Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Midcontinent Supply, Demand From LNG, Power Gen, Industrials All On Boardwalk’s Agenda

Over the next few years, Boardwalk Pipeline Partners LP has a “higher concentration” of capacity contracts coming up for renewal. But developments in the Gulf Coast-Midcontinent region offer the potential for new business.

CEO Stan Horton said Monday during an earnings conference call that 2018 to 2020 will see contracts coming up for renewal on large pipeline projects that went into service during the 2008-2010 period. These are projects that were driven by the Midcontinent shale boom, such as Boardwalk’s Gulf Crossing Pipeline Co. LLC system, which was constructed at the time.

“Although the majority of the renewals are a couple of years away, we continue to focus on best positioning the company to renew or remarket the capacity, particularly in light of current market conditions,” Horton said. “Adding end-use markets and new natural gas supply sources remains integral to our strategy.”

Current projects by other companies that would move gas out of Oklahoma — primarily from the SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend of the Anadarko Basin in Canadian and Kingfisher counties) plays — could benefit Gulf Crossing, which could pick up supplies from the SCOOP/STACK at Bennington, OK.

“While it’s too early to tell what impact these recently announced projects will have, we believe this development could provide new gas supply for Gulf Crossing,” Horton said.

Cheniere Energy’s Midship Pipeline Co. LLC is developing a project to create firm capacity of up to 1.44 million Dth/d connecting Anadarko Basin production to Gulf Coast markets. Midship would have two zones. Zone 1 would involve 200 miles of new pipeline from the Okarche Processing Plant in Okarche, OK, to Bennington. Zone 2 would involve leasing 353 miles of existing pipeline capacity from Kinder Morgan Inc.’s Midcontinent Express Pipeline LLC and/or Gulf Crossing, Cheniere said. The leased capacity would run from Bennington to Tallulah, LA.

A competitor to Midship, NextEra Energy Inc.’s Sooner Trails, was apparently canceled recently.

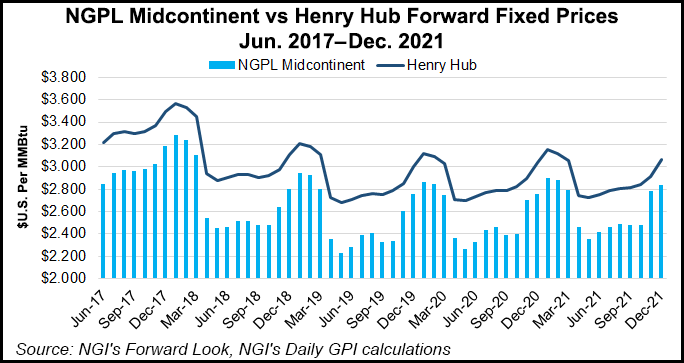

Located near several major Oklahoma resource plays, the forward curve at NGPL Midcontinent might offer some insight into how the market expects prices to be affected by additional Midcontinent supply reaching the Gulf. Currently, on an annual basis, the curve shows NGPL Midcontinent basis to Henry Hub contracting from -38 cents in 2018 to -29 cents by 2021.

Elsewhere, Boardwalk continues to respond to the shale era, which has rearranged supply basins and redirected pipeline flows. It recently placed into service its Northern Supply Access Project. This is the second north-to-south project on Texas Gas Transmission LLC to enter service over the last year, and it increased total north-to-south capacity to more than 900,000 MMBtu/d on Texas Gas.

The pipeline “…is now truly a bidirectional system that allows us to maintain gas flows in the traditional south-to-north direction while north-to-south capacity has been added,” Horton said.

The company’s Coastal Bend Header project — its largest among more than $1 billion of growth projects under construction — will serve the Freeport LNG terminal. The 1.4 Bcf/d project is fully contracted and expected to enter service next year, Horton said.

Projects are in the works at Boardwalk Louisiana Midstream to serve ethane and ethylene transportation needs in Louisiana with in-service dates ranging from 2017 to 2019. And Gulf South Pipeline has two Louisiana projects to provide firm gas transportation service for two power plants.

Further out, better days are likely ahead for Boardwalk Gulf Coast region natural gas storage assets if demand volatility increases from LNG exports, power generation loads and variable loads from industrial end-users.

“My viewpoint is that over time, operational storage is going to be needed, not only for the LNG plants but for additional electrical generation that’s being built, additional industrial load that’s coming on,” Horton said. “All of these markets have some sort of peaks and valleys…It’s my belief that they’re going to need to be able to park gas at times and pull off gas to hit peaks at times…I’m still bullish on storage long term. I think storage is a good play.”

Boardwalk’s capital spending for 2017 is expected to be about $850 million, of which $710 million will be for growth projects and $140 million will be for maintenance, CEO Jamie Buskill said.

Compared with the first quarter of 2016, Boardwalk operating revenues in the first quarter of 2017 were helped by recently completed growth projects and an increase in parking and lending and storage revenues from improved market conditions, the company said.

First quarter operating revenues of $367 million showed a 6% increase from $345 million in the year-ago period. Net income of $119.3 million was an 18% increase from $101 million in the year-ago quarter. Earnings before interest, taxes, depreciation and amortization of $246.2 million marked an 11% increase from $222.7 million in the year-ago quarter. And distributable cash flow of $176.1 million was up 10% from $160.1 million a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |