachian Basin and whether it might consider sales of some of its gassy positions.

“As you look at the Marcellus and the Utica in the Northeast, these are very, very strong cash-generating assets — some of the best rock shale, gas rock in the world,” Lawler said. “When you can spend $100 million and keep an asset flat at 2 Bcf/d for the next five-plus years, it’s a tremendous asset to have in our portfolio.

“What I’m getting at there is that, if we can accelerate the value, we will absolutely do that and consider bigger asset sales, broader asset sales, to accelerate the value to our shareholders.”

Production for the quarter totaled 48 million boe, including 8 million bbl of oil, 211 Bcf of natural gas and 5 million bbl of natural gas liquids (NGLs). That’s compared with year-ago totals of 61 million boe, including 9 million bbl of oil, 276 Bcf of gas and 6 million bbl of NGLs.

First quarter realized prices averaged $51.72/bbl for oil, $3.02/Mcf for gas and $24.04/bbl for oil, compared with year-ago prices of $37.74/bbl, $2.29/Mcf and $11.44/bbl, respectively.

Revenues totaled $2.753 billion for the quarter, up from $1.953 billion in the year-ago period.

Chesapeake reported a net income for the quarter of $75 million (8 cents/share), versus a year-ago net loss of $1.111 billion (minus $1.66/share).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |