E&P | NGI All News Access | NGI The Weekly Gas Market Report

BP Fuels Optimism as Profits Surge, Lower 48 Rig Count Rises

BP plc continued the growth story on Tuesday, joining its Big Oil peers in reporting strong quarterly profits, rising output and lower costs following the historic downturn.

The London-based supermajor’s replacement cost (RC) profit, analogous to U.S. net income, totaled $1.4 billion in 1Q2017, reversing a year-ago loss of $485 million. Excluding payments related to the 2010 Macondo oil spill in the Gulf of Mexico (GOM), cash flow from operations improved to $4.4 billion from $3 billion, which in turn helped to maintain a 10 cent/share dividend.

“It has been a quarter with stronger underlying earnings and robust cash flow, reflecting the firming of the environment relative to prior periods and continued operational momentum in our businesses,” CFO Brian Gilvary said during a conference call from London.

“Our year has started well,” said Group CEO Bob Dudley. “BP is focused on the disciplined delivery of our plans. First quarter earnings and cash flow were robust. We have shown continued operational momentum — it was another strong quarter for the downstream and the first of our seven new upstream major projects has started up, with a further three near completion. We expect these to drive a material improvement in operating cash flow from the second half.”

BP’s strong results followed strong first quarter profit reports last week by ExxonMobil Corp. and Chevron Corp. Far and away the top natural gas marketer in North America, according toNGI‘s quarterly tally, BP continues to be a gas powerhouse, while it also has taken up more oil development in the Lower 48. And it’s rapidly building its onshore rig count.

During the fourth quarter BP was running only five rigs in the Lower 48. By the end of March, it was running about 12, Gilvary said.

“You’ll see that ramp-up as teams experiment within each of the basins,” he said. “Cash breakeven on a full free cash basis has now come down almost half from the full-year 2015 to where we are in the first quarter of 2017, down around $2.60 or that sort of level in terms of cash breakeven.”

A lot of BP’s legacy U.S. onshore is gas-driven, with Colorado operations in the San Juan Basin providing 30% of total Lower 48 production. On the New Mexico side of the San Juan, BP is expanding its gas developments while in Oklahoma, BP produces tight gas in the Arkoma, Woodford and Anadarko basins.

In the East Texas portion of the Haynesville Shale, BP operates about 800 wells that produce from conventional reservoirs, shale and tight gas. BP’s Permian Basin operations in West Texas include about 1,200 operated wells, while in the South Texas Eagle Ford Shale, the resource potential is 1.7 billion boe. The Wyoming operations are anchored in the Wamsutter field, a tight gas reservoir, where it has about 2,000 wells.

Lower 48 Inflation Hasn’t Materialized

BP hasn’t seen “any inflation at this point in terms of the Lower 48,” but the total U.S. rig count is “way, way off where the peak was,” Gilvary said. “There’s certainly more activity coming through, but we’re not seeing a huge amount in the way of inflation. We’ll continue to reduce operating costs and improve on our capital efficiency. And 2017 is really a development program that pivots on the focus on robust projects and growth and trying to take out any underperformance that we see in the activities.

“We’ll continue to target the resource base to make sure that it’s economic below $3.00 Henry Hub on an earnings basis…On a cash basis, it’s below that.”

BP’s upstream arm earned $1.37 billion in 1Q2017, reversing a year-ago loss of $747 million. In the U.S. upstream business, underlying RC profits year/year totaled $166 million from a loss of $667 million, while domestic exploration expenses fell to $40 million from $112 million. The downstream arm earned $1.7 billion in 1Q2017 from $1.8 billion a year ago.

BP’s major upstream projects are on track to provide 800,000 boe/d of new production by 2020. Projects now under construction are on average ahead of schedule and 15% below budget, Gilvary said.

“Looking ahead we expect the oil market to continue to rebalance in 2017, driven by above-average global oil demand growth,” Gilvary said. “The timing and extent of this rebalancing will depend on a number of factors,” led by whether OPEC, the Organization of the Petroleum Exporting Countries, extends its production cuts beyond this month; a meeting of the cartel members is scheduled for later in May.

Oil Prices ”Uncertain and Volatile’

When the market rebalances also depends upon “the extent to which U.S. tight oil responds to the more favorable outlook,” Gilvary said. “So we expect oil prices to remain uncertain and volatile, but we continue to expect the momentum in our businesses to drive stronger operating cash flows as we move through the second half of the year driven by our cost restructuring over the last three years and the series of new projects we have coming online this year.”

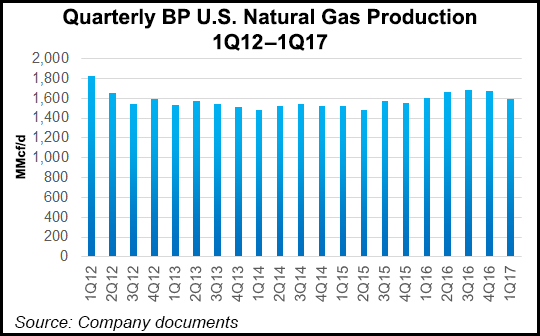

Reported oil and gas production in 1Q2017 was 3.5 million boe/d, 5% higher than in 1Q2016. U.S. natural gas production fell slightly year/year to 1,594 MMcf/d from 1,603 MMcf/d, while domestic liquids output increased to 448,000 b/d from 403,000 b/d. Total U.S. hydrocarbon production increased to 723,000 boe/d from 679,000 boe/d.

Seven major upstream projects are scheduled to come online this year, with a natural gas compression project onshore Trinidad & Tobago (T&T) kicking things off.

The initial Trinidad project began operation in April. The Taurus and Libra development of the West Nile Delta project in Egypt is ramping up, while Quad 204 in the UK, and Juniper in T&T, also are nearing completion. During the first three months, a third gas discovery in the North Damietta Offshore Concession in the East Nile Delta in Egypt was announced, and following completion of BP’s entry into Mauritania and Senegal, exploration drilling has begun.

“We expect second quarter 2017 reported production to be broadly flat with the first quarter with the continued ramp-up of major projects, offset by seasonal turnaround and maintenance activities,” Gilvary said.

Average gas realizations in 1Q2017 rose year/year to $3.50/Mcf from $2.84. Total liquids realizations climbed to $49.87/bbl from $29.61, with total hydrocarbon realizations averaging $37.19/boe from $23.81.

Beginning with the first quarter, BP is reporting organic, inorganic and total capital expenditure (capex) on a cash basis to align with its financial framework. Organic capex in 1Q2017 was $3.5 billion, down from $4.5 billion a year ago. Organic capex in 2017 is expected to total $15-17 billion. Inorganic capex for the first quarter was $500 million; there was none reported in 1Q2016. Macondo-related payments, which totaled $2.3 billion in 1Q2017, are expected to be $4.5-5.5 billion this year before falling to around $2 billion in 2018.

BP sold $300 million of assets between January and March, well below its year-ago sales of $1.1 billion. Total divestments this year are expected to total $4.5-5.5 billion. At the end of March, BP’s net debt was $38.6 billion, compared with $30 billion in 1Q2016.

Longer term, BP, like its Big Oil peers, is advancing a bevy of liquefied natural gas (LNG) projects with a goal to eventually produce about 25 million metric tons/year (mmty). Today, it is at about 12 mmty, but Gilvary said BP would continue to access its supply contracts “across the globe. We still have the intent to get to 25 mmty by growing both equity and merchant LNG. But I think that goal still remains a realistic goal for us going forward. And we’ll continue to see third-party supply contracts coming.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |